Diamond hands has become one of the most repeated phrases in crypto.

It sounds strong.

It sounds disciplined.

And during bull markets, it feels smart.

But for most traders, diamond hands is not a strategy.

It’s an excuse.

This blog breaks down when holding actually works, and when “diamond hands” quietly turns into cope.

Because yes, it’s easy to say in hindsight.

But I’ve been telling people to sell since last August, while the timelines were still shouting “hold”. Or “we gonna pump in Q4”.

Let’s talk about why.

What “diamond hands” was supposed to mean

Originally, diamond hands had a simple meaning.

Buy early.

Hold through volatility.

Sell into euphoria.

That worked in older cycles.

Supply shocks were real.

Spot buying mattered.

And when momentum flipped, it flipped hard.

Holding wasn’t passive.

It was patience combined with timing.

Somewhere along the way, that message got lost.

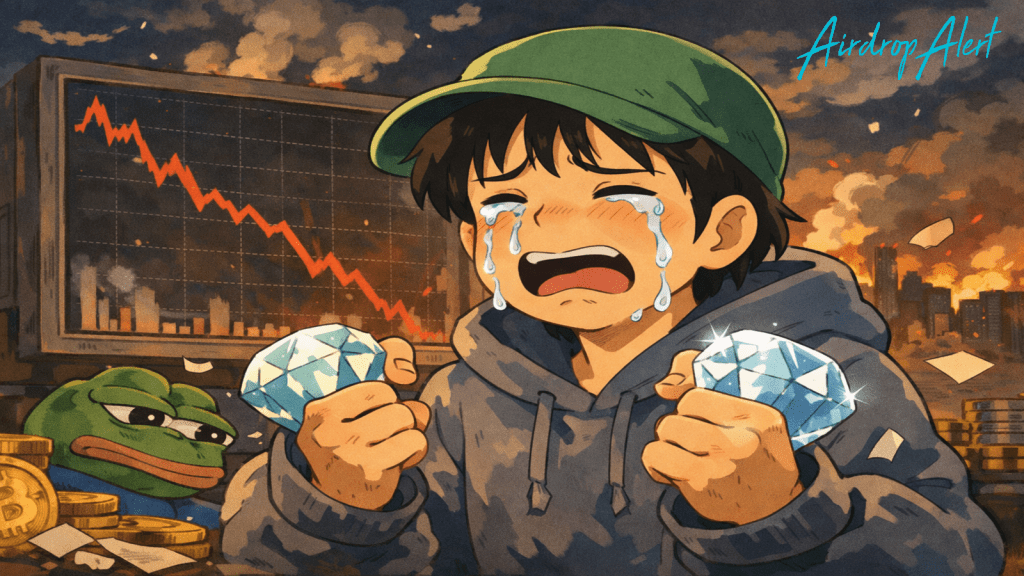

How diamond hands turned into cope

Today, diamond hands often shows up after price already topped.

After insiders distributed.

After bots farmed liquidity.

And after retail became exit liquidity.

Instead of asking “should I reduce risk here?”, people are told to believe harder.

Memes replaced analysis.

And holding became a personality trait.

That’s not conviction.

That’s denial.

The meme coin effect and the Pepe illusion

This cycle was heavily shaped by memes.

Especially Pepe.

Pepe running to billions in market cap reignited an old dream.

The idea that if you just hold long enough, you’ll get a 1000x.

That single move pulled an entire generation of traders back into hope mode.

But here’s the part people don’t like to hear.

Pepe made a lot of noise.

But it also created massive survivorship bias.

For every Pepe, there were thousands of coins that never came back.

Yet timelines were filled with insiders spamming slogans like “believe in something”.

Not because they believed.

But because they needed liquidity.

Diamond hands became a marketing tool.

Related: Here are some of the biggest airdrop mistakes we still see in 2026.

Who actually won this cycle

If we’re honest, only a few groups really won this cycle.

Bitcoin maxis who bought early, held through noise, and actually took profits.

Airdrop farmers who picked the right farms, went hard, and rotated instead of marrying bags.

Active traders who stayed flexible, rotated capital, and respected momentum shifts.

That’s pretty much it.

If you bought late and decided to hold “for the long term”, chances are you lost.

And that part is genuinely sad.

Older cycles didn’t punish late holders this brutally.

So what changed?

Why this cycle punished holders so hard

I’m speculating here.

But a few things stand out.

First, ETFs.

ETFs brought massive volume, but not real supply pressure.

Most of it is paper exposure.

People buy price, not coins.

You can see the same thing in silver right now.

Depending on where you try to buy physical silver, prices can differ by 30 to 40 percent.

That’s insane.

It tells you one thing.

Paper markets suppress real supply signals.

Crypto is starting to look the same.

If spot buying doesn’t remove supply, you don’t get god candles.

You don’t get real FOMO.

You get bots trading bots, while retail gets chopped.

Second, large exchange influence.

Liquidity is fragmented.

Order books are thin when it matters.

And price can be pushed just enough to trigger liquidations without real demand.

Whether that’s manipulation or structural imbalance doesn’t even matter anymore.

The result is the same.

Third, the insider-heavy meme economy.

Launches are faster.

Information spreads instantly.

And insiders distribute earlier than ever.

By the time “diamond hands” trends, the trade is often already over.

Or, did Binance cause all the pain in the markets?

When holding actually makes sense

Holding is not dead.

But it’s contextual.

Holding works when you are early.

Holding works when supply matters.

Holding works when you already sized risk correctly.

Bitcoin is the best example.

Long-term holders who took profits into strength did exactly what diamond hands was meant to represent.

Holding does not work when you buy late and hope fundamentals will save bad timing.

Markets don’t care about belief.

Support Our Work

If you found this helpful, consider signing up on BloFin (Non-KYC) or Bybit using our referral links. Your support keeps this content free and flowing.

Why selling is not weakness

Selling doesn’t mean you’re bearish forever.

It means you’re managing risk.

You can always rebuy.

You can always rotate.

You can always wait for structure to improve.

What you can’t do is recover capital that’s already gone.

Diamond hands without a plan is just holding bags politely.

Final thoughts on Diamond hands

Diamond hands sounds good on X.

It feels good in group chats.

And it makes losses feel noble.

But trading isn’t about being noble.

It’s about surviving long enough to catch the next opportunity.

This cycle rewarded flexibility, not faith.

Rotation, not religion.

And action, not slogans.

Holding can be powerful.

But only when it’s intentional.

Everything else is just cope.

If you enjoyed this blog, check out our latest list on crypto casinos, including farming strategies.

As always, don’t forget to claim your bonus below on Bybit. See you next time!