We’ve been farming the HyperEVM and stacking points for the second Hyperliquid airdrop for months. Along the way, we shared strategies about staking $HYPE, shorting it to hedge, and building steady delta-neutral positions. But for the past few weeks, we decided to go full degen and stake naked. No hedges, no shorts, just pure HYPE exposure. And it paid off.

The token has blasted through resistance, delivering a fresh HYPE ATH that’s been the talk of Crypto Twitter. Let’s break down what triggered this rally, the on-chain signals, and where the price might head next.

Hyperliquid Hits Fresh ATH on Growing Momentum

Hyperliquid has been on fire. The token’s price rallied to $55, marking a brand-new all-time high. This move didn’t happen in isolation. Activity across HyperEVM and HyperCore has surged, with the user base jumping above 180,000. That kind of adoption fuels liquidity and confidence.

The rally got an extra boost when VanEck’s leadership publicly endorsed the project. They confirmed holding $HYPE for months and praised its decentralized structure, tech rollout, and governance. Coming from one of the world’s major asset managers, that’s no small nod. Social chatter quickly followed, with HYPE’s dominance on social platforms doubling and sentiment flipping strongly bullish.

The price had been hovering under $50 for weeks, testing that psychological barrier again and again. Breaking through it sent shockwaves, and now traders are eyeing higher levels.

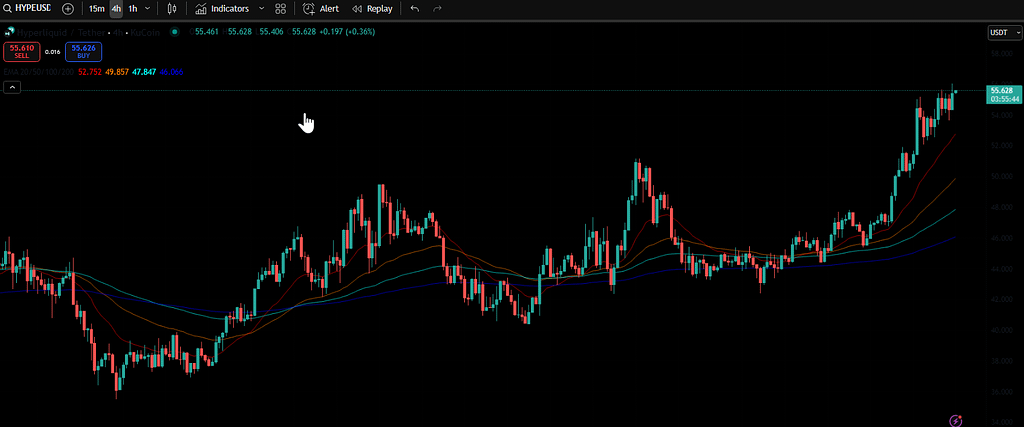

Price Action and Market Structure

For weeks, HYPE’s chart showed an ascending triangle. Price action pressed against the $50 to $52 ceiling multiple times, while the base kept rising. Every attempt brought stronger participation, showing that buyers were gaining the upper hand.

Once the breakout happened, momentum carried the token straight into price discovery. The surge to $55 confirmed that supply was being absorbed and buyers had the strength to push higher. As long as support near $44 to $45 holds, the bullish structure remains intact.

Traders know that once you clear a zone like $50–$52, the chart starts opening doors to the next leg up. The market is already sniffing $60 as the next battleground.

Hype was one of our top alt calls for September. Check the others on the list.

On-Chain Signals: Absorption Ratio and Buybacks

Fresh data has shown an encouraging trend. Hyperliquid’s absorption ratio keeps sliding lower while the price climbs. That usually means fewer sell orders are weighing down bids. In other words, demand has more room to push price higher with less resistance.

At the same time, consistent buy support has been evident. The major kicker here is the announced allocation of 95% of USDH’s revenue toward HYPE buybacks. That’s a huge fundamental driver. It creates continuous demand pressure, which the market can’t ignore.

Pair that with declining sell absorption and it’s clear why traders are bullish. When buyers are supported by both structure and fundamentals, the setup favors continuation.

RSI Reset and Technical Strength

Looking at the weekly chart, HYPE has defended the $42 zone during every pullback. That level became a strong foundation during consolidation. Now, the weekly RSI has fully reset and started to climb again. This is often a powerful signal that a new rally is brewing.

A reset like this clears out overbought conditions and gives bulls a clean slate. Combined with volume expansion, the technical picture supports higher levels. The door toward $60 to $70 doesn’t look far-fetched.

HYPE Price Prediction: Path to $60 and Beyond

So where does Hyperliquid go next? The chart paints a pretty clear picture. A breakout above $52 triggered the move into uncharted territory, and the consolidation before that breakout built a strong base.

As long as the $46 to $47 region holds as support, the market structure stays bullish. Analysts already point to $60 as the next obvious target, with $70 not far behind if momentum continues.

Price discovery can be tricky, though. Once you’re in new territory, volatility spikes. That means while the upside looks promising, traders need to prepare for sharp pullbacks along the way.

My Trade Plan

Here’s how I’m playing it. I’ve been staking $HYPE naked and enjoying the move to this new HYPE ATH. But once the token hits the $60 to $70 range, I’ll start layering shorts again. That will bring me back to a delta-neutral staking setup.

The idea is simple: take profits from the rally while still farming points and collecting staking rewards. No need to risk giving back gains with a roundtrip. At this stage, protecting the trade while enjoying yield feels like the smarter play.

Final Thoughts: What Comes After the HYPE ATH

Breaking $55 shows that Hyperliquid isn’t just a flash in the pan. The ecosystem is growing, adoption is strong, and fundamentals like buybacks add constant demand pressure. Social sentiment is hot, and big names like VanEck jumping in only reinforce the momentum.

The next hurdle is $60. If the market clears that, $70 could follow quickly. On-chain signals, strong support, and renewed RSI strength all support that case. For now, it looks like the HYPE train is running full speed ahead.

As always, manage risk. It’s tempting to ride momentum forever, but crypto rewards those who plan exits as carefully as entries. For me, that means taking advantage of the yield, farming points, and rebalancing when the time feels right.

HYPE ATH is just another step in what could be one of the most exciting runs this year. Buckle up, it might not be over yet.

If you enjoyed this blog, check out our recent blog about the 4-year cycle.

As always, don’t forget to claim your bonus below on Bybit. See you next time!