Bitcoin recently hit $123,000. Altcoins are running wild. It is a good time to be a trader. I hope you are active and making some profits. As always, we provide updates on trending coins and major movers like BTC and ETH. Right now, it feels like ETH season might be here already.

Two weeks ago, when ETH was around $2,400, we called for $3,000. Some laughed, others said it was impossible. But look at it now! Ethereum is closing in on $3,200. Check out our previous call here: ETH 3k This Summer.

So, is it ETH season?

ETH/BTC Pair Signals Ethereum Season

Ethereum’s price is gaining serious momentum against Bitcoin. The ETH/BTC pair surged over 50% since April’s lows. On July 16, ETH/BTC hit 0.0267 BTC, a four-month high. This breakout happened after ETH moved above a key bull flag pattern.

This breakout started on July 10. ETH closed above the flag’s upper trendline, supported by strong trading volume. Even more importantly, ETH/BTC broke above the 200-day EMA for the first time in over a year. This moving average now acts as strong support.

This is a big deal because breaking the 200-day EMA often signals more upside. Analysts predict ETH/BTC could reach 0.035 BTC by August or September. That’s 30% more from today’s levels.

The breakout at 0.02425 was crucial. Many altcoins will follow Ethereum if this trend continues.

Why is Ethereum Outperforming Bitcoin?

The first reason is clear—Ethereum investment products are attracting massive inflows. For twelve weeks straight, ETH products had inflows, now totaling $990 million. That is the fourth-highest on record.

Big companies are also joining the ETH movement. Firms like SharpLink, BitMine, and Bit Digital now hold over $5 billion worth of ETH. You can track it here: StrategicETHReserve.XYZ.

Ethereum Overtakes Johnson & Johnson

Ethereum just overtook Johnson & Johnson in market cap. It is now the 30th largest asset globally. This rally pushed ETH prices to levels we last saw in February.

Total Value Locked (TVL) on the Ethereum network rose by 33%. The amount of ETH staked grew by 4% in Q2. Both numbers show rising adoption and investor confidence.

Many factors are driving this momentum—strong institutions, growing stablecoin use, and positive regulatory shifts. All of this is helping Ethereum outperform Bitcoin.

Public Companies Are Stockpiling Ethereum

Ethereum’s five-month high is also driven by companies building ETH treasuries.

SharpLink Gaming purchased $225 million in ETH this month. After raising $425 million, they pivoted from online gaming to Ethereum investing. They now hold 280,000 ETH, worth nearly $884 million.

BitMine raised $250 million to buy Ethereum. Since switching focus, their stock pumped over 1,100%. Even Peter Thiel’s Founders Fund bought a 9.1% stake.

Bit Digital exited Bitcoin mining and moved entirely to Ethereum. They now hold 100,603 ETH, valued at over $316 million. Their latest share sale aims to buy even more.

Two Major Catalysts for $4,000 and Beyond

Right now, Ethereum trades near $3,169. Analysts predict a move toward $4,000 soon. Javon Marks believes Ethereum could go even higher, reaching $4,800 or even $8,500 in the coming months.

So, what are the key drivers behind these predictions?

1. Layer 2 Boom

Ethereum’s Layer 2 chains like Base, Arbitrum, and Optimism are exploding in use. Transaction costs dropped 49% in Q2, and Layer 2 activity surged. This increases network adoption and supports Ethereum’s price growth.

2. Deflationary Supply

Since the EIP-1559 update, Ethereum has become deflationary. Less supply with rising demand means prices tend to go up. This is a big reason why ETH is gaining traction.

Macro Environment Favors ETH

Global macro trends also help Ethereum. Inflation in the US is cooling, recently reported at 2.7%. A weaker dollar boosts ETH, and falling bond yields add more fuel to the rally.

While Bitcoin dominates headlines, Ethereum quietly benefits from these macro conditions. With stocks at record highs and risk appetite growing, Ethereum remains a strong play.

Layer 2 Ecosystem Keeps Growing

Ethereum’s ecosystem keeps expanding. Total Value Locked (TVL) on Layer 2 networks rose to $41.2 billion. That’s an 18% increase in just a month.

Top Layer 2 platforms like Optimism, Base, and Arbitrum show strong fee revenue growth. Transaction volumes are up, and institutional adoption is rising. Ethereum remains the top platform for tokenization, stablecoins, and DeFi activity.

Spot Ethereum ETFs Accelerate ETH Season

Spot Ethereum ETFs are seeing massive inflows. In just one week, ETFs had $1.25 billion in net inflows. BlackRock’s ETHA leads the pack with $171 million in a single day.

ETHA now manages $6.5 billion worth of ETH, and the share price surged 15% last week. Daily trading volume hit $1 billion. This growing institutional demand is a strong bullish signal.

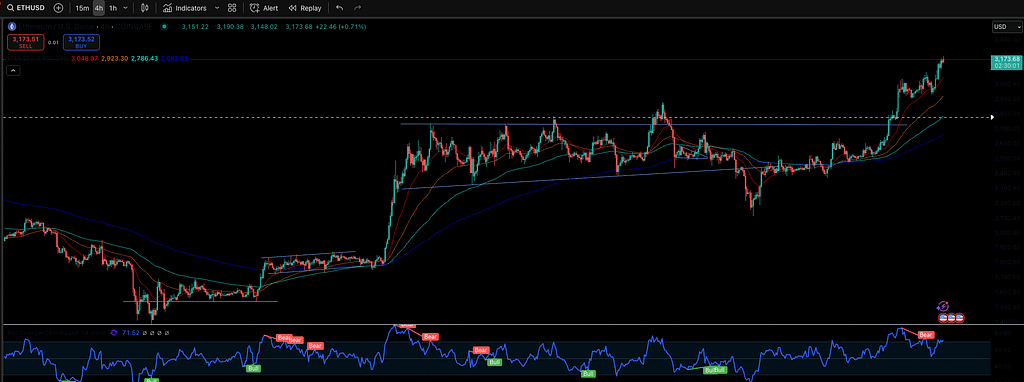

Our Trading Strategy

We are waiting for a potential retest of the $2,800 breakout zone. If that happens, it could be a simple long.

Another option is waiting for consolidation above $3,000 to build a new range.

Meanwhile, we are looking at ETH-beta plays like Aave, Uniswap, Arbitrum, and Optimism for more aggressive gains.

Support Our Work

If you enjoy these updates, consider supporting us by signing up on BloFin (Non-KYC) or Binance via our referral links. Your support helps us keep this content free and running.

Final Thoughts: Is It ETH Season?

Ethereum’s breakout is hard to ignore. Strong fundamentals, bullish technicals, and macro tailwinds are creating a perfect storm.

ETH/BTC is climbing. Institutions are stacking ETH. Spot ETFs are gaining momentum. Layer 2 networks are booming.

This could very well be the start of ETH season. Are you ready?

Don’t miss the next big airdrop either. When altcoins go up, your next airdrop might even be a larger cook!

As always, don’t forget to claim your bonus below on Blofin. See you next time!