The market feels like it’s waiting. Traders are sitting on their hands, hoping altseason finally wakes up. Meanwhile, NFT holders are staring at their wallets, wondering if our beloved jpegs will ever see upside again. Will NFTs catch their own season this year? That’s the big question. In the middle of this wait, something new is stirring: PunkStrategy.

I’ve been around long enough to see strange experiments in both tokens and NFTs. Some die quickly, others spark real waves. PunkStrategy feels like one of those ideas that could shake things up. Let’s dive into what it is, how it works, and whether it might breathe life back into the Punk market.

What is PunkStrategy?

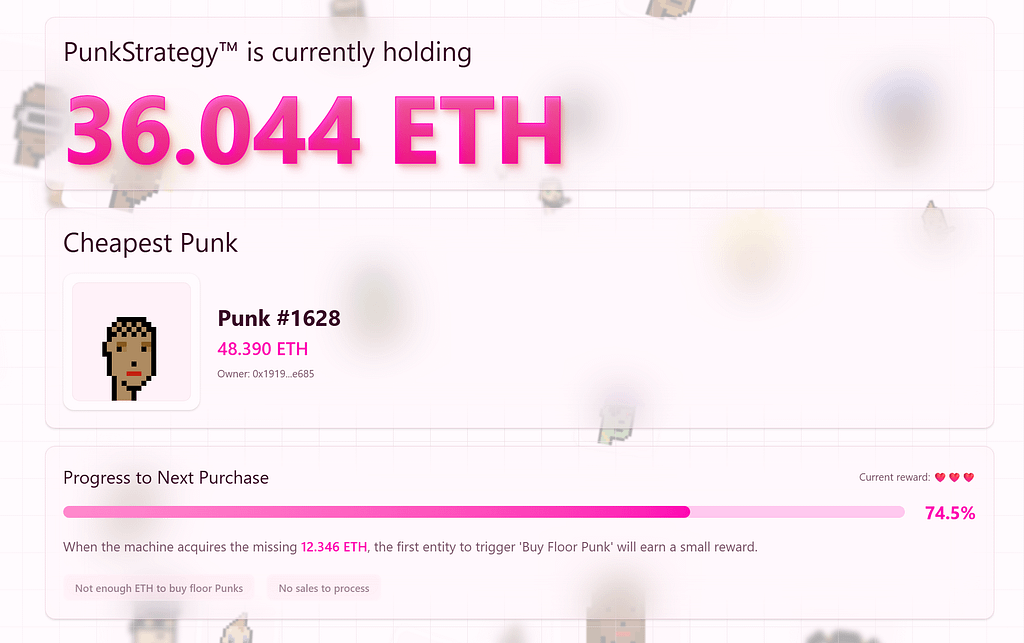

PunkStrategy calls itself the “Perpetual Punk Machine.” It’s built by TokenWorks and comes with a warning: high fees, so read carefully before diving in. At its core, the project ties CryptoPunks, one of the most iconic NFT collections, to a new token called $PNKSTR.

The mechanism is called the Yoyo. It’s a simple loop of buying and selling Punks while reducing token supply forever. This is how the Yoyo keeps spinning.

How the Yoyo Works

Here’s the breakdown of the system in four clear steps:

- Fees from $PNKSTR trading pile up inside the smart contract until there’s enough to buy the floor Punk.

- Anyone can trigger the “BuyPunk” function and claim a small 0.01 ETH reward for pressing the button.

- That Punk is immediately listed for sale at double the price it was purchased for.

- Once sold, the ETH from that Punk goes straight back into buying and burning $PNKSTR tokens.

That’s the full loop. Fees go in, a Punk gets scooped up, and the process resets. It’s all about keeping supply in check while linking token action to NFT action.

The Fee System

Fees are a big part of this experiment. Here’s how they play out:

- There’s always a 10% buy and sell tax on $PNKSTR.

- Before the first Punk is purchased, the sell fee is a brutal 50%. This is to reward long-term holders and discourage quick flips.

- After a Punk is sold by the protocol, fees spike to 90%. They slowly decrease over time to balance things out and avoid MEV attacks.

- The rake is split 80/20.

It’s heavy, but it’s designed to keep the system sustainable and push attention toward holding.

Of course, the community has thoughts. Many love the concept. Anything that might “pump the bags,” as they say, tends to get traction. But there are debates too.

The biggest question so far: is listing Punks at 200% above floor the right move? Some argue that a more modest relist at 10–15% above floor would be better. The team has responded by saying they’ll listen to community input and may adjust in future.

It’s a reminder that PunkStrategy is not static. It’s designed to evolve with feedback, which is often a good sign for early-stage protocols.

Current Punk Market Stats

Let’s zoom out for a second. Here’s where the Punk market stands right now:

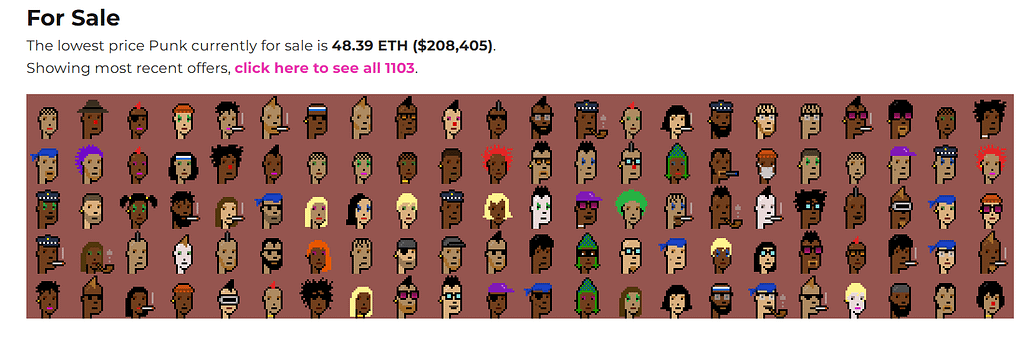

- The cheapest Punk listed sits at 48.39 ETH (around $208,405).

- Over the past year, the average sale price for a Punk has been 59.26 ETH (about $171,259).

- In total, Punks worth 136,358.99 ETH have been sold in the last year, which equals $394 million in value.

That’s serious money, even in a slow NFT market. It shows there’s still depth, liquidity, and collector demand in Punks.

I foolishly sold 2 CryptoPunks at 44 ETH in the summer run up. Even tho i banked a couple of ETH, i missed the majority to the upside when they ran to mid 50’s. Oh well, profit is profit as they say.

Related: AI bought a CryptoPunk

Why PunkStrategy Matters

I like projects that mix old and new. CryptoPunks are the OG NFTs, carrying cultural weight that newer collections dream of. Pairing them with a deflationary token loop is something different.

It creates constant pressure: tokens get burned, Punks get bought, and players get engaged. Even if you’re not holding Punks, you’re tied to their market through $PNKSTR. That’s a clever way of keeping relevance alive.

For me, it also taps into something nostalgic. I still remember watching the first NFT waves hit, wondering if they’d last. PunkStrategy reminds me of that energy. It feels experimental, maybe risky, but exciting all the same.

Risks to Keep in Mind

Not everything is smooth sailing. There are clear risks:

- The fee structure is punishing if you’re not patient.

- If Punks don’t sell quickly at double floor, the cycle could stall.

- Community sentiment could shift fast if the mechanism feels too rigid.

Still, I’ve learned over time that high-risk experiments often create the most interesting stories in crypto. The key is knowing what you’re stepping into.

Also read: The New Pudgy Penguins game is killing it!

Support Our Work

If you found this helpful, consider signing up on BloFin (Non-KYC) or Bybit using our referral links. Your support keeps this content free and flowing.

Final Words

Will PunkStrategy bring back NFT season? Hard to say. But it’s definitely an experiment worth watching. It ties together one of the most iconic NFT collections with a fresh token economy, and it has already sparked strong community chatter.

Personally, I enjoy seeing these kinds of ideas come to life. Whether it pumps or flops, it adds flavor to the market. And who knows? Maybe this Yoyo will keep spinning long enough to pull Punks back into the spotlight.

If you’re curious, take a closer look at PunkStrategy. Just make sure you read the fine print on those fees before you dive in.

If you enjoyed this blog, be sure to check out the blog on Pump Fun’s new fee structure, which favors creators.

As always, don’t forget to claim your bonus below on Bybit. See you next time!