With the conflict in the Middle East intensifying, crypto markets have faced rising uncertainty. Volatility is high. Many traders are struggling to find a clear direction for the SOL price. Summer could bring a range-bound market, as macro risks like war and inflation dominate the news cycle.

Still, Solana remains one of the most popular chains in the crypto space. Our community continues to build and trade on it daily. So in this update, we take a closer look at the SOL price, technical levels, ETF news, and what could happen next.

Increase your trading edge with our series of trading guides

Solana Tests Key Support Zone

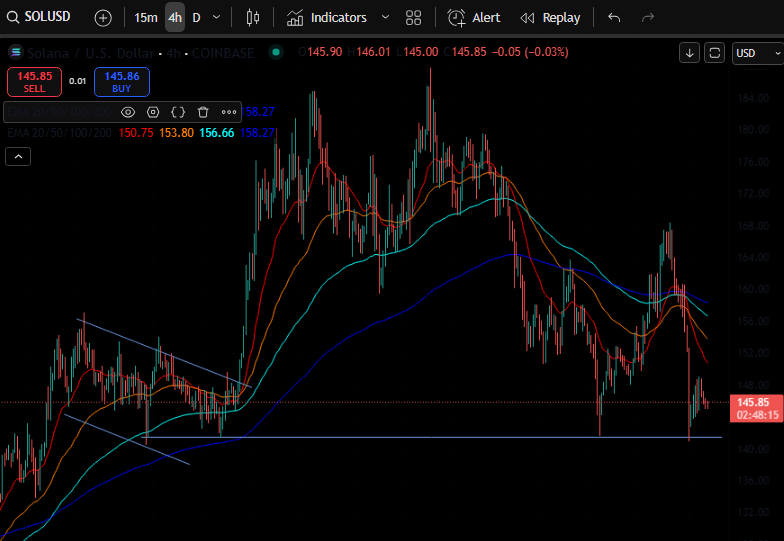

Solana is once again testing the $141 to $144 price area. This range has acted as strong support since early April. The last time SOL touched this level, it bounced quickly toward $160.

Traders are watching this zone closely. If it holds, Solana might move up again and retest the $160 to $165 resistance range. But if it breaks down, the price could fall fast. The next support zones are near $120, and then $100. These levels have seen buying interest in the past.

ETF Speculation Boosts Long-Term Confidence

Despite short-term fear, Solana’s long-term outlook is improving. Hype around a possible U.S.-listed Solana ETF is gaining momentum. According to Polymarket, there’s now a 90% chance that the SEC will approve a SOL ETF.

This optimism follows the news that the Invesco Galaxy Solana ETF was officially registered in Delaware. It’s a major step forward. JPMorgan analysts even predict that a Solana ETF could bring in $6 billion in its first year. That would be nearly double what Ethereum ETFs attracted since their launch.

Related, Check the price action of Solana based meme coin: $BONK

Solana’s Resilience Still Impresses

SOL has recovered from sharp sell-offs before. In April, the token fell to $95.40—but bounced back 96% to nearly $187. After the FTX crash in 2022, Solana dropped below $10. Yet it later climbed close to $300.

Right now, funding rates are low, suggesting caution in the market. But this could also signal room for another move higher. If ETF optimism continues and geopolitical risk cools down, Solana might outperform other major coins.

Current Price Action and Next Targets

SOL recently bounced off the $142 support zone to $168, and is currently trading around $145. This move brought renewed interest among traders, and trading volume has spiked over 40% in just 24 hours.

The Sol Price is looking to head for the $165 to $170 resistance range again.. If SOL closes above $170, the next price target is $180.

A clear break and retest above $180 could open the path toward higher zones. Bulls are eyeing $195 as a mid-term goal. If momentum continues, even $241 might come into play later this year.

Network Activity Aligns With Price Strength

Solana isn’t just gaining on the charts—it’s also showing strength on-chain. According to DeFiLlama, the total value locked (TVL) in Solana’s DeFi ecosystem grew by $860 million in just five days. That brought the TVL to $8.81 billion.

This growth came from both DEX trading and liquidity farming. DEX volume on Solana almost doubled between June 8 and June 11, jumping from $1.53 billion to $2.95 billion.

Even meme coins are driving attention back to Solana. The total market cap of Solana-based meme coins rose by 6.7% in just 24 hours. Historically, this kind of speculative interest has sparked larger rallies in SOL price.

Regulatory Developments Add Fuel

On the regulatory side, ETF hopes are rising. Polymarket data shows a 61% chance of ETF approval, the highest in months. The SEC recently asked ETF applicants to update their filings. This shows the process is moving forward.

If a Solana ETF gets the green light, new money could enter the market fast. Institutions may finally get a clear way to invest in SOL. Combined with strong network usage and bullish technicals, this could make Solana one of the top-performing altcoins in the next cycle.

What to Watch Next

Right now, traders are focused on a few key levels. First, $144 must hold as support. If it does, SOL could climb back to $170. From there, $180 becomes the main resistance.

If price breaks $180 with volume, momentum could carry SOL to $195—and maybe even $241. But if $144 breaks, downside risk increases. Traders should watch $120 and $100 as potential bounce zones.

On the macro side, any updates on the Solana ETF application will move markets. Also, if the conflict abroad cools down, we could see risk-on behavior return fast.

Support Our Work

If you enjoy insights like these, consider using our referral links when signing up for exchanges. It helps us continue offering free content.

Try BloFin for a fast, non-KYC exchange or Bybit, our go-to trading platform. Every referral makes a difference. Thanks for the support!

Always trade with proper risk management. Don’t bet it all and use a stop loss! This is a long game, not a get-rich-quick scheme.

Final Thoughts: Summer May Be Choppy, But Solana Stays Strong

The market may stay tricky in the short term. War, inflation, and ETF decisions are all in play. But Solana continues to attract both retail and institutional interest.

On-chain activity is growing. Price structure looks solid. And the buzz around a potential ETF is giving long-term investors a reason to watch closely.

We’ll continue tracking the SOL price over the coming weeks. Whether you’re trading levels or just farming on-chain, Solana remains a top player in this market cycle.

If you enjoyed this blog, check out our recent look at the $HYPE chart.

As always, don’t forget to claim your bonus below on Bybit. See you next time!