Bitcoin’s market structure reflects growing risk aversion, with ETF outflows, weakening futures, and declining on-chain activity. Rising options hedging and falling profitability signal investor distress. Without renewed liquidity, downside pressure may persist despite spot market resilience.

Overview

The Bitcoin market continues to navigate a complex landscape, with spot market strength contrasting with ETF outflows, declining futures activity, and weakening on-chain conditions. Options markets show heightened risk perception, while profitability and liquidity indicators suggest growing investor caution.

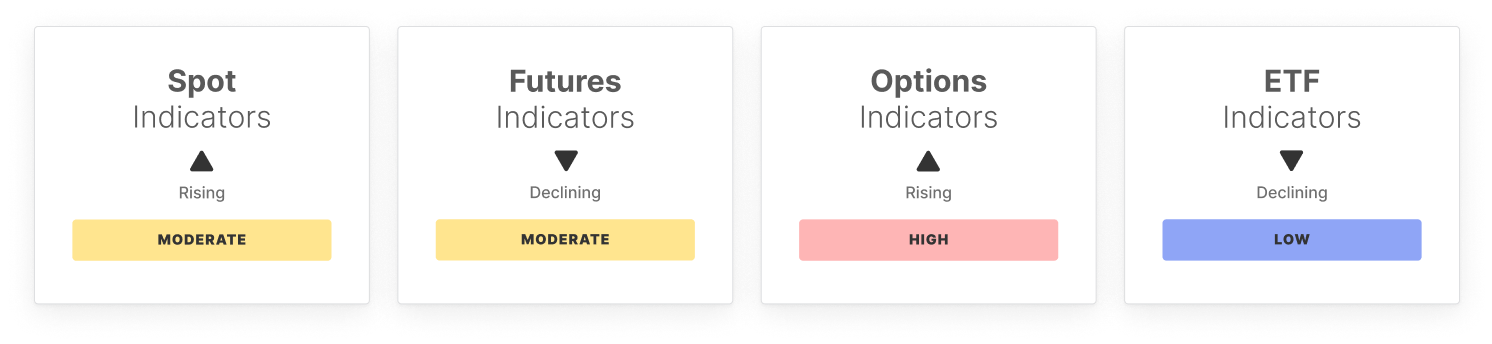

Spot markets have shown resilience, with rising price momentum and steady trading activity, though ETF flows have turned sharply negative, signalling institutional de-risking. Futures markets continue to weaken, with declining open interest, lower funding rates, and increasingly negative perpetual CVD, suggesting a continued unwinding of leverage. Meanwhile, Options market activity has surged, with volatility spread and 25 Delta Skew breaking above statistical highs, reflecting elevated hedging demand and market uncertainty.

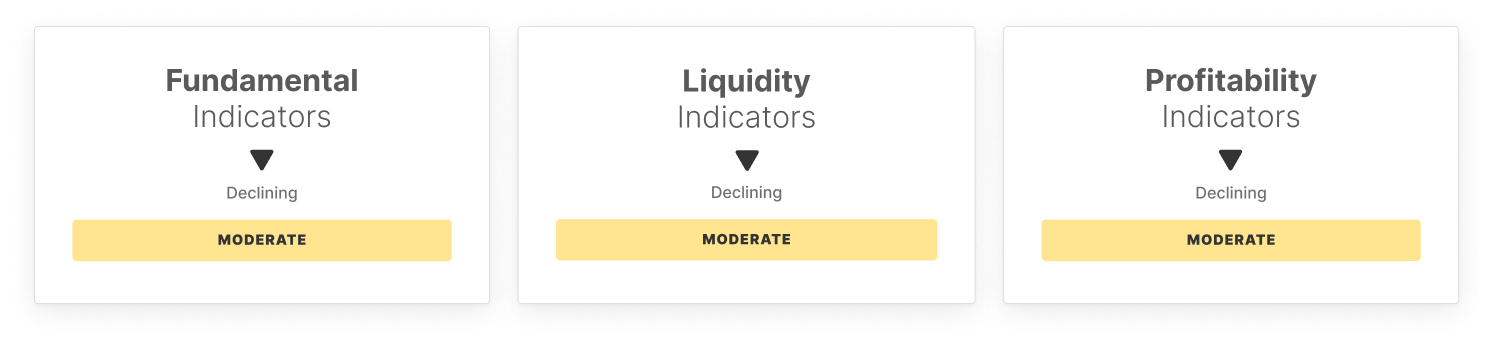

On-chain activity remains subdued, as active addresses, transfer volume, and total fees continue to decline, signaling lower network engagement. Liquidity conditions are deteriorating, with realized cap growth slowing and hot capital share declining, suggesting weaker capital inflows and cooling speculative demand. Profitability metrics continue to slide, with percent supply in profit and NUPL nearing critical lower bands, while realized profit/loss has plunged below the long-term low, signaling intensifying loss realization and investor distress.

Overall, while spot markets remain stable, the broader market structure reflects a defensive stance, with ETF outflows, futures selling, and increased downside hedging in options markets reinforcing risk aversion. Without renewed liquidity inflows, Bitcoin remains vulnerable to continued downside pressure.

Off-Chain Indicators

On-Chain Indicators

Download the full report:

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

Exchange balances presented are derived from Glassnode’s comprehensive database of address labels, which are amassed through both officially published exchange information and proprietary clustering algorithms. While we strive to ensure the utmost accuracy in representing exchange balances, it is important to note that these figures might not always encapsulate the entirety of an exchange’s reserves, particularly when exchanges refrain from disclosing their official addresses. We urge users to exercise caution and discretion when utilizing these metrics. Glassnode shall not be held responsible for any discrepancies or potential inaccuracies.

Please read our Transparency Notice when using exchange data.