The world of investing keeps getting weirder—in the best way possible. Imagine trading your favorite meme coin one minute, and flipping Tesla stock the next. Thanks to tokenized stocks on platforms like Solana and Kraken, that dream is now closer to reality.

Let’s dive into this modern twist on equity trading, and why tokenized stocks are shaking up traditional finance.

What Are Tokenized Stocks?

Tokenized stocks are digital assets on the blockchain that represent real-world shares of companies like Apple, Microsoft, and Tesla. Each token mirrors the value of the underlying stock. When the stock goes up, so does the token. It’s basically a blockchain version of a traditional share.

Unlike regular stocks, these tokens can be traded 24/7, and on-chain. That means more flexibility and often fewer restrictions. No waiting for market hours. No paperwork. Just blockchain and instant execution.

Previously, we wrote a guide on how to buy stocks with crypto on platforms like Bybit. But yesterday, it more options were born.

Who’s Leading the Charge?

Right now, a few platforms are bringing tokenized stocks to the spotlight:

- Kraken: The well-established crypto exchange is exploring deeper integrations of real-world assets. Its offering of tokenized stocks could blend traditional equities with modern crypto functionality.

- Solana: Known for lightning-fast transactions and cheap fees, Solana’s DeFi ecosystem is now home to tokenized stocks via protocols like xStocks from Backed Finance.

- Bybit: This platform already offers tokenized stocks and ETFs, creating a smooth experience for both crypto-native and traditional investors.

Backed Finance and xStocks: Powering the Shift

A lot of this innovation comes from Backed Finance, the team behind xStocks. They’ve created compliant versions of tokenized equities backed 1:1 by real shares held by a regulated custodian. These tokens are programmable, transferable, and compatible with decentralized applications.

You can trade Google or Meta stock just like a meme coin. Pretty wild.

Why Tokenized Stocks Matter

This isn’t just a fun gimmick. Tokenized stocks solve real problems in traditional finance. Here are some reasons investors are paying attention:

- 24/7 trading: Traditional stock markets close every day. Blockchains don’t.

- Global access: Anyone with an internet connection and crypto wallet can participate.

- Fractional ownership: Buy $10 of Amazon instead of one full share.

- Composability: Use tokenized stocks in DeFi protocols—borrow, lend, or provide liquidity.

And let’s be real: this also gives crypto traders a chance to diversify without leaving the chain.

Solana’s Speed Is a Game-Changer

One reason tokenized stocks on Solana are gaining traction is because of its speed and low cost. Transactions on Solana are near-instant and cost less than a penny. This makes it ideal for traders who want real-time execution without paying high gas fees.

Plus, thanks to Solana’s growing DeFi infrastructure, these stocks can interact with other protocols like lending, staking, and automated trading bots. It’s a financial playground, and now it includes stocks too.

Related: Check our stock picks for long term hold.

Kraken’s Entry Signals Institutional Interest

Kraken isn’t new to innovation. By stepping into tokenized stocks, they’re not only opening doors for their millions of users, but they’re also sending a signal to regulators and institutional investors: tokenized real-world assets are here to stay.

Kraken’s infrastructure is built for compliance, which helps legitimize the entire space. This could lead to broader adoption and more trust in tokenized equities.

Regulatory Considerations

Of course, tokenized stocks aren’t without controversy. Questions around regulation, jurisdiction, and investor protection remain. Some platforms restrict these products to certain regions to avoid legal issues.

But this is evolving fast. With projects like Backed Finance working to stay compliant, and exchanges like Kraken operating with licenses in multiple countries, we’re likely to see more clarity soon.

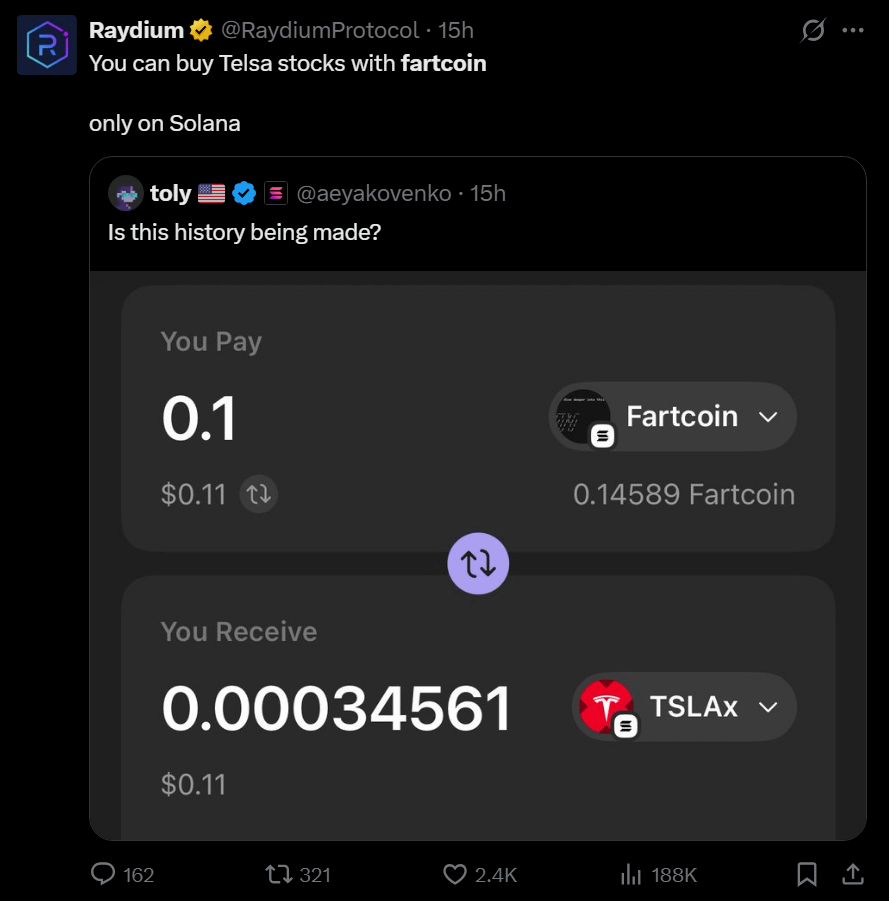

Real Use Case: Trading Fartcoin for Tesla?

Now here’s where it gets funny. Thanks to Solana’s DeFi, you can theoretically swap your bags of Fartcoin (yes, it’s real) for tokenized Tesla stock. It’s like turning a joke into a portfolio.

It may sound absurd, but that’s the beauty of open finance. You’re not stuck with just ETH or USDC anymore. You can use crypto gains—no matter how silly—to buy into real-world companies. The lines are blurring, and it’s all happening on-chain.

You can test it out on Jupiter, and who knows, it might count as volume towards your JUP airdrop for season 3.

What’s Next for Tokenized Stocks?

As the space matures, expect even more platforms to join the party. We may soon see:

- Dividend payouts directly on-chain

- Tokenized bonds and real estate

- Cross-chain stock swaps

- Integration with social investing apps

Tokenized stocks could also spark a new wave of DeFi activity, especially among users who previously avoided crypto due to volatility. After all, Apple stock feels a bit safer than the latest meme token.

Final Thoughts

Tokenized stocks are more than a trend. They’re a practical solution to the inefficiencies of traditional markets. With platforms like Solana and Kraken leading the charge, the future of investing looks faster, more inclusive, and definitely more fun.

So whether you’re a Wall Street veteran or just a degenerate swapping fartcoins in the dark, one thing is clear: your next Tesla trade might happen entirely on-chain.

If stocks aren’t for you, we recently published a solid list of 9 altcoins to trade.

As always, don’t forget to claim your bonus below on Bybit. See you next time!