Everyone and their mother believes Q4 will be hella bullish for crypto. The markets are buzzing with that narrative. But the real question is, can a Solana breakout happen before we even get to Q4?

Solana (SOL) was the hottest coin in the early stages of this bull run. It wasn’t just about speed and scalability. It was about culture. Memecoins were going wild on Solana. Trading volume was insane. People turned a few dollars into life-changing bags.

Fast forward to today, and things look a bit different. The memecoin casino on Solana now feels emptier. Liquidity is thinner. Rugs are way more common. Hell, I even lost a couple Solami on the Kanye coin last week. That’s the game. But despite all the chaos, Solana itself has been holding strong. This year it’s been grinding, setting up a technical structure that screams one thing: a Solana breakout may be in the cards.

Let’s dive into the charts, the on-chain data, and my own trades to see where we could be headed.

Study our series of trading guides

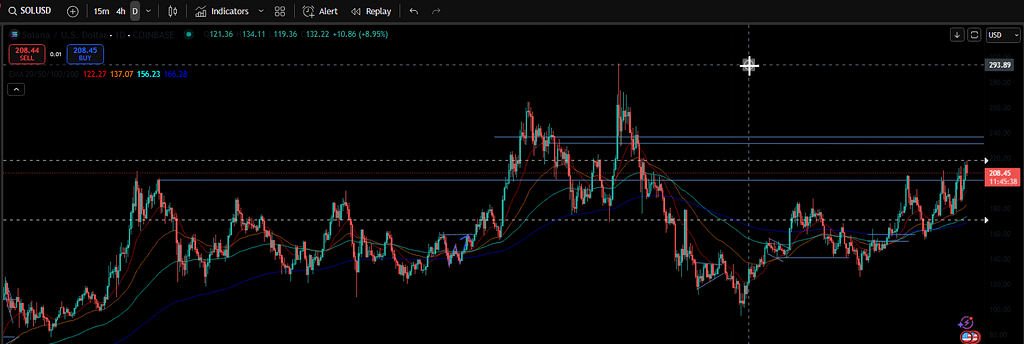

Solana Breaks Out of Triangle Pattern

On Thursday, Solana hit a six-month high of $216. That move came after breaking through one of its toughest resistance zones. From Monday’s lows, SOL bounced 16%, reclaiming $200 as support by Wednesday and closing above it.

This wasn’t the first time we saw Solana try to break higher. In early August, it reclaimed $200 for a moment before dropping back into the $175–$195 range. But this latest bounce has people paying attention.

Market watcher Daan Crypto Trades noted Solana is in a multi-month rising wedge. It’s testing the upper resistance again. Normally, rising wedges lean bearish. But in bull markets, patterns often defy textbook rules. Breakouts to the upside are common, especially when momentum is strong.

That’s where we are today. Solana is pushing near levels where it has been rejected three times since July. A fourth attempt raises the question: is this the real deal?

The Case for a Solana Breakout

Analyst Views

Ali Martinez highlighted a six-month ascending triangle pattern. The target? Around $360 if it plays out clean. He pointed out that Solana retested resistance near $205–$207 multiple times but failed to turn it into support.

This time could be different. With Solana breaking $210 again, the setup looks stronger than past attempts. Martinez explained that social sentiment is muted compared to previous rallies. When optimism runs too high, tops usually form. Right now, there’s skepticism instead of euphoria. That’s a healthy sign.

He also noted that around $1 billion in realized profits were booked after the surge to $212. Traders are cautious. Many don’t believe this rally yet. That means fewer crowded trades, which often allows stronger moves.

Technical Levels

The $207 area has been crucial. Below that, there are big accumulation zones between $165 and $206. Buyers have stepped in aggressively there. Above $212, resistance is surprisingly thin. If Solana can sustain momentum, the path to $300 looks far less obstructed.

For confirmation, analysts suggest watching the $212–$215 zone. A strong close above that level on solid volume could set off the next wave.

My Own Solana Story

I’ve always kept some spot Solana on hand. Part of it is practical. If I feel like diving into the meme casino, I need SOL ready. That’s how I ended up in that Kanye mess. Lost a bit, nothing crazy, but it still stung.

On the trading side, I caught a solid move. I was long from $190 to $214, which felt great. But here’s the kicker: Solana has been flirting with the $200 level for weeks. We even covered it last week on Airdrop Alert: Solana breaks $200 again.

General rule of thumb in trading: the more often a resistance is tested, the weaker it becomes. That’s exactly what’s happening at $200–$210. It’s like tapping on a wall until it cracks. Eventually, it breaks.

After closing my long yesterday afternoon, I re-entered at $209 this morning. The setup feels too good to ignore. If we magically close the monthly candle above $239 on Sunday, I think we’ll see Solana full send.

Read about the $ADA price action here.

Risks to Watch

Not everything is sunshine and rocket emojis. There are risks to this Solana breakout attempt.

- Rising Wedge Pattern – By textbook definition, it’s bearish. If this fails, we could see a sharp retrace.

- Profit Taking – With $1 billion already booked, cautious traders may continue selling into rallies.

- Macro Backdrop – Q4 may be bullish, but the Fed and global markets still have influence. A surprise event could derail momentum.

- On-Chain Liquidity – The meme casino may have lost steam, but liquidity matters. Solana needs real usage, not just speculation, to sustain moves.

That said, crypto thrives in uncertainty. Often, when traders expect failure, the opposite happens.

Solana Fundamentals Still Solid

Beyond charts and memes, Solana is still delivering. Developers keep building. The Alpenglow consensus upgrade is one of the things on the horizon. If successful, it could improve scalability and efficiency even further.

Treasury vehicles and structured products on Solana are also increasing. Big players are experimenting with DeFi strategies on this chain. That adds depth to the ecosystem, which feeds into price stability.

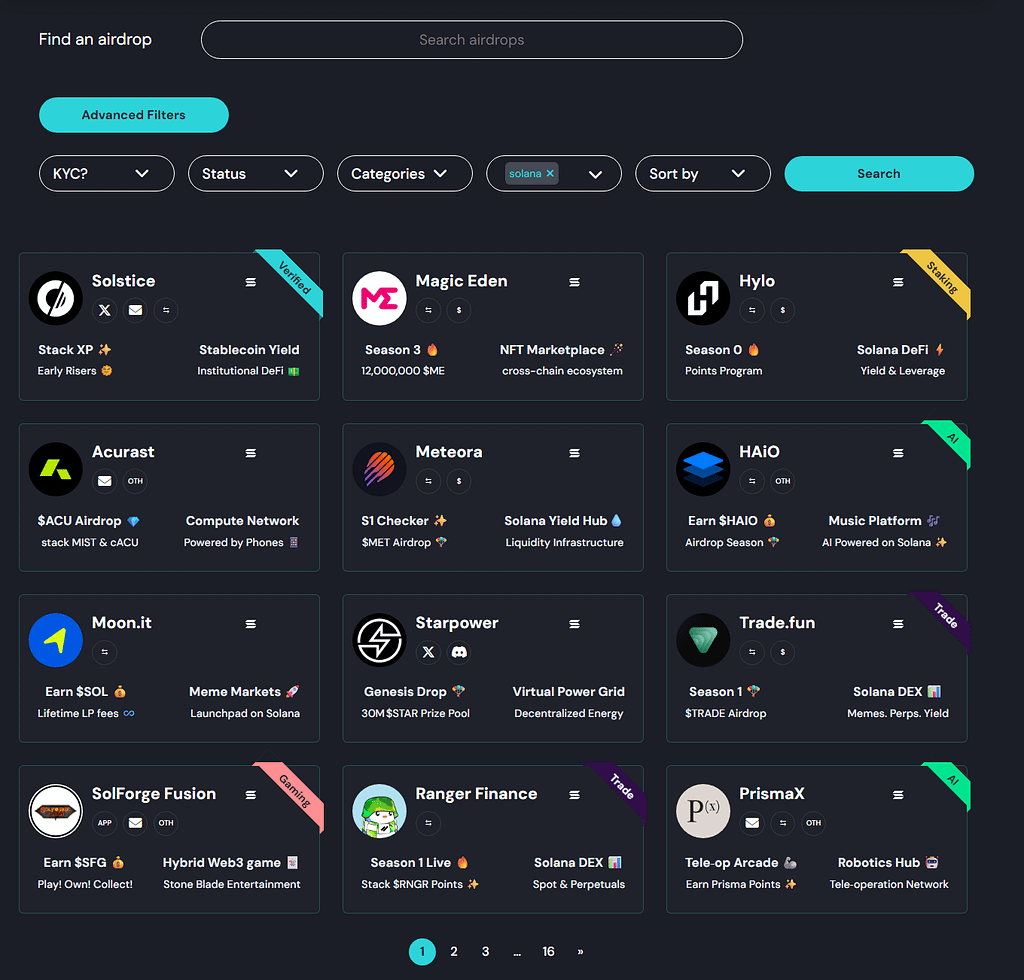

Add in NFTs, gaming, airdrops, and Solana Pay, and you see a network still expanding. When fundamentals stay strong, technical breakouts often have more fuel behind them.

Price Targets: Where Could We Go?

If Solana confirms a breakout above $215, here’s how I see it:

- Short Term – Push to $230–$239. That’s where the monthly close matters.

- Mid Term – Break $239 and we’re looking at $280–$300. Thin resistance zones make this possible.

- Long Term – If Q4 lives up to the hype, the ascending triangle target of $360 isn’t crazy.

On the flip side:

- Failure Point – A clean rejection below $200 could drag us back to $175–$185 support. That’s the danger zone for longs.

Join the biggest trading competition with $10 million in prizes.

My Trading Plan

I’m keeping things simple:

- Holding spot Solana for the memes and general exposure.

- Trading leverage with stops around $192.

- Looking for that magical close above $239 on Sunday.

If we get it, I’ll lean heavier into longs. If not, I’ll happily scalp the volatility. Solana gives great moves when it runs.

Support Our Work

If you found this helpful, consider signing up on BloFin (Non-KYC) or Bybit using our referral links. Your support keeps this content free and flowing.

Final Words

A Solana breakout feels more likely now than at any point this year. The setup is clean. Sentiment is skeptical, which is good. Support is strong below. Resistance is weak above. Fundamentals are intact.

Will it happen before Q4 fireworks kick in? That’s the million-dollar question. I’m betting on yes. But in crypto, nothing is guaranteed. All I know is this: Solana has given us incredible runs before, and when it breaks, it doesn’t walk—it sprints.

Until then, I’ll keep some SOL handy for both the charts and the meme casino. After all, you never know when the next Kanye coin will appear.

If you enjoyed this blog, check out our recent blog about cleaning your wallets to find some gems.

As always, don’t forget to claim your bonus below on Bybit. See you next time!