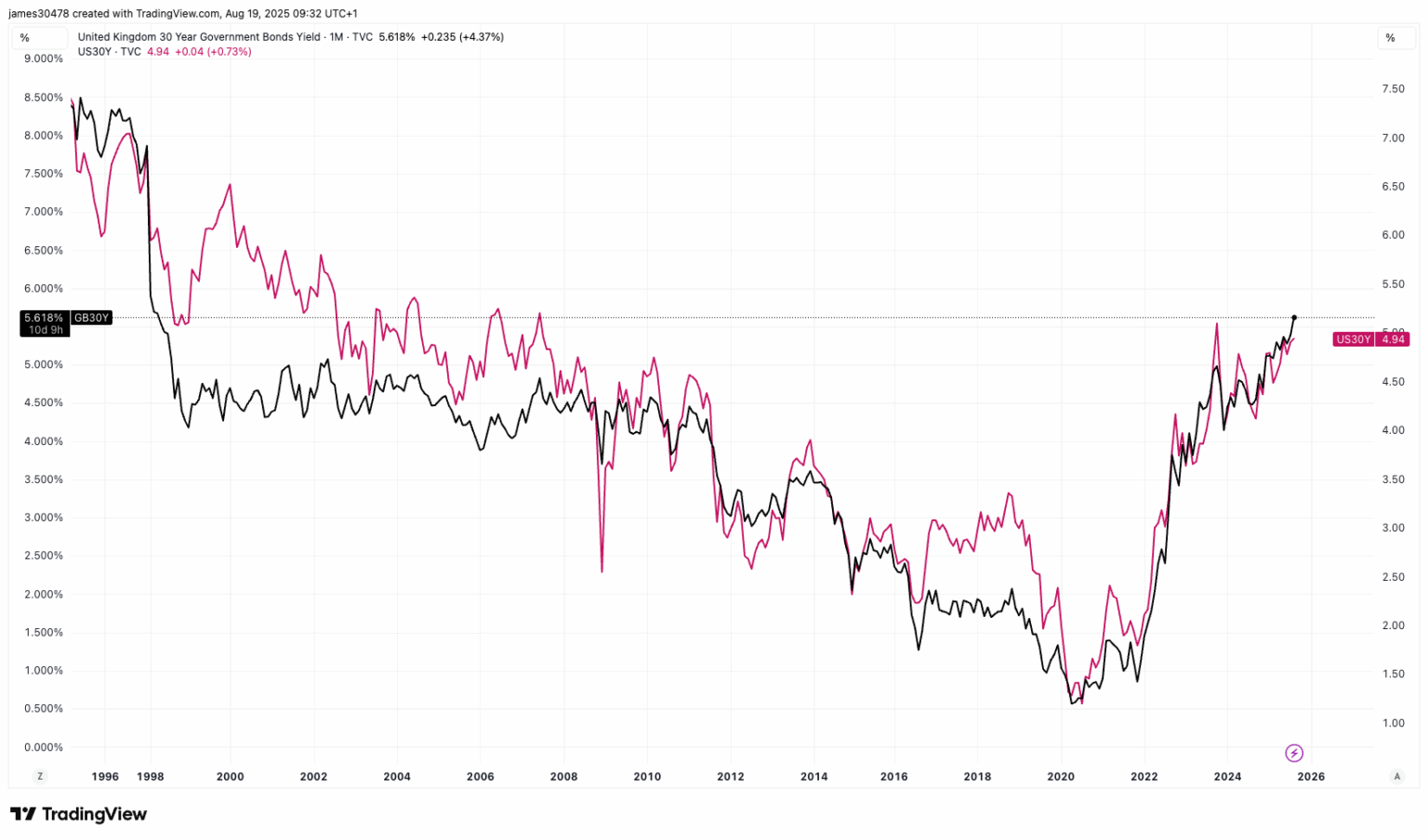

The U.K.’s fragile fiscal situation is back in focus as yields on long-term government bonds surged, topping their U.S. counterparts for the first time this century.

The 30-year U.K. government bond offered a yield of 5.61% at press time. That’s 68 basis points more than the 30-year U.S. Treasury yield according to data source TradingView.

The widening gap means that the market is demanding a significant premium to hold U.K. debt versus Treasury notes, a sign that investors are becoming increasingly wary about the U.K.’s fiscal situation.

The U.K. gilt market (bond market) has taken on a life of its own, as the country faces structural, long-term economic challenges that it has built up over decades; yet, this is not a uniquely British issue. Japan, the EU, and the U.S. have also seen bond yields rise as debt burdens and inflation pressures mount.

This indebtedness of the advanced world supports the bullish case for perceived store-of-value assets like bitcoin

and gold.

Focus on U.K. inflation report

Wednesday’s U.K. inflation report is critical for bond markets.

The data is expected to show that both the headline consumer price index (CPI) and core CPI remained well above the 2% target in July, according to data source Trading Economics. The headline CPI is expected to be 3.7% year-over-year (up from the previous 3.6%), while core inflation is forecast to remain at 3.7% (unchanged from the prior month). The data will hit the wires just weeks after the Bank of England cut rates to 4%.

Expectations for sticky inflation couldn’t have come at a worse time, as the GDP growth has weakened and unemployment has begun to edge higher from secular lows.

Repeat of 2022 crisis?

A hot inflation report could only worsen the debt-bond dynamics by accelerating the uptrend in yields. This calls for both crypto and traditional market traders to remain vigilant for a 2022-style volatility in the U.K. markets.

The hardening of the 30-year gilt yield, representing the long end of the curve, played a big role in the liability-driven investment (LDI) pension crisis of 2022, which erupted under Liz Truss. The longer duration yield is now testing the upper bound of a long-term trend and could rise to 5.7%, the highest level since May 1998.

LDI strategies use leverage to hedge pension liabilities. When gilt yields spiked in 2022, collateral calls led to a mass sale of gilts, creating a feedback loop that threatened financial stability. That prompted the Bank of England to intervene with emergency purchases to prevent a systemic crisis.

If Wednesday’s inflation report runs hotter than expected, gilt yields could break new highs, putting further pressure on the government and raising the risk of another LDI-style crisis.