The crypto market never sleeps, and neither should your news feed. This week, Ethereum broke the $4,000 mark, and traders are buzzing. Staying updated is not just for entertainment. It’s a survival skill when managing your bags and finding great trade entries.

Let’s dive straight into the headlines, starting with the big one — the September rate cuts everyone is talking about.

Fed Rate Cuts Forecast Moved to September

J.P. Morgan now expects the U.S. Federal Reserve to cut interest rates by 25 basis points in September. This shift from their previous December forecast comes after signs of a softer labor market and political shifts in Washington.

The move also coincides with President Donald Trump’s nomination of Stephen Miran to a temporary seat on the Fed’s board. Miran is known for his critical stance toward the central bank, which could spark more internal division.

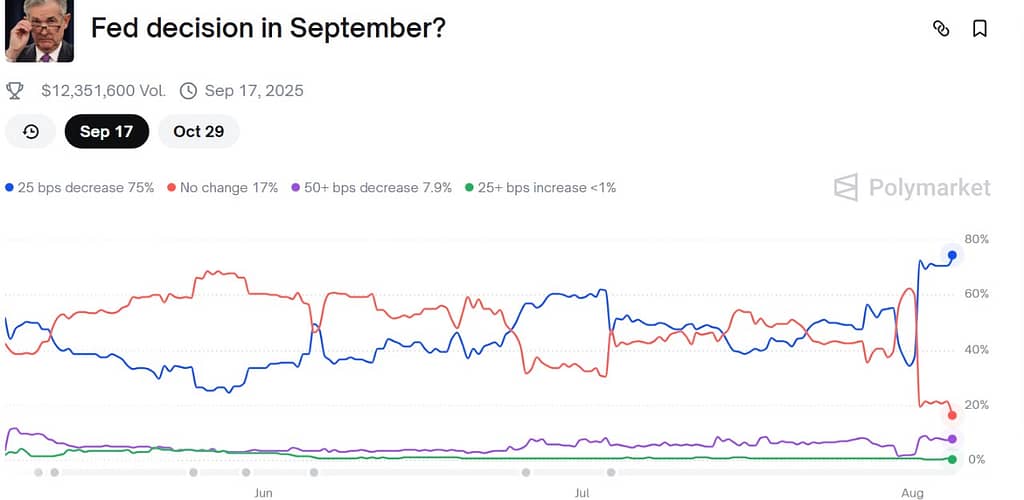

Traders have noticed. The CME Group’s FedWatch tool now shows an 89.2% chance of a September rate cut, compared to just 37.7% last week. On Polymarket, the odds have jumped as well.

Analysts suggest the Fed’s decision will depend heavily on the August jobs report. A 4.4% unemployment rate or higher could push them toward a bigger cut. Anything lower might strengthen resistance from inflation-focused policymakers.

Market watchers are also eyeing Christopher Waller as a potential successor to Jerome Powell when his term ends in 2026. Barclays says a Waller appointment could bring stability and make markets less jumpy about policy shifts.

For crypto traders, earlier rate cuts often mean looser monetary conditions. This can push risk assets, including Bitcoin and Ethereum, higher. That’s why the September rate cuts story is being followed closely.

Quick Airdrop Updates

Over at AirdropAlert, there’s been plenty of activity. And we make sure you don’t miss the important airdrop updates.

- The Towns airdrop claim is live, and the token is already tradable on MEXC and Binance.

- Gaia airdrop claims have also gone live.

- Magic Eden Season 2 rewards just got a major boost, now totaling 10 million $ME.

If you’re farming airdrops, these are worth a look before they expire. If you missed these, take a look at the new BNB airdrops that are currently trending.

SEC Says Liquid Staking Tokens Are Not Securities

The SEC just gave liquid staking platforms like Lido a reason to breathe easier. In a new statement, the regulator clarified that receipt tokens from liquid staking are not securities.

The reasoning is simple. Providers act as agents and don’t manage or control your assets. They just facilitate staking. That means no need for registration under federal securities laws.

Lido currently holds $31.8 billion in deposits, and the entire liquid staking sector boasts $66.8 billion in total value locked. The ruling removes a cloud of regulatory uncertainty that’s been hanging over the industry.

Not everyone’s celebrating, though. Former SEC official Amanda Fischer compared liquid staking to risky behavior seen before the 2008 crisis. Crypto leaders quickly pushed back, saying DeFi protocols are transparent and nothing like Wall Street banks.

Trump Signs Order to Allow Crypto in 401(k)s

President Trump signed an executive order to open the door for alternative assets — including cryptocurrencies — in 401(k) retirement accounts.

The order instructs the U.S. Secretary of Labor to review fiduciary guidance on these investments. It builds on earlier moves during Trump’s first term and comes as big asset managers like BlackRock and Empower roll out private asset options in retirement products.

This is a huge win for the crypto industry. Allowing Bitcoin and other digital assets into 401(k) plans could unlock a massive pool of capital. Americans currently hold around $8.7 trillion in these accounts.

Of course, the move isn’t without risk. Private assets often have high fees, less transparency, and long lockup periods. But for crypto bulls, it’s a clear sign of growing mainstream acceptance.

Crypto Treasury companies are moving into Alt coins and NFTs.

Phantom Buys Solana Trading Platform Solsniper

Phantom, the popular multichain wallet, has acquired Solsniper — a go-to tool for Solana traders. Solsniper is known for its speed, wallet-tracking features, and advanced analytics.

The platform will keep operating on its own, but its team is now working under Phantom. This follows Phantom’s earlier acquisition of Simplehash and shows they’re building beyond just wallet storage.

By integrating Solsniper’s trading tools, Phantom is clearly aiming to become an all-in-one DeFi hub. Think of it as a mix between a wallet, a trading terminal, and an analytics platform.

Learn how to spot the top on the charts.

The Man Who Lost 8,000 Bitcoin Has a New Plan

James Howells, the man who accidentally threw away a hard drive with 8,000 Bitcoin back in 2013, is not giving up. After years of trying — and failing — to convince his local council to let him dig through a landfill, he’s changing tactics.

Howells plans to tokenize his claim to the lost BTC, creating 800 billion Ceiniog Coin (INI) on Bitcoin Layer 2. The tokens will be integrated with other blockchain tech like Stacks, Runes, and Ordinals.

At Bitcoin’s all-time high of $123,091, that hard drive would be worth nearly $985 million. Even at today’s price of $114,168, it’s still worth over $913 million.

It’s one of the longest-running sagas in crypto, and now it’s taking a DeFi twist.

Final Thoughts

The September rate cuts story is the one to watch. If the Fed moves sooner than expected, risk assets could rally hard. Ethereum already touching $4,000 shows how quickly sentiment can shift.

Meanwhile, regulatory wins, big acquisitions, and airdrop opportunities are shaping the market’s mood. Whether you’re a long-term holder or an active trader, staying informed is key.

Crypto moves fast. So should you.

If you enjoyed this blog, you may want to check our other crypto news updates.

As always, don’t forget to claim your bonus below on Bybit. See you next time!