It’s never boring in crypto. One minute you’re sipping coffee, the next a whale wipes out half of the order book. Yesterday, that’s exactly what happened with XPL. In less than a minute, a few whales managed to squeeze shorters, pump the token over 300%, and walk away with nearly $48 million.

Unfortunately for me, I had just closed my XPL long a few days before. Instead of banking a juicy 300%, I settled for a measly 3%. Classic trader story: cut too early, watch the market moon without you. Oh well. Let’s dive into what happened, who may have been behind it, and how you can avoid being the unlucky one next time.

The XPL pump that shocked Hyperliquid

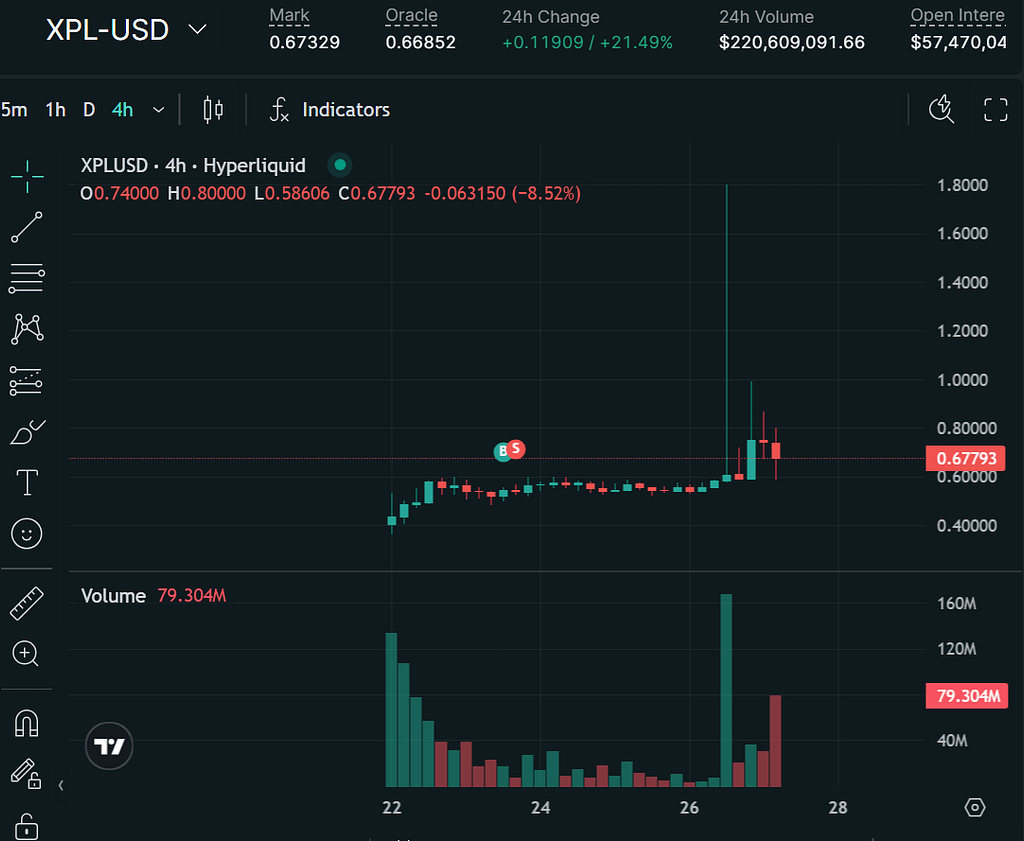

The drama started when four whale wallets went long on XPL, the Plasma blockchain’s token, on Hyperliquid. The move cleared the entire order book, sending XPL soaring from under $0.60 to nearly $1.80 in just minutes.

By the time the dust settled, the whales had pocketed a combined $47.5 million in profit. The largest of them, address 0xb9c, reportedly walked away with more than $15 million. Blockchain analysts quickly labeled this wallet the “main orchestrator” of the short squeeze.

For every winner, there’s a loser. One unlucky trader lost $4.5 million. Another, an X user named CBB, admitted he blew $2.5 million shorting XPL. His response was short and sweet: “Never touching isolated markets again.” Can’t blame him.

Allegations of manipulation

The sudden move sparked plenty of debate. Was this a brilliant trade or pure manipulation? Many traders called it whale games. Others argued it was fair play within Hyperliquid’s rules.

Spot On Chain, a blockchain data platform, didn’t mince words. They described it as one of the wildest short squeezes and wealth redistributions seen on-chain.

Adding spice to the story, one onchain sleuth pointed the finger at Justin Sun, founder of Tron. According to them, Sun may be behind wallet 0xb9c, which triggered the squeeze by opening massive longs and then slowly unwinding them. In just one minute, the wallet reportedly made $16 million. Whether true or not, it certainly adds to the crypto soap opera.

Hyperliquid’s response

To their credit, the Hyperliquid team was quick to respond. In a Telegram post, they clarified that only XPL positions were affected. No bad debt was incurred. They reminded traders that pre-launch markets are volatile, and that risk management is essential.

They also announced new rules. Price swings will now be capped at ten times the token’s eight-hour average price. While this wouldn’t have prevented the XPL carnage, it’s a step toward reducing future volatility. The bigger solution, according to Hyperliquid, is onboarding more liquidity.

No compensation will be offered to those who were liquidated. Instead, Hyperliquid pointed users to the documentation, reminding everyone that trading thin markets is risky. Translation: “Read the docs, and don’t blame us if you get wrecked.”

A personal lesson

Here’s the part that stings. I was long on XPL not too long ago. I saw some potential, took a position, and even thought about holding for a bigger move. But as usual, I got bored, took my small profit, and walked away.

Then, 3 days later, whales turned XPL into a 300% rocket ship. My $1,000 profit could have been closer to $100,000 if I held. Instead, I got to sit on the sidelines and watch Twitter light up with memes of crying Wojaks. Been there, done that. At least I didn’t lose millions like CBB. Small victories, right?

Why whales win in DeFi

On decentralized exchanges, everything is transparent. Whales can see the order book, calculate exactly how much money is needed to cause a stop hunt, and then push the market where they want.

This isn’t new. In fact, Hyperliquid has already seen whales exploit vulnerabilities. Earlier this year, the JELLY memecoin incident cost traders $6.26 million. With thin liquidity and high leverage, these events will keep happening.

Centralized exchanges usually impose safeguards like position limits. On a DEX, however, the game is wide open. That’s part of the appeal, but also the danger.

How to protect yourself

So, how do you avoid getting steamrolled by whales in markets like XPL?

- Avoid trading low-liquidity coins with big size.

- Use tight stop losses, but know they can be hunted.

- Stick to majors like Bitcoin, Ethereum, or even HYPE when farming points.

- If you want to gamble on smaller tokens, keep your size small.

I personally use Hyperliquid mainly for BTC, ETH, and HYPE trades. Sometimes I dip into smaller names like XPL for fun, but I size them like I’m buying a lottery ticket, not making a serious investment.

For more on how liquidity zones work and how whales play them, check out this guide: Guide to Liquidity Zones. It’s worth the read if you don’t want to end up another CBB.

You can farm Hyperliquid safely with stablecoins. Read our guide here.

The bigger picture

The XPL squeeze shows both the strengths and weaknesses of decentralized trading. On the one hand, it’s wild, transparent, and offers opportunities to make life-changing money in minutes. On the other, it highlights how thin liquidity can be exploited.

Regulation, governance, and better safeguards will likely come as these platforms mature. But for now, the Wild West vibe is alive and well. Traders who enter these markets must accept the risks—or risk being liquidated.

Final words

XPL’s 300% pump on Hyperliquid was one of the craziest short squeezes in recent memory. Four whales bagged nearly $48 million, a few traders lost life-changing sums, and the rest of us sat on the sidelines wondering why we closed early.

If there’s one lesson here, it’s this: crypto is a game of patience, risk management, and sometimes dumb luck. You’ll never catch every move. Sometimes you sell too early, sometimes you get squeezed, and sometimes you just laugh at your mistakes.

XPL isn’t going anywhere, and I’ll definitely keep it on my watchlist. But next time, maybe I’ll size a little smaller, hold a little longer, and hope the whales throw me a bone instead of eating me alive.

If you enjoyed this blog, you may want to check out our recent update on the WLFI token that’s coming very soon.

Over $10 million in prizes in Bybit’s WSOT competition. Join by clicking the link below.