Chainlink is making headlines again. The LINK price has surged nearly 44% in just one month, crossing $22 for the first time in months. This rally has been powered by a mix of fresh fundamentals, bullish on-chain data, ETH breaking the $4k resistance signaling alt season, and strong technical signals. Many traders now wonder: is this just the beginning?

Chainlink Price Surges 44% in a Month

Chainlink has been one of the strongest performers in the market recently. The LINK price jumped 43.99% in August alone, riding a wave of positive developments. The rally picked up steam in early August, helping LINK break above multiple resistance levels that had held for months.

The momentum comes as both retail traders and large investors—better known as whales—are taking positions. On top of that, new tokenomics developments have introduced deflationary pressure, giving bulls even more reasons to stay confident.

Guide: How to spot the top patterns.

Chainlink Reserve Launch Adds Deflationary Pressure

One of the most talked-about catalysts is the launch of the Chainlink Reserve on August 7. This on-chain mechanism channels protocol revenue directly into LINK purchases. So far, over $1 million worth of LINK has been locked from enterprise adoption fees and on-chain service payments.

This setup mirrors corporate treasury strategies like MicroStrategy’s Bitcoin reserves. It sends a clear message to the market: Chainlink is committed to long-term value. All reserve transactions are publicly trackable on Etherscan, adding transparency to the process.

Analysts believe the real test will be how quickly the reserve grows and whether upcoming partnerships with big names like Mastercard and JPMorgan fuel more adoption.

Whales Load Up as Exchange Reserves Drop

On-chain data tells another bullish story. Wallets holding between 100,000 and 1 million LINK increased holdings by 4.2% in August, adding a total of 4.55 million tokens—worth about $97 million.

At the same time, exchange reserves have dropped by 33 million LINK since July. This hints at a potential supply squeeze, as more tokens move into cold storage. Derivatives markets are also heating up, with open interest rising 27% to $1.06 billion.

This accumulation suggests whales expect more upside and are willing to hold rather than trade short term.

Why Whale Accumulation Matters

Whale accumulation is one of the strongest confidence signals in crypto. A single day in August saw $1.21 billion worth of whale transactions. This buying wave helped the LINK price surge more than 15% within hours.

Large-scale accumulation not only supports price stability but also attracts institutional interest. When the biggest players in the market are willing to commit, it tends to create a self-reinforcing cycle of demand and credibility.

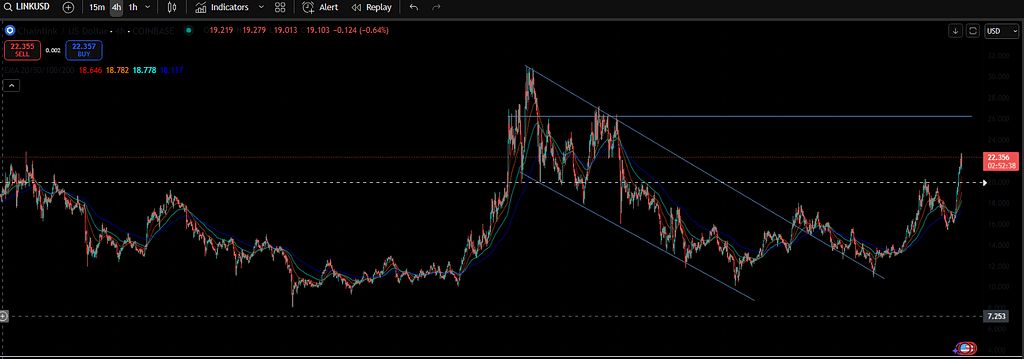

Technical Breakout Targets $26

From a charting perspective, LINK has broken above its 200-day EMA at $17.02 and cleared a multi-year symmetrical triangle. Technical indicators remain bullish, with the RSI around 65 and the MACD histogram in positive territory.

A daily close above $21.89 could be the spark for a run toward $26. Traders are watching these levels closely as the next resistance test.

How the Chainlink Reserve Impacts Liquidity

The Chainlink Reserve’s closed-loop model uses off-chain enterprise revenues to purchase and lock LINK. This reduces circulating supply, potentially creating upward pressure on the LINK price.

The system also uses Payment Abstraction to convert different payment tokens into LINK. This makes it easier for enterprises to adopt Chainlink services without holding LINK directly. Over time, this model could prove to be a significant driver of liquidity and price stability.

Multi-Year Triangle Breakout Points to Higher Targets

According to analyst Crypto Patel, LINK’s breakout from its multi-year triangle could set the stage for much higher prices. The key support level at $8.95 has held strong for years, while the breakout above $17 marks a major shift in market structure.

The bullish projection includes targets of $35, $50, and even $100 this market cycle. If macro conditions align and adoption continues, an extreme long-term target of $230 has even been floated.

For now, holding above $20 is essential to keeping bullish sentiment alive.

Technical Indicators Support Current Momentum

At the time of writing, LINK is trading around $22, up 4.63% for the day. Price is hugging the upper Bollinger Band, with the midline at $17.96 acting as dynamic support.

The RSI at 68 is nearing overbought territory, but momentum remains strong. The daily chart shows consistent closes above the 20-day moving average.

Volume patterns also point to strong buyer participation. As long as LINK holds above $19.50, the uptrend remains intact. A dip below that level might trigger a short-term consolidation phase before the next leg up.

Also check out the Bullish Price momentum of $PEPE.

Support Our Work

If you found this helpful, consider signing up on BloFin (Non-KYC) or Bybit using our referral links. Your support keeps this content free and flowing.

Final Words

The LINK price has staged an impressive comeback, with whales accumulating, technical patterns breaking out, and the new reserve mechanism adding deflationary pressure. If the momentum holds, a push toward $26 could come sooner rather than later.

From there, the bigger targets of $35 and beyond are in play for this market cycle. The key will be holding critical support levels and maintaining bullish volume. For now, Chainlink’s future looks brighter than it has in months.

If you enjoyed this blog, check out our recent blog about WLFI, the Trump-backed DeFi project that holds $LINk in its treasury.

As always, don’t forget to claim your bonus below on Bybit. See you next time!