An ongoing EU crypto investigation into OKX for allegedly laundering $100 million from the Bybit hack in February 2025, has seen the European bloc threatening to remove OKX MiCA license.

European regulators are reportedly probing OKX’s decentralized trading and self-custody offerings, which they claim were used by the Lazarus Group—a notorious hacking outfit allegedly sponsored by the North Korean regime—to launder some of the loot stolen from Bybit.

In February 2025, hackers struck Bybit, stealing over $1.4 billion of one of the best cryptos to buy in 2025 from one of its cold wallets. Though the exchange continues to operate normally without halting withdrawals, the hack was a major blow to the industry, once again bringing scrutiny to exchanges that had managed to fend off hackers for months.

The Bybit Hack and Its Fallout for OKX in the EU

The alleged investigation, which could see OKX lose its license to operate in the EU, raises critical questions about regulatory oversight and compliance, particularly with the Markets in Crypto-Assets (MiCA) framework. In their last meeting on March 6, 2025, regulators reportedly discussed OKX, focusing on one of the exchange’s decentralized tools and whether it complies with MiCA guidelines.

MiCA, which came into force in late 2024, lays down guidelines on how dApps, including all permissionless tools, should comply with existing laws. During the meeting, some regulators argued that this tool should fall under MiCA and thus be subject to stricter compliance requirements.

Under MiCA, approved exchanges—including OKX, Crypto.com, Coinbase, and others—must always protect their clients, including those who buy some of the best high-risk, high-reward cryptos. For example, they will be held accountable if they mismanage funds or commit fraud.

To curb money laundering, MiCA imposes strict laws requiring exchanges to verify their clients’ identities and report suspicious transactions. Moreover, exchanges must implement robust monitoring systems to prevent the funding of illegal activities or the flow of illicit funds.

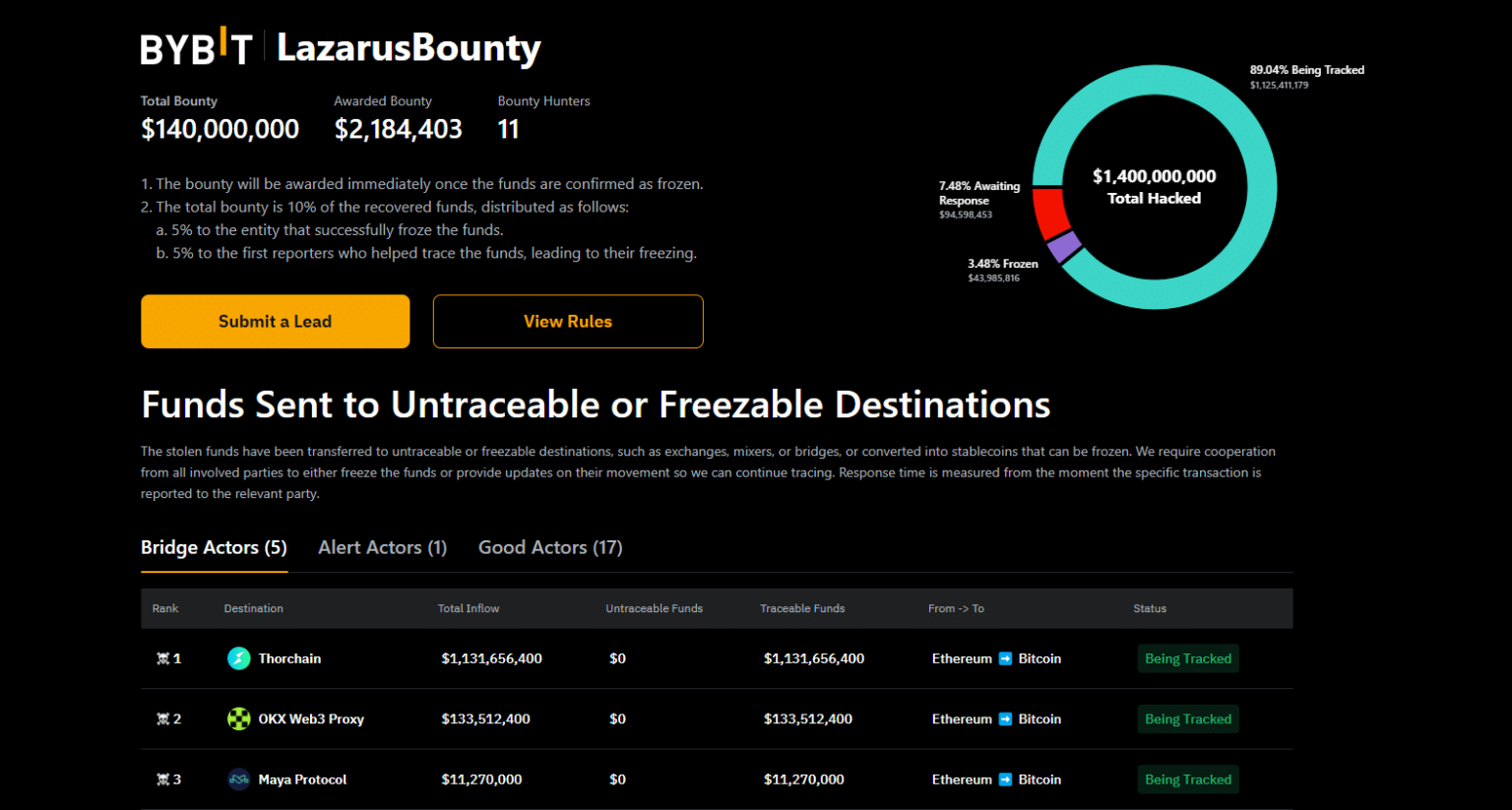

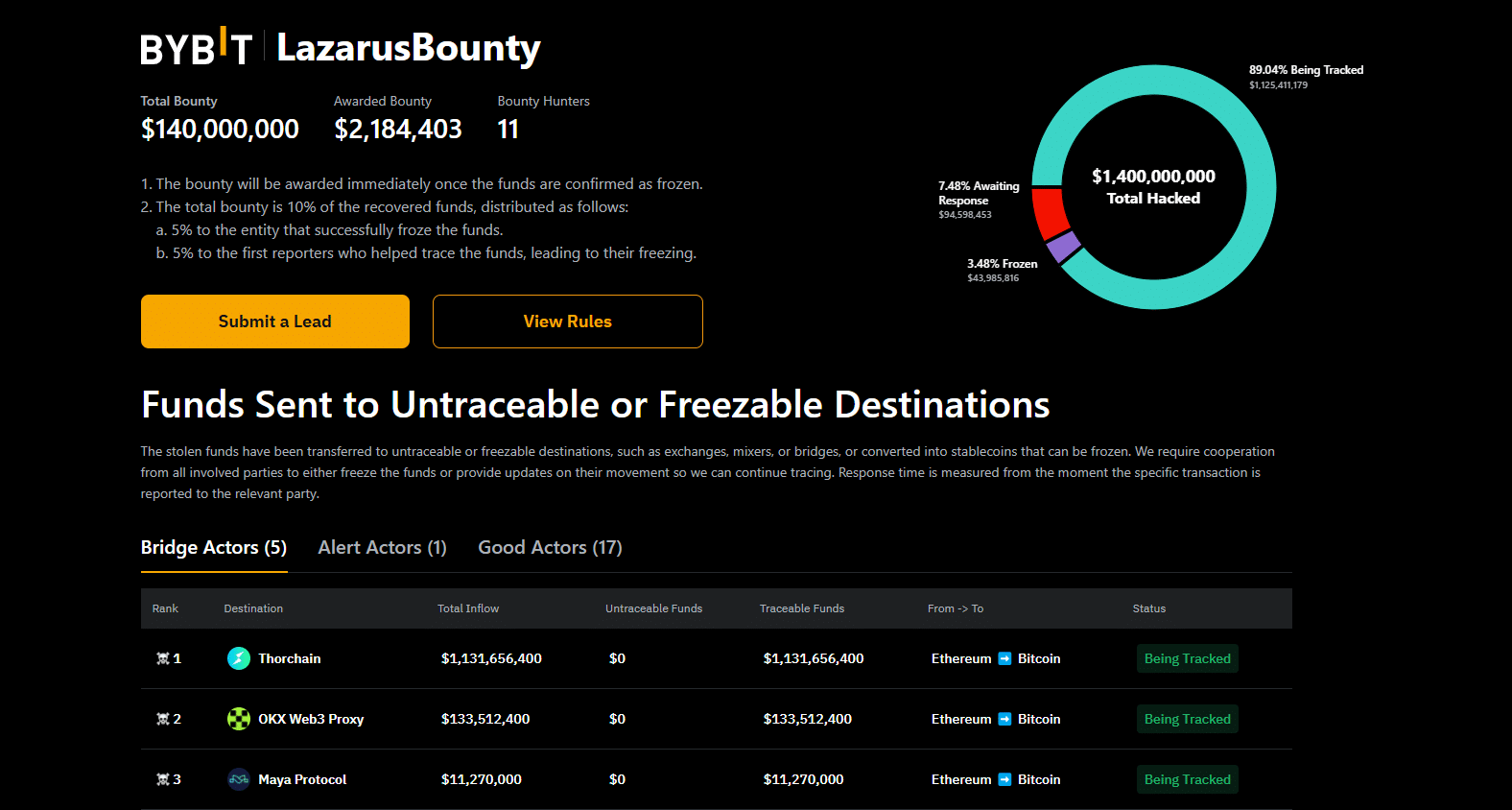

After the February hack, Bybit CEO Ben Zhou claimed that at least $100 million of stolen funds were moved through OKX’s Web3 platform. The Lazarus Group used multiple protocols to launder funds, and over 89% of the stolen ETH are being tracked.

(Source)

OKX Defense and the Regulatory Threat

OKX has since responded, stating that its tool is no different from other non-custodial crypto offerings. The CEO said their crypto wallet is purely self-custodial and has implemented measures to block users from sanctioned countries.

Moreover, as part of their collaboration with Bybit and other exchanges, OKX helped freeze funds from the hack, even cooperating with investigators and Bybit’s legal team to freeze funds and recover stolen coins.

Despite these efforts, if the reports are true and OKX is found guilty, it may face heavy penalties and be forced to comply with MiCA’s strict guidelines further. This, in turn, could set a problematic precedent, allowing regulators to become more involved in otherwise decentralized solutions where asset holders should remain in control.

If things escalate and OKX loses its license to operate in the EU mere months after receiving it, it could be a blow to crypto investors. Most crucially, it may deter other firms from expanding into the EU, limiting competition and innovation in the process.

EXPLORE: 10 Best AI Crypto Coins to Invest in 2025

Key Takeaways

- EU probes OKX for laundering $100 million from Bybit’s $1.4B hack, risking its MiCA license

- OKX claims its Web3 tool is non-custodial and has frozen funds, aiding Bybit and investigators

- License loss could deter crypto firms from the EU, curbing competition and innovation

The post Is The EU Going to War With Crypto? EU Threatens to Pull OKX License Over Bybit Hack appeared first on 99Bitcoins.