This blog is for the serious airdrop farmers. If you have some capital, understand the basics, and are ready to go deeper into the Hyperliquid airdrop strategy, you’re in the right place. This isn’t a beginner’s guide. It’s for people who’ve already farmed a few airdrops, know how to loop and hedge, and want to maximize their chances in the next big airdrop opportunity.

A Look Back: Hyperliquid Airdrop Season 1

Back in December 2024, Hyperliquid shocked the crypto world with what turned out to be the biggest airdrop in history. Billions of dollars in $HYPE tokens were dropped on traders, stakers, and early ecosystem users. It was massive, and it rewarded those who spent time on-chain, took risks, and explored early.

Traders who built volume. DeFi users who looped across protocols. NFT minters. They all got a piece of the pie.

Hyperliquid Update: New ATH and New Players

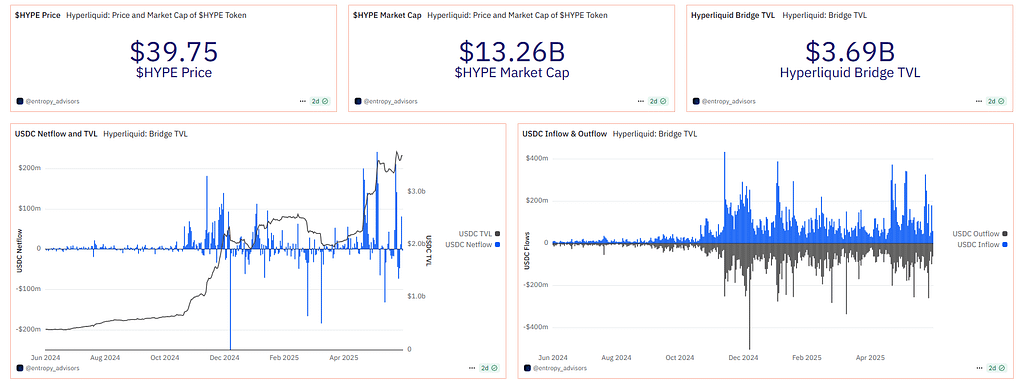

Fast forward to now—$HYPE just reached a new all-time high. The total value locked (TVL) in the Hyperliquid ecosystem is also at record levels, approaching $4 billion.

Daily activity is still relatively low. Only about 10,000 to 20,000 people use Hyperliquid daily, out of roughly 600,000 total wallet addresses. That’s incredibly early. It means the rewards for each active user are still very high.

Another exciting development is HIP-3, a new proposal that will allow anyone to launch a perpetual market on Hyperliquid without needing central team or DAO approval. This will bring more markets, more trading, and more volume.

And here’s something wild: several Web2 companies have added $HYPE to their treasury. One is even a public company based in the United States. If adoption continues, the price of $HYPE could explode this year.

Use our Referral link to join the new Hyperliquid Season.

Why You Shouldn’t Miss Hyperliquid Airdrop Season 2

Let’s be honest—season 1 was life-changing for many farmers. But season 2 might be even bigger.

Here’s why:

- The remaining allocation for airdrops is over $20 billion (based on current prices).

- Hyperliquid didn’t turn off the “points” tab on their dApp, suggesting that farming continues.

- As $HYPE climbs in value, the size of the next airdrop pool will likely increase.

- Hyperliquid is expanding fast, especially with the rise of HyperEVM and all the DeFi protocols building on top.

If you missed the first season or want to farm even harder this time, now is the moment to act. Here’s a step-by-step guide about this season. But below is the real value. Let’s dive into the full-blown airdrop strategy to maximise your points and future airdrop.

Full Hyperliquid Airdrop Strategy (Capital-Efficient Edition)

Let’s dive into the full farming plan for season 2. This strategy is designed for farmers with capital and a bit of experience. It’s focused, layered, and efficient.

1. Volume Farming (Delta-Neutral Setup)

Hyperliquid rewards trading activity, so farming volume is one of the most important components.

You don’t need to take on risk. Here’s how to go delta-neutral.

Goal:

Boost your trading volume on Hyperliquid Core to farm airdrop points without taking directional market risk.

Setup:

- Open both long and short positions simultaneously on the same pair (e.g., BTC, ETH) with equal size.

- This creates a delta-neutral strategy: market goes up or down, your net PnL stays close to zero, but your volume counts toward the airdrop.

Strategy to Boost Volume:

- Choose high-liquidity pairs like BTC/USDT or ETH/USDT for tighter spreads and better fills.

- Set tight stop losses just 2-3% from entry on both sides.

- When a stop gets triggered, re-open the same side at market or limit depending on trend.

- Use low leverage (1x–2x) to avoid liquidations and widen your stop-loss thresholds.

- Scale capital slowly if fees and funding rates are favorable.

Pro tip: Use taker trades during low activity hours to simulate organic volume. Avoid thin pairs unless you want targeted incentives.

When you’re farming delta-neutral, there is a small risk that Hyperliquid detects the relation between your wallets and excludes both from an airdrop. To avoid this risk:

- Avoid on-chain relations between wallets. Fund them from different wallets, never transact between them.

- Consider farming neutral on a CEX. Have one open position on Hyperliquid, and counter-trade it on a CEX like Bybit or Blofin. This way, you’re never at risk of “cheating” the system.

- Farm a different DEX. There are several other DEXs offering airdrop programs. You can open a counter position on a different wallet and a different DEX. One of them is Ostium.

2. Stake $HYPE and Farm Vaults

Staking your $HYPE is simple and effective.

Go to the Hyperliquid staking page and delegate to a community validator like Nansen x HypurrCollective. This supports the network and may qualify you for community-linked airdrops.

For extra yield, explore Hyperliquid Vaults. For example, the Sifu vault recently offered 300% APR. These vaults often pay out points and yield at the same time.

You can even go delta-neutral here:

- Buy $HYPE and stake it or deposit in vaults.

- Short an equal amount of $HYPE on Bybit or another exchange.

- This way, you earn staking rewards without price risk.

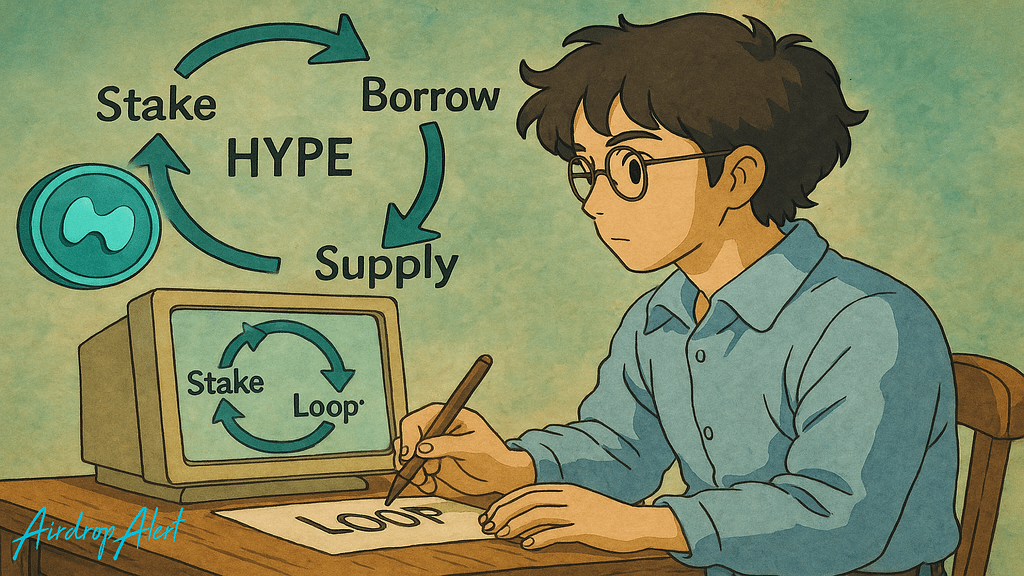

3. Looping Across HyperEVM: The Core Strategy

This is where serious capital meets serious returns. You’ll use HyperEVM to supply assets, borrow against them, and loop for yield and points.

Step-by-step strategy:

Step 0: Bridge Funds

Use Hyperunit to bridge ETH or USDT to HyperCore, then transfer to HyperEVM. You can also deposit on Hyperliquid through a CEX.

Step 1: Loop With $HYPE

- Buy $HYPE on HyperCore and bridge it to HyperEVM.

- Convert it to stHYPE on HyperBeat.

- Supply stHYPE on HypurrFi or HyperLend.

- Borrow $HYPE → convert to stHYPE → loop 3–5x.

- Hedge with a short on Hyperliquid Core or Bybit.

You now earn passive yield, protocol points, and ecosystem exposure, all while delta-neutral.

Step 2: ETH Yield Stacking

- Bridge ETH to HyperEVM and convert it to cmETH.

- Split it:

- 50% to HyperBeat: loop 10x

- 50% to HypurrFi: loop 7x

This setup earns HyperBeat, Karak, EigenLayer, Veda, and HypurrFi points. You also get base APY.

4. Maximize Stablecoin Yield (Felix, HypurrFi, HyperSwap)

The most efficient farming setup right now revolves around stablecoins (more important now that the GENIUS Act got approved). Here’s how to make it work:

- Supply HYPE or BTC on Felix.

- Borrow feUSD or USDT0.

- Deposit the stablecoins in Felix’s Earn tab or LP them on HyperSwap.

- Loop into HypurrFi for boosted points.

You’ll touch multiple protocols while earning APR, farming points, and staying capital-efficient.

5. Full Ecosystem Exposure = Airdrop Boost

To qualify for more drops, interact with the entire HyperEVM ecosystem.

Things to do:

- Buy HL domains on HLNames.

- Mint NFTs on Drip.trade (like Hypio Babies).

- Hold Hypio NFTs to earn ecosystem airdrops.

- Use Kittenswap for swaps and LP positions.

- Vote on governance pools where possible.

- LP riskier assets like BUDDY/HYPE for high APR.

Each of these adds more points and broadens your footprint.

6. Tools and Risk Management

Use Hyperfolio by @StableAPY to track positions and health metrics. Managing loops, borrow rates, and exposure can be tricky. Don’t wing it—track everything.

Also consider allocating a portion of your funds to newer platforms like:

- Valantis

- HyperStableX

- LiquidLaunch

- Hyperpie

These protocols are smaller but may reward early users better than large ones.

Capital Allocation Example (for a 100k+ Portfolio)

| Bucket | Allocation | Strategy Type |

|---|---|---|

| Volume Farming (BTC/ETH) | 15% | Delta-neutral spot/futures |

| $HYPE Loop + Hedge | 25% | Yield, points, neutral exposure |

| Felix & HypurrFi Loops | 30% | Stablecoin yield & leverage loops |

| ETH Loop (HyperBeat/Hypurr) | 15% | Staked ETH + EigenLayer points |

| Vaults + NFT + Domains | 10% | Passive + onchain airdrop triggers |

| Risk/Rotation (BUDDY, Kittenswap, Valantis) | 5% | Opportunistic farming |

Summary: Why This Strategy Works

- Breadth > Size: Touch all protocol verticals (staking, LP, trading, lending, NFTs, bridging)

- Delta-Neutral Focus: Minimize downside while boosting volume and exposure

- Protocol Depth: Felix, HypurrFi, HyperBeat, and Valantis are at the center

- Stacked Yield: APRs + points + token exposure

- Flexible & Scalable: Add leverage loops or hedge risk depending on capital

When Will the Hyperliquid Airdrop Take Place?

No official date has been announced yet. But based on what we’ve seen with other protocols, we have two likely timelines:

- December 2025: Same timing as season 1

- September 2025: If they accelerate the rollout

Either way, we are early. There’s still time to farm all summer and stack exposure across every part of the ecosystem.

Summer in crypto is often quiet. Use that time to dive deep and position yourself.

If this guide was helpfull please use our ref link to join. Support our work and keep all our content free!

More Airdrops in The Hyperliquid Ecosystem

You can find airdrops within the Hyperliquid ecosystem on Airdrop Alert. Over the next few weeks, we will add even more opportunities, helping you optimize your farming strategy further. This way, you can continue stacking points and farm other potential airdrops alongside Hyperliquid. It worked great during the Blast ecosystem wave, and we’re aiming to replicate that success here.

Simply click the image below, and filter on “Hyperliquid”.

Final Words

Hyperliquid changed the game in 2024. Now, we’re gearing up for something even bigger.

With $HYPE at an ATH, TVL surging, and the ecosystem expanding rapidly, this is your window to build positioning before the next massive wave hits.

Loop smart. Hedge your exposure. Touch everything. And most of all—don’t be lazy. The farmers who go the extra step are the ones who win.

Stay safe, and stack those points. See you on-chain.

If you enjoyed this blog, check out our farming strategy for the Virtuals Airdrop.

As always, don’t forget to claim your bonus below on Bybit. See you next time!