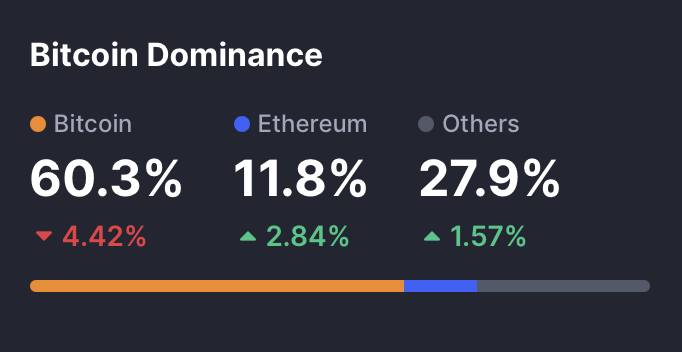

Despite a flurry of altcoin rallies and renewed buzz around Ethereum ETFs, the crypto market continues to lean heavily into Bitcoin. According to CoinMarketCap’s Altcoin Season Index, the current reading of 39 out of 100 confirms that we’re in Bitcoin Season, with capital consistently flowing back to the market’s most established asset. Even as altcoins like SUI and BNB post impressive weekly gains, broader investor confidence appears concentrated in BTC.

In this context, early-stage presales like MAGACOIN FINANCE are emerging quietly as top altcoin contenders, offering a strategic play for those seeking upside outside institutional pipelines.

Bitcoin holds firm as institutions favor stability

Bitcoin’s dominance rate sits at 60.32%, reflecting an 18.5% increase over the past 30 days. The growth has persisted even as spot Ethereum ETF assets under management surpassed $9.33 billion. Traders, however, appear reluctant to shift capital into altcoins, citing macro volatility and Ethereum’s lagging derivatives performance. Bitcoin, with its deep liquidity and regulatory clarity, remains the smart money’s preferred risk-adjusted play—especially as ETF-driven inflows provide ongoing structural support.

While large-cap altcoins stumble, retail focus is shifting toward early-stage tokens with high multiple potential. MAGACOIN FINANCE is leading that wave. Its explosive presale growth and rapidly expanding Telegram base are turning heads across crypto Twitter. With batch sales closing in record time and community participation metrics hitting new highs, analysts now project that $1,300 invested early could return up to $75,400—representing a potential 58x rally if current demand accelerates through Q3.

This mirrors the rotation we’ve seen in past cycles, where retail front-runs institutions by identifying viral opportunities before mainstream listings. MAGACOIN FINANCE’s model of political engagement, deflationary supply, and grassroots expansion is winning favor from crypto veterans and newcomers alike.

Derivatives and liquidations show risk-off for alts

Even with attention spikes around assets like VINE – sparked by Elon Musk teasing Vine’s comeback—altcoin positions remain fragile. Binance Futures data shows that 87% of derivatives volume is concentrated in Bitcoin, while Ethereum funding rates have turned negative (−0.0094%). Meanwhile, $9.4 million in VINE long positions were liquidated, reflecting a persistent lack of confidence in altcoin breakouts.

Compared to Bitcoin’s short liquidation of just $16.17 million, the message from futures markets is clear: traders remain defensive and selective—favoring BTC’s structural stability over altcoin hype.

Conclusion: Capital follows conviction—and conviction follows Bitcoin

The momentum may shift quickly in crypto, but for now, Bitcoin remains the asset of choice for institutions and cautious traders. Until altcoins offer clearer catalysts backed by ETF flows or major adoption headlines, sector-wide rotation seems unlikely. However, the appetite for high-upside exposure remains—especially through fast-moving altcoin presales like MAGACOIN FINANCE, where research updates now project a 58x rally for proactive holders. As Bitcoin anchors the top, nimble investors are turning to presales for growth.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.