The crypto market is heating up again, and Solana is back in the spotlight. After weeks of lagging behind Ethereum and other major altcoins, SOL has surged over 15% in the past 24 hours, reclaiming the $200 level for the first time since late July. Traders are asking the big question — is this the start of another Solana breakout, or just a short-term pump?

A Key Psychological Level

Breaking $200 is more than just a number. It’s a key psychological and technical milestone for Solana. According to Kronos Research CIO Vincent Liu, clearing this threshold can attract fresh buyers and boost market momentum.

The last time SOL traded above $200 was only for a brief moment in July. Before that, you’d have to go back to February. This return to triple digits comes after a choppy August where ETH outperformed, leaving Solana bulls frustrated.

Ethereum’s Surge Ignites Altcoins

Ethereum’s latest rally above $4,700 — its highest since the all-time high in 2021 — has reinvigorated the altcoin market. ETH has now flipped BTC for year-to-date gains, and the excitement is spilling over into other majors.

In the past day alone, XRP, BNB, DOGE, and ADA all posted strong gains alongside SOL. While Bitcoin’s move was a modest 1.6%, altcoins clearly had the upper hand. This kind of broad rally often marks a shift in trader sentiment toward higher-risk assets.

Treasury Firms and Institutional Buying

Another factor supporting Solana’s move could be the rise of crypto treasury companies. Several have raised and deployed billions into the market in recent weeks.

One standout is DeFi Development Corp, a Solana treasury firm reportedly earning $63,000 daily from its 1.3 million SOL holdings. Public company SOL holdings now approach $675 million, highlighting growing institutional interest in the network.

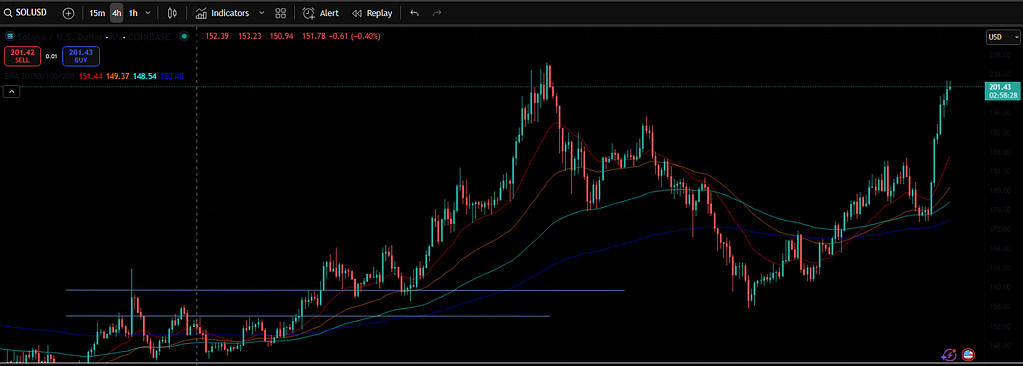

The Technical Picture

On the charts, SOL is trading above $202 and its 100-hourly simple moving average. The price recently broke a bearish trend line near $178, then cleared $195 resistance during the rally.

Immediate resistance now sits at $202 and $205. A strong close above $205 could open the path toward $212 and even $220 in the short term. The MACD is still gaining bullish momentum, and RSI remains healthy above 50.

On the downside, initial support sits at $194. If the rally fades, $186 becomes the first major support level, followed by $180 and $175.

Whale Moves Could Add Volatility

While technicals look solid, whale activity adds an element of uncertainty. Large holders moved over 226,000 SOL to exchanges recently. One whale sold roughly $17.2 million worth of tokens in just two days, while Alameda Research unstaked $35 million in SOL from long-term holdings.

Such moves can create short-term supply pressure, especially if paired with weaker market sentiment. Traders will want to watch exchange inflows closely.

Guide: How to spot the top patterns.

The $170 Support Line in the Sand

Despite recent selling, Solana’s net position remains positive. The $170 level has emerged as a critical support zone for bulls to defend. Losing it could shift the narrative toward deeper corrections, while holding above it keeps the door open for another leg higher.

Final Thoughts: Can Solana Hold $200?

Solana’s return to $200 is a big win for bulls, especially after ETH stole the spotlight in recent weeks. The mix of technical strength, renewed altcoin momentum, and institutional interest makes the case for more upside.

Still, whale sales and the $205 resistance zone will be the first real tests. If SOL can clear and hold above $205, a push toward $220 looks realistic. If not, a retest of the $186–$194 range may be in store.

For now, traders are watching closely. Solana 200 isn’t just a number — it’s the battleground that could decide the next big move.

If you enjoyed this blog, check out our recent blog about the price of $LINK

As always, don’t forget to claim your bonus below on Bybit. See you next time!