The last few days have been intense for crypto traders. It felt like watching a high-stakes thriller unfold on-chain. Whale wallets moved, speculators held their breath, and the pseudonymous trader James Wynn became the talk of the town. Some rooted for him, others waited for him to fall. And yesterday, the market got its answer — the much-anticipated James Wynn liquidation finally happened.

But this wasn’t just another trading loss. It was a major event that sent shockwaves across the Bitcoin market. Let’s break down what happened and what it means for the future of BTC.

Bitcoin Briefly Breaks Below $105,000

On Thursday, May 30th, Bitcoin dipped under the crucial $105,000 level. The move caused panic and heavy selling, dragging the price to $104,150 before bouncing slightly. As of now, Bitcoin is trading at $105,795.12 — a 1.90% drop in 24 hours and down 3.8% from its recent peak of $110,000.

The market cap fell to $2.1 trillion while daily volume spiked over 16%, reaching nearly $59 billion. The message was clear: traders were rushing to adjust their positions.

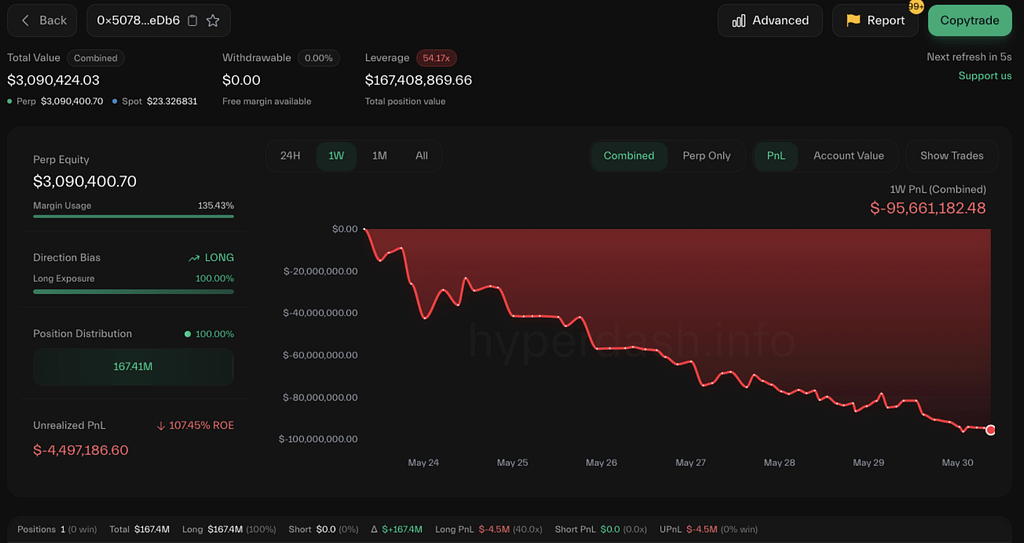

$110 Million Gone: James Wynn Liquidation Trade Unravels

James Wynn is known for placing bold, high-leverage positions. On May 21st, he entered a long worth $830 million on Hyperliquid — buying more than 7,700 BTC at $105,000. By May 24th, he had increased his bet to 11,588 BTC, worth around $1.25 billion at an average entry of $108,243.

But markets can turn fast. After former President Donald Trump revealed plans for a 50% tariff on EU exports, risk sentiment flipped. Bitcoin started falling, and Wynn’s massive leveraged position became vulnerable.

According to Hypurrscan, his liquidations came in waves:

- 527 BTC at $104,950

- 422 BTC at $104,150

- 95.5 BTC at $104,620

In total, he lost over 1,044 BTC — wiping more than $110 million from his portfolio.

James Wynn Reacts: “The Market Is Rigged”

Following the liquidation, Wynn posted on X, expressing frustration. He claimed the market was “corrupt” and added, “Guess it’s better to just buy and hold BTC on spot.”

His loss sparked debate. Some said it was reckless leverage. Others agreed that market conditions felt unusually coordinated — especially around such high-profile liquidations.

Trump’s Tariff News Adds Fuel to the Fire

On the same day, a U.S. appeals court temporarily revived Trump’s controversial tariffs, overturning a trade court’s earlier ruling. The decision added uncertainty to already fragile markets.

Trump’s original post on Truth Social read:

“If allowed to stand, this would completely destroy Presidential Power — The Presidency would never be the same.”

The legal back-and-forth added more volatility, affecting not only stocks and commodities but also crypto — with Bitcoin reacting quickly to macro headlines.

Will Bitcoin Revisit $100,000?

After the dip, traders are now asking the big question: how low can Bitcoin go?

$105,000 is still seen as an important psychological and technical level. Bulls are defending it to close the Wall Street trading week strong. But some analysts are sounding alarms.

Popular trader Roman pointed out that each cycle delivers smaller returns. “This cycle so far 600%, last cycle 2,000%, before that 10,000%,” he wrote on X. According to him, the current bull market might be near its peak.

He expects Bitcoin to move sideways now that $105,000 is in play again.

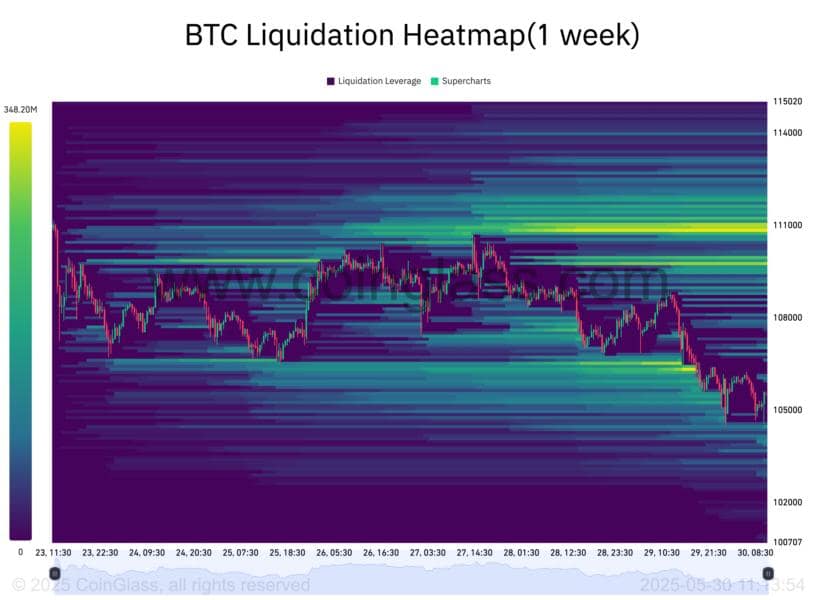

Exchange Data: $99K and $103K Are Key Zones

Looking at the order books, the $103,000–$104,000 zone is full of buy orders and liquidity. This could act as near-term support. But if that fails, things might get messy.

Data from CoinGlass shows long positions stacked between $99,000 and $103,000. If price dips into that range, many of those leveraged trades could be wiped out. I personally placed some spot orders around the $99k level, just in case we get there.

This means if selling pressure increases again, a cascade of forced liquidations could push BTC below six figures.

What Traders Are Doing Now

For now, many retail and institutional players are reducing leverage. It’s becoming clear that whales are dominating the market, and retail traders are trying to stay out of their way.

Some are buying spot BTC at lower levels, avoiding high-risk plays. Others are simply watching from the sidelines, waiting for the market to cool down.

Support Our Work

If you enjoy insights like these, consider using our referral links when signing up to exchanges. It helps us continue offering free content.

Try BloFin for a fast, non-KYC exchange or Bybit, our go-to trading platform. Every referral makes a difference. Thanks for the support!

Final Thoughts: The Lesson From Wynn’s Liquidation

We also tried to long around the $105,500 range last night, hoping for a bounce. Unfortunately, we got stopped out too. But that’s why we always use stop-losses — risk management keeps you in the game.

This week, we didn’t post or tweet the Bitcoin trade publicly, so none of our community followed us into it. That’s a relief after a solid win streak lately.

The takeaway? If whales are waging war on-chain, it’s sometimes best to watch from the sidelines. The James Wynn liquidation was a reminder that even the biggest players can fall hard — and fast.

Let’s stay sharp and wait for better setups. Crypto moves quickly, but there’s always another trade around the corner.

If you enjoyed this blog, check out our recent news on the SEC dropping the Binance lawsuit.

As always, don’t forget to claim your bonus below on Bybit. See you next time!