Over the past few days, global markets have been caught off guard. A sudden military conflict between Israel and Iran has rattled investors across the board. From crypto to commodities, the ripple effects have been intense. When ETH was starting to look strong, we got a full-blown war on our hands.

Bitcoin dipped fast. Oil shot up. Gold spiked. Traders scrambled for safe havens. As always, we keep you informed about what’s happening. In this blog, we walk you through what’s happening, what it means, and how Bitcoin and other top assets are reacting.

Let’s unpack it.

Tensions Between Israel and Iran Reach Boiling Point

It started with escalating threats. Then, airstrikes were confirmed.

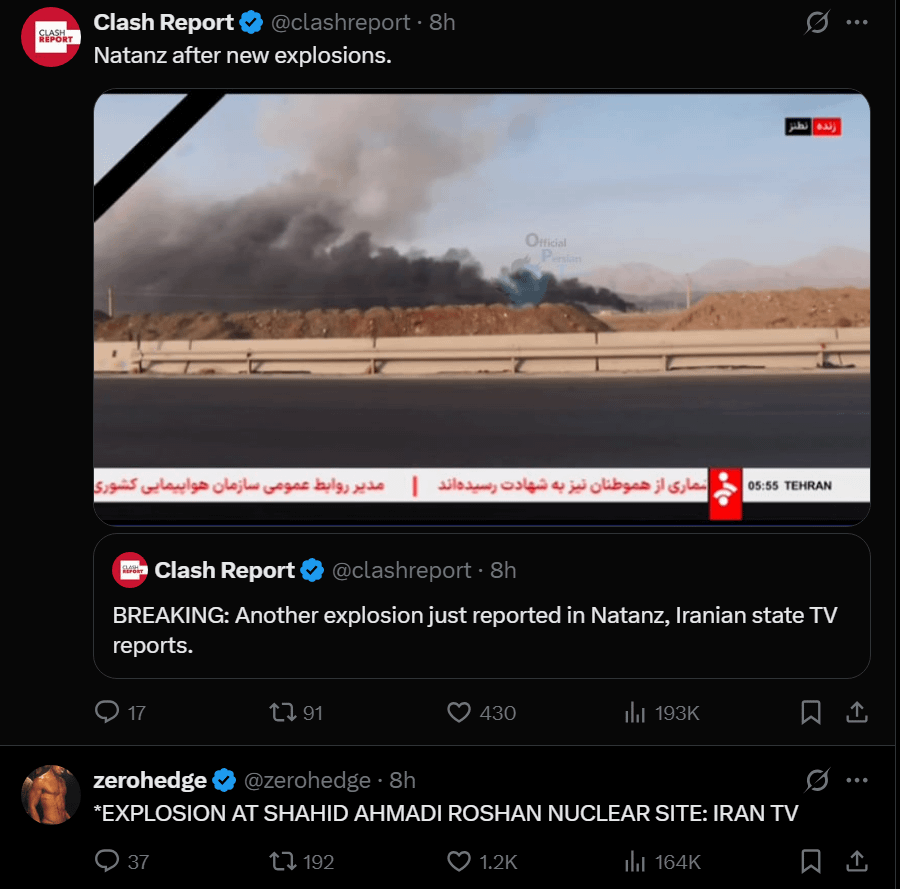

On June 12th, reports came in that Israel had launched precision airstrikes on key targets inside Iran, including military facilities and nuclear-related infrastructure. The move was a direct response to Iran’s previous drone and missile attacks.

Within hours, Iranian officials called the strikes an “act of war” and promised a strong retaliation. As news spread, global markets instantly reacted. The world was suddenly on edge, fearing this could evolve into a much larger regional war.

Why does this matter so much for markets?

Because both Israel and Iran sit near critical global oil routes. Any disruption in that region can quickly lead to panic in energy and financial markets. And that’s exactly what we saw.

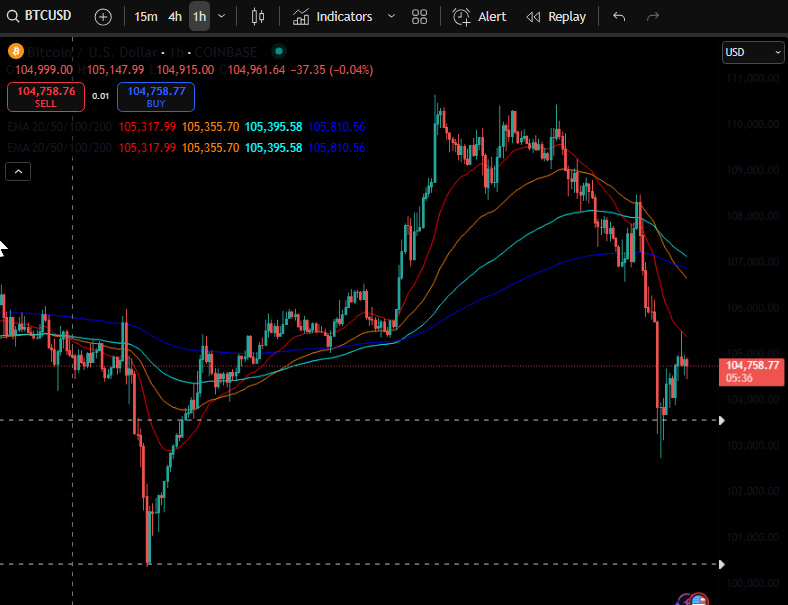

Bitcoin Takes a Sudden Nosedive

Bitcoin has been on a strong run recently, briefly trading above $108,000 just days ago. But after the news broke from Israel, the price of Bitcoin sank fast.

Within a few hours, it dropped under $104,000. Then, it slid even further to around $103,000 in European and U.S. trading sessions.

This wasn’t just Bitcoin. Ethereum, Solana, and other top cryptocurrencies followed suit. A wave of selling pressure hit the market as traders exited risky assets.

Crypto is known for being volatile. But this drop was directly tied to geopolitical fear. The war between Israel and Iran didn’t just shake traditional markets—it had a serious impact on digital assets too.

Ethereum, Solana, and the Rest Join the Slide

Bitcoin wasn’t the only one bleeding.

Ethereum fell below $2,500 after days of flirting with the $3,000 breakout. Solana lost more than 5% on the day. Altcoins across the board followed the same path.

Why?

Because when geopolitical fear hits, investors tend to go into “risk-off” mode. That means they sell volatile assets like crypto and move toward safer ones.

This time, Bitcoin did not act as a “digital gold” safe haven. Instead, it behaved more like a tech stock—sensitive to fear and quick to drop.

Gold Becomes the Go-To Safe Haven

While crypto struggled, gold soared.

As soon as headlines came out of Israel, investors rushed into traditional safe-haven assets. Gold climbed over 1.3% in a single session, hitting around $3,427 per ounce. That’s the highest price in nearly two months.

For the week, gold was up over 3.5%. This proves that when things get scary, investors still trust precious metals more than digital ones.

Gold might be boring to some. But in times of uncertainty, it shines.

Related: How to trade gold with crypto

Oil Prices Spike as Supply Worries Grow

Another major reaction came from the oil markets.

The Middle East is a vital hub for global oil supply. So, when Israel hit targets in Iran, traders immediately priced in the risk of supply disruptions.

West Texas Intermediate (WTI) oil surged to $74 per barrel. Brent crude went even higher, nearing $78. These are some of the biggest daily moves in oil we’ve seen this quarter.

Some analysts now warn that if the conflict expands, oil could easily jump to $100 or even $120 per barrel.

This isn’t just speculation. It’s a reflection of how fragile the current global energy system is—and how any conflict involving Israel or Iran can send shockwaves worldwide.

Why This Affects Bitcoin and Risk Assets

You might wonder—why would a war in the Middle East crash crypto?

Here’s the simple version.

When conflicts happen, uncertainty rises. And uncertainty is bad for risky assets like crypto, tech stocks, and small-cap equities.

Instead, money flows into:

- Gold

- Bonds

- Cash

- Oil (as a hedge against supply disruptions)

Crypto, especially Bitcoin, was once seen as a hedge too. But right now, it’s still viewed as speculative. That means in moments like these, people sell it—fast.

This is especially true for short-term traders and institutional investors who need to manage risk.

U.S. and Asian Markets React Strongly — But Wall Street Is Still Asleep

Asian markets were first to react. The Nikkei tumbled over 2%, and Chinese tech stocks also dipped as traders priced in geopolitical risk. European futures slid soon after, setting the stage for a risk-off mood across the globe.

But in the United States, the situation is still unfolding.

The Israeli airstrike took place just minutes after the U.S. markets closed on Thursday. So while futures dropped slightly, we haven’t yet seen the full reaction from Wall Street.

When U.S. markets open on Friday, all eyes will be on:

- Energy stocks, which could benefit from higher oil prices

- Tech and crypto-linked companies, which may struggle in risk-off conditions

- Defense and military contractors, which often gain during global tensions

Traders are bracing for volatility—and how the market opens could set the tone for Bitcoin’s next move as well.

Guide: How to buy stocks with crypto.

What’s Next for Bitcoin?

Bitcoin has bounced back from many crashes before. And long-term believers are still holding strong.

However, in the short term, a few key things could impact price action:

- More escalation: If Iran retaliates aggressively, we might see another leg down.

- Oil prices: If oil keeps rising, inflation could spike—causing more fear in markets.

- Rate cuts: If the Fed sees enough slowdown, they might cut interest rates sooner, which could help Bitcoin regain ground.

In the meantime, traders are watching for $100,000 as key psychological support. If that breaks, lower levels could follow.

On the flip side, if tensions ease, Bitcoin could quickly recover to above $105,000 and beyond.

Final Thoughts: Israel Conflict Proves Bitcoin Still Isn’t “Digital Gold”

This week reminded us of something important.

Bitcoin is still not a reliable safe haven. At least, not yet.

When Israel launched its airstrikes, gold went up. Bitcoin went down. The market made it clear—gold is the go-to when fear kicks in.

However, this doesn’t mean crypto is doomed. It simply highlights how early we still are in its adoption. In the long run, Bitcoin may still become a true hedge. But right now, it’s a high-risk asset that responds quickly to panic.

Whether you’re holding Bitcoin, watching oil, or stacking gold, one thing’s clear: geopolitics matter. And the Israel–Iran conflict is a powerful example of how fast markets can shift.

Key Takeaways

- Israel’s airstrikes on Iran triggered global panic.

- Bitcoin fell under $104,000 as traders ditched risk.

- Ethereum and Solana joined the dip.

- Gold surged as a traditional safe haven.

- Oil jumped on fears of supply disruption.

- Global markets turned risk-off in a matter of hours.

We’ll be watching closely as events unfold. But for now, stay cautious and informed. And don’t forget—the crypto world doesn’t move in a vacuum. It moves with the world.

If you enjoyed this blog, you may want to check our other crypto news updates.

As always, don’t forget to claim your bonus below on Bybit. See you next time!