According to Kristian Csepcsar, chief marketing officer at Braiins, the U.S. still lacks a fully domestic supply chain for mining hardware.

With Trump’s sweeping trade tariffs—including a 10% levy on imports and a hefty 34% tariff on Chinese mining equipment—miners may soon find themselves in even deeper waters.

Rising Tariffs Put Bitcoin Miners in a Tough Spot

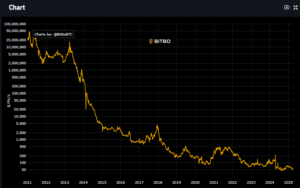

The Bitcoin mining industry is no stranger to challenges, but tariffs could be the straw that breaks the camel’s back. Csepcsar points to hashprice—a key profitability metric for miners—as a major concern. This metric, which measures daily revenue per terahash, has been on a downward spiral since 2022. In March 2024, it hit a record low of $50, barely climbing to $53 by the end of the month.

With these low returns, miners are already feeling the squeeze. Tariffs on essential mining hardware, which started under President Biden, are only getting stricter under Trump. Companies like Bitmain, the world’s largest ASIC manufacturer, are now facing a 34% tariff in addition to an existing 20% levy. In response, China has fired back with its tariffs, escalating the trade battle.

Source: bitbo

While some in the Bitcoin community believe the impact of these tariffs is overblown, others see them as a real threat. Csepcsar argues that the U.S. is years behind in chip manufacturing, meaning miners will continue to rely on overseas suppliers for the foreseeable future. As tariffs drive up costs, smaller miners could be pushed out, leaving only the biggest players in the game.

More About the Relation between Trump’s Tarriffs and Crypto

Despite Trump’s sweeping tariffs shaking up global trade, major financial players aren’t backing down on Bitcoin. Grayscale, Fidelity, and ARK Invest are all doubling down, continuing to buy up BTC despite the economic uncertainty.

DONALD TRUMP JUST TARIFFED THE ENTIRE WORLD. SO?

GRAYSCALE IS BUYING BITCOIN

FIDELITY IS BUYING BITCOIN

ARK INVEST IS BUYING BITCOIN pic.twitter.com/5WhjPBtWNo

— Arkham (@arkham) April 3, 2025

This signals strong institutional confidence in Bitcoin as a hedge against inflation and market instability. While tariffs may squeeze certain industries, these financial giants see Bitcoin as a long-term bet that’s worth holding onto—no matter what’s happening on the world stage.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted risk tolerance levels of the writer/reviewers, and their risk tolerance may differ from yours. We are not responsible for any losses you may incur due to any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Trump’s Tariffs Turn Up the Heat on Bitcoin Miners appeared first on Altcoin Buzz.