And just like that, ETH looks strong again. Earlier today, the Plasma deposits hit $500 million in just 60 seconds. We were at the desk, ready to go. Sadly, we missed it. The deposit window closed before our transaction went through. That’s how fast demand moves when a major project launches on Ethereum. It’s no surprise, really. Ethereum remains the most secure, backtested blockchain in the entire industry.

This frenzy shows just how much attention and money are lining up behind Ethereum right now. So, let’s take a closer look at the price of ETH. Because today, $ETH is looking strong.

Increase your trading edge with our series of trading guides

Institutions Quietly Accumulating Ethereum

Ethereum is starting to attract serious institutional attention again. Over the past month, spot ETH ETFs have seen inflows for four weeks straight. In total, they’ve now accumulated 3.77 million ETH — a clear sign that big money is positioning early.

BlackRock, the world’s largest asset manager, is leading the pack. They’ve been moving aggressively, quietly building a position that now exceeds 1.5 million ETH. That’s over $2.7 billion held in custody. In just the past ten days, they’ve added another $500 million worth of ETH.

On top of that, BlackRock is actively exploring tokenization — bringing real-world assets onchain using Ethereum infrastructure. This kind of adoption isn’t about hype. It’s about long-term positioning.

Even with ETH still trading nearly 50% below its all-time high, these institutions are buying with confidence. That should tell you something.

This quiet accumulation phase reminds us of Bitcoin’s pre-ETF days. Once those gates open, we may never see ETH under $3K again.

BTC/ETH Ratio Signals a Possible Rotation

Let’s talk about the Bitcoin-Ethereum ratio. It’s one of the most important indicators when comparing market strength.

Lately, the ratio has been holding around 0.05–0.053. Historically, this zone acts as a base before ETH begins outperforming. When Ethereum gains momentum, it usually eats into Bitcoin dominance.

If the ratio starts pushing toward 0.06 again, it may signal a major alt season with Ethereum in the lead. And based on current market structure, that breakout could come soon.

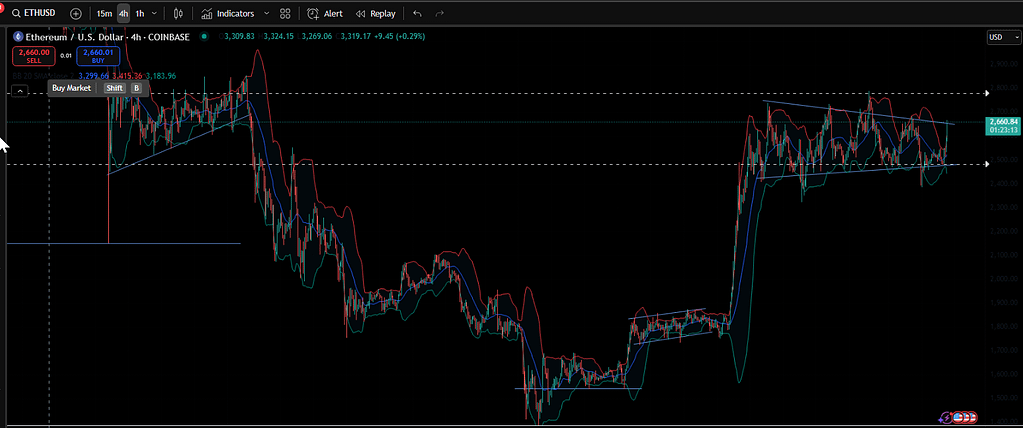

Technical Setup: Will ETH Break Out of the Range?

We’ve been tracking a channel between $2500 and $2700 for some time. It’s been a reliable structure. Every time ETH drops to the $2500–$2600 zone, buyers step in. Now, we’re approaching the top again.

Will it break?

Momentum suggests yes. The candles are tightening. Volume is growing. And most importantly, ETH is staying above the 200-day EMA. This is a bullish sign that many traders respect.

Currently, the 200-day EMA sits just above $2550. If ETH continues to hold this level as support, it increases the chance of a breakout. In fact, a daily close above $2750 with volume could send us flying.

MACD Flashes Bullish Momentum

The MACD has also flipped bullish. The histogram turned green this week. The lines crossed upward on the daily chart. This signal has historically preceded 10–30% moves on ETH.

It’s not just the MACD alone, though. RSI is hovering around 60, with room to push higher. This means the rally isn’t overextended. There’s fuel left in the tank.

If this momentum continues, we may see Ethereum aim for that $3.5K level sooner than expected.

Will $ETH See $4K This Summer?

This is the big question. Can ETH hit $4,000 before summer ends?

Let’s be real. It won’t be easy. We have resistance near $3,200 and again around $3,600. But with growing institutional demand, a strong technical setup, and Ethereum’s ecosystem heating up, it’s possible.

Especially if Bitcoin ranges or consolidates. That’s when ETH typically shines.

If the Plasma narrative continues, and the ETF finally gets approved, $4K could just be the beginning.

Support Levels to Watch

Here are the key support levels right now:

- $2500 – Bottom of the long-standing channel

- $2600 – Psychological and technical level

- $2550 – Where the 200-day EMA is sitting

As long as ETH stays above these, the bulls are in control.

A dip into this zone may be a gift, not a signal of weakness.

If ETH stays bullish, don’t forget to keep an eye on ETH betas we discussed earlier.

Support Our Work

If you enjoy insights like these, consider using our referral links when signing up for exchanges. It helps us continue offering free content.

Try BloFin for a fast, non-KYC exchange or Bybit, our go-to trading platform. Every referral makes a difference. Thanks for the support!

Always trade with proper risk management. Don’t bet it all and use a stop loss! This is a long game, not a get-rich-quick scheme.

Closing Thoughts: Ethereum Isn’t Just Surviving – It’s Thriving

Ethereum has taken a lot of heat over the past year. Slow upgrades. L2 migration confusion. Strong competition from newer chains.

But it keeps doing what it does best: powering the crypto economy.

The Plasma rush was just a small preview. World Liberty Financial (WLFI) will be the next summer banger. Institutional interest is real. Technicals are improving. And ETH is once again becoming a hot trade.

We’ll be watching closely. Because this summer, Ethereum might just remind everyone why it’s still king of smart contracts.

If you enjoyed this blog, check out our recent look at the $HYPE chart.

As always, don’t forget to claim your bonus below on Bybit. See you next time!