Everyone in crypto is talking about Hyperliquid. It has already dropped one of the biggest airdrops in history, and the second one is set to be even larger. This is probably the most successful platform that came out of this bull cycle.

In this guide, we’ll walk through the most popular platforms on HyperEVM. I’ll also share my top picks for farming methods. But remember, everyone can choose their own path depending on their goals.

The focus here is farming with stablecoins. Why? Because it’s safe, simple, and efficient. Plus, it’s the perfect way to rack up points for the potentially biggest airdrop in crypto history.

Why Farm HyperEVM?

Hyperliquid has changed the game. It’s the platform I use on a daily basis, and I know many of you do too. Points earned here are not just for bragging rights. They are likely to translate into real rewards.

The first Hyperliquid airdrop was massive. The second one is expected to be even bigger. Farming on HyperEVM now gives you exposure to this once-in-a-cycle opportunity.

For me, this is a no-brainer. I want to make my stablecoins work and earn yield while I wait for the next big move in the market.

What Are the Risks of Farming with Stablecoins on HyperEVM?

Nothing in crypto is risk-free. Even stablecoin farming has its risks.

- Protocol risk: The platform you farm on could fail. Bugs, hacks, or management issues can put deposits at risk.

- Stablecoin risk: Even stables can depeg. While it’s rare for major ones like USDC, it has happened before.

How to Mitigate Risks

The best way is diversification. Don’t go all in on one platform. Split your funds across several protocols.

For example, you can spread funds 20% each across five protocols. Or use a split like 40/30/20/10, depending on your risk appetite.

That way, if one goes down, your whole farm doesn’t go with it.

Why Farming Stablecoins Is More Popular Now

We might be in the final inning of this bull cycle. If the four-year Bitcoin halving cycle still holds, a bear could come soon. That’s why many are derisking into stablecoins.

Crypto treasury companies are already looking for strategies to earn yield on their holdings. DeFi TVLs are growing. Stablecoin farming is becoming a natural fit.

Personally, I’ve been trimming down my spot holdings. I farm with stablecoins while still swing trading with leverage. That way, I eat when the market goes up, and I eat when it goes down. My stablecoins are always working.

Related: Wyoming is the first state to create their own stablecoin

Target Hyper Points Efficiently

Hyperliquid rewards volume, LP, staking, and ecosystem activity. If you want to maximize your airdrop, you need to target points smartly.

Farming with stables should focus on safe leverage and high turnover strategies. The goal is to rack up points without big market exposure.

If a platform integrates directly with HyperEVM, that’s even better. Those usually have “synergy points” that weigh heavier.

Related: Best Ethereum Yield Farms.

Types of Stablecoin Plays

Delta-Neutral Farming

Use USDC or USDT to farm funding fees with no exposure to BTC or ETH. For example, long spot and short perp. That way you farm points while staying market-neutral.

Liquidity Provision on HyperEVM Venues

Provide stables into DEX pools or vaults that settle on HyperEVM. The key is to check if rewards are in HYPE points, not just yield tokens.

Vaults and Structured Products

Some strategies auto-loop stablecoins with leverage. They farm both yield and points. Great for set-and-forget farming if integrated into Hyperliquid.

Trading Volume Strategies

Rotate stables through volume farming with small spreads. This earns Hyper Points tied directly to activity.

Farming Hyperliquid with Stablecoins

We’ve written before about active farming by trading on the DEX. This time, let’s focus more on the passive side.

1. HYPE Staking

Staking HYPE is the simplest way to farm points. You just stake and wait. The downside is price exposure.

A neat trick is buying HYPE, staking it, and shorting HYPE perps to neutralize risk. That way, you earn staking points without caring about price moves.

2. Stablecoin Vaults

Hyperliquid has USDC vaults that auto-manage basis trades. These vaults generate both yield and Hyper Points. They’re great if you don’t want to micromanage.

3. Indirect Stablecoin Farming

Some integrations boost your Hyper Points multiplier. For example, vaults that accept USDC and deploy into perps. You earn both yield and boosted points.

Airdrop Alert’s Farm Pick for Hyperliquid

- Stake HYPE and short HYPE for neutrality.

- Add USDC into a vault for around 13% APR.

👉 Please use our Ref link: Hyperliquid Referral

👉 Guide: Full Hyperliquid Airdrop Guide

HyperBeat: The Passive Farming Powerhouse

HyperBeat is both a validator and a yield protocol on HyperEVM. It lets you stake assets and earn “Hearts,” a multi-protocol points system.

It’s easy to use. Just deposit into a vault and wait.

Vault Options

- HyperETH Vault

- HyperBTC Vault

- HyperUSD Vault (perfect for stablecoins)

Why I Like It

- Earn yield and Hearts from multiple protocols at once.

- No need to rotate positions.

- Perfect “set and forget” for stablecoin farmers.

HyperBeat vs. Other Passive Farms

| Strategy | Effort | Exposure | Reward Profile |

|---|---|---|---|

| HyperBeat Vaults | Very low | Stablecoins (USD vaults) or assets in vaults | Yield + Hearts from multiple protocols |

| Stake HYPE + Short | Medium | Neutral HYPE | Pure point farm with hedged exposure |

| Other Protocols | Moderate | Mixed (HYPE, stablecoins, leverage) | Yield + respective platform points |

Airdrop Alert’s Farm Pick for HyperBeat

- USDT vault for about 10% APR.

- Stake HYPE here too for multiple airdrops.

👉 Please use our Ref link: HyperBeat Referral

👉 Guide: Full HyperBeat Airdrop Guide

HyperLend: Money Market Farming

HyperLend is Hyperliquid’s own money market. Think of it like Aave but on HyperEVM.

Ways to Farm

- Supply stables to earn interest and XP.

- Borrow assets to increase point weight.

- Use HyperLoop strategies to auto-compound.

- Stake in the wHLP vault once the token launches.

Points System

You earn XP daily, claim it, and convert to Points weekly. At TGE, Points convert to $HLP tokens.

Hyperlend Summary Table

| Action | What You Earn |

|---|---|

| Supply (lend assets) | XP → Points → HLP |

| Borrow against collateral | XP → Points |

| Participate in HyperLoop | XP → Points with compounding benefits |

| Stake $HLP (post-launch) | Boosted Points + revenue share |

| Loop NFTs or referrals | Point multipliers |

| Hold for 7+ days | Maintains eligibility for snapshot |

Airdrop Alert’s Farm Pick for HyperLend

- Lend USDe for around 7% APR.

- HLP Vault for around 12% APR.

- Small allocation to HyperLoop for 16% APR.

👉 Please use our Ref link: HyperLend Referral

👉 Guide: Full HyperLend Airdrop Guide

HypurrFi: Leveraged Yield

HypurrFi is a leveraged lending protocol. You can deposit HYPE or stHYPE and borrow USDXL.

Farming Options

- Deposit HYPE or stHYPE to earn yield.

- Borrow USDXL and deploy it for more rewards.

- LP USDXL with HYPE, LHYPE, or feUSD on DEXs.

Even before points are visible, your activity is tracked for future rewards.

Summary Table: HypurrFi Farming Pathways

| Action | What You Get |

|---|---|

| Deposit HYPE / stHYPE | Earn yield + accumulate early participation weight |

| Borrow USDXL | Earn yield on borrowed asset + extra point weight |

| LP USDXL with HYPE, LHYPE, feUSD | Yield + boosted multipliers via DEX campaigns |

| Early activity (even before UI shows) | Eligibility for future airdrop or ecosystem rewards |

Airdrop Alert’s Farm Pick for HypurrFi

- Pooled lending USDe for about 13% APR.

- Small allocation to USDXL vault for extra point boosters.

👉 Please use our Ref link: HypurrFi Referral

👉 Guide: Full HypurrFi Airdrop Guide (coming soon)

Felix Protocol: The CDP Farm

Felix is a CDP and lending protocol on HyperEVM. You can mint feUSD by locking collateral like HYPE.

Farming Options

- Mint feUSD and supply it to the Stability Pool.

- Use vanilla lending markets for variable yield.

- LP feUSD pairs on DEXs.

- Refer friends for bonus rewards.

Points System

Felix Points are tied to your wallet. They convert into $FEL tokens at TGE. About 10% of the supply is reserved for this.

Felix Summary Table

| Action | What You Get |

|---|---|

| Mint feUSD (via CDP) | Unlock liquidity, retain exposure |

| Supply feUSD to Stability Pool | Earn yield + build points |

| Use Vanilla Markets | Borrow/lend assets; earn variable yield |

| Provide DEX liquidity | Earn fees on feUSD pools |

| Stake or refer | Bonus Felix Points via staking/referral |

| Consistent activity | Higher point weight for upcoming airdrop |

Airdrop Alert’s Farm Pick for Felix

- Lend Vault for 11% APR.

- HYPE Pool for around 13% APR.

👉Please use our Ref link: Felix Referral

👉 Guide: Full Felix Airdrop Guide

Personal Thoughts

We’re close to the top of this cycle. Whether that’s now or in Q4, I don’t know. I still believe in the four-year cycle until proven otherwise.

That’s why I’m derisking into stablecoins. Farming them makes the most sense for me now. It keeps my capital working without betting too hard on market direction.

Hyperliquid is the most anticipated airdrop left. I want to farm as many points as possible at this stage.

More HyperEVM Airdrops

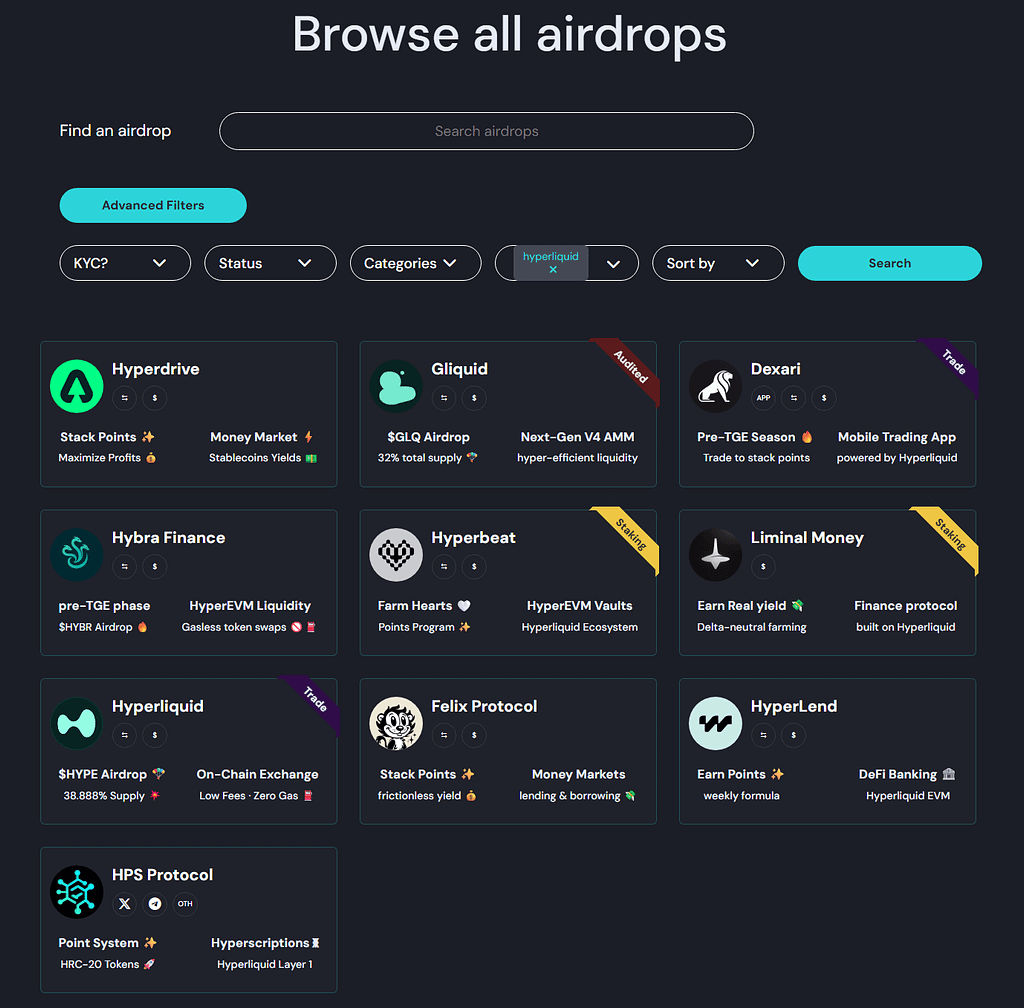

We’re tracking HyperEVM closely. Many projects are launching with point systems that could convert into tokens.

You can find the latest opportunities on AirdropAlert by filtering for Hyperliquid in our browse section:

Browse Hyperliquid Airdrops

Support Our Work

If you found this helpful, consider signing up on BloFin (Non-KYC) or Bybit using our referral links. Your support keeps this content free and flowing.

Final Words

Stablecoin farming on HyperEVM is one of the safest and smartest plays right now. You spread risk, earn yield, and farm points for what could be the biggest airdrop ever.

Personally, I like mixing Hyperliquid vaults, HyperBeat, HyperLend, HypurrFi, and Felix. Each offers a different balance of yield and points. Together, they form a strong, diversified farm.

The bear market will come eventually. Until then, my stables are working hard.

If you enjoyed this blog, you may want to check our content related to airdrop farming.

As always, don’t forget to claim your bonus below on Bybit. See you next time!