It is a great time to be a trader. Bitcoin hit a new all-time high, then tested the bottom of its range. After Jerome Powell’s latest speech, the market bounced hard. Range traders are eating well, while breakout traders are struggling. With each passing day, a rate cut looks more likely.

The mood feels very different from earlier this week. Five red days in a row had everyone on edge. Yet Powell’s talk at Jackson Hole changed the tone in minutes.

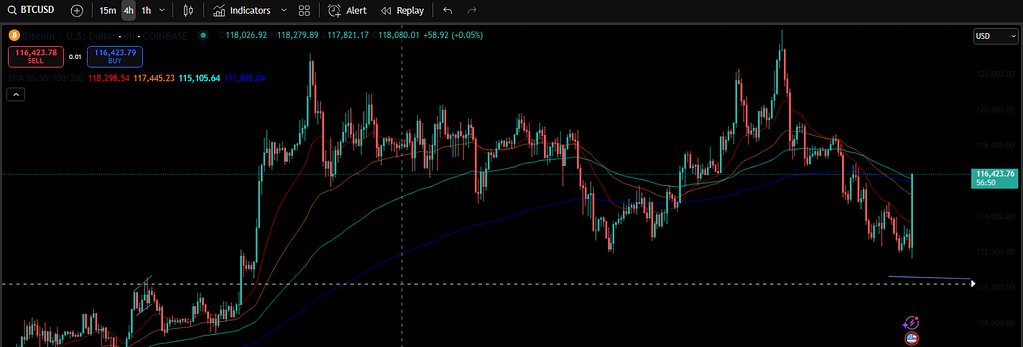

Bitcoin Reclaims $116,000

Bitcoin surged to $116,000 after Jerome Powell hinted that an interest rate cut could come as soon as September. Within minutes, risk assets jumped, while the US dollar lost strength.

Traders had been watching the $112,000 range support carefully. That level held, and Powell’s dovish comments sparked a fast rebound. Charts showed a quick 3% gain from the lows, which had been the weakest since early July.

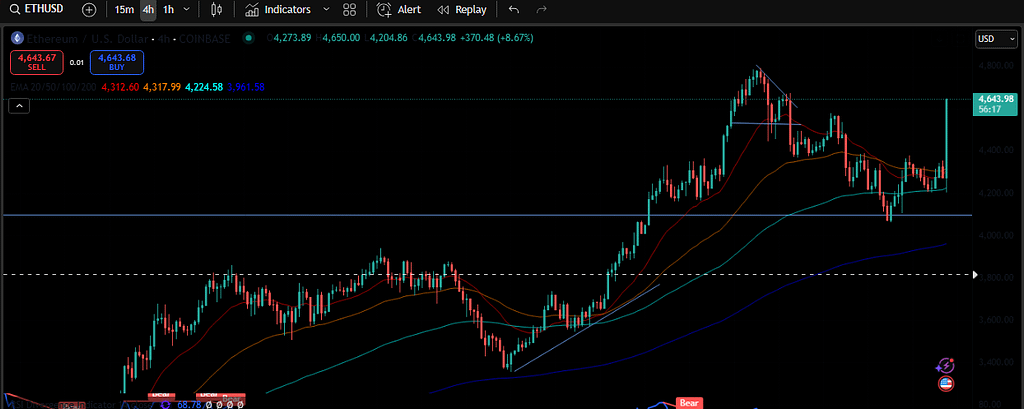

Ethereum joined the party too. Within 15 minutes of Powell speaking, ETH jumped 10%, moving from $4,200 to $4,600.

Bybit’s Trading Competition

If you enjoy this kind of market, now is the time to get active. Bybit’s WSOT competition is live, with a $10 million prize pool. It’s open for new and existing users, and it’s always exciting to trade during volatile weeks.

Personally, I love trading when volatility is high. These competitions add even more spice. If you haven’t joined yet, it’s worth a look.

More details on the WSOT here.

Personal Trade Story

I had been watching this range closely all week. This morning, I finally decided to long the bottom. The setup was not perfect, but something felt right. When Jerome Powell speaks, volatility always follows.

Markets had been dropping for 5 days. Late last night, the red candles piled up. For me, that’s usually a signal to go against the crowd. I pulled the trigger.

My take-profit was set at $114,200. The bounce came quickly, and my trade hit target. But honestly, I left some gains on the table. Price shot even higher, but I stuck to my plan. Better safe than greedy.

It’s these moments that make trading fun. Not always perfect, but full of lessons.

Jackson Hole and the Fed’s Message

Every year, the Jackson Hole economic symposium offers clues about the Federal Reserve’s next moves. This time, Jerome Powell signaled that the balance between inflation and jobs is shifting. He suggested that policy adjustments may be necessary.

His exact words hinted at flexibility. He noted the risks of sticky inflation, but also pointed out that labor market pressure is easing. He stressed that the Fed is not locked into any single path, but his tone leaned dovish.

Markets loved it. Stocks, crypto, and other risk-on assets spiked. Meanwhile, the dollar weakened, showing that traders expect liquidity to improve.

Ethereum Steals the Show

Bitcoin’s bounce grabbed headlines, but Ethereum’s rally was even more impressive. A 10% gain in just minutes shocked traders. ETH had been stuck in a choppy downtrend, but Powell’s words gave it new life.

Ethereum still ended the week slightly down, but the fast move reminded everyone why it remains a top trading asset. Big percentage swings are always on the table.

Best Yield farms for Etrhereum explained.

Rate Cut Pressure

President Trump has been vocal in pushing Powell toward rate cuts. With economic uncertainty and tariff-related inflation, the pressure keeps growing. Powell, however, remains careful with his words.

He admitted that tariffs are creating delayed inflation impacts. He warned that supply chains still need months to process the changes. At the same time, he emphasized that the Fed will not let short-term spikes turn into long-term inflation.

For traders, this balance means volatility. Every word Jerome Powell says becomes a trigger for speculation.

The Trader’s Perspective

From my side, trading around Powell speeches feels like controlled chaos. You never know the exact direction. Often, the first move is a fake-out, followed by a reversal.

That’s why I kept my target modest today. Sure, I could have stretched for $116,000. But I’ve seen too many sharp reversals. Locking in gains felt smarter.

This kind of trading environment rewards range players. If you’re looking for breakouts, the chop will punish you. But if you’re comfortable buying lows and selling highs, it’s paradise.

Well-known traders also weighed in. Daan Crypto Trades called the bounce from the range low a textbook move. Others noted bullish divergence building up before the speech. Analysts pointed out oversold RSI levels that suggested a bounce was coming.

It’s interesting how technicals and fundamentals often align. Powell’s dovish tone gave the final push to a setup that was already forming.

Looking Back and Ahead

Jerome Powell also reflected on his time as Fed chair. He mentioned the dramatic measures taken during the COVID-19 pandemic. Stimulus and emergency programs kept markets alive. But the rebound also drove inflation to four-decade highs.

Now, years later, the Fed is still balancing those effects. Inflation is not fully tamed. Employment remains solid. The challenge is finding the sweet spot.

For traders, the next Fed meeting in September is the big event. The odds of a cut are higher than ever. If it happens, liquidity could surge, fueling risk assets again.

Support Our Work

If you found this helpful, consider signing up on BloFin (Non-KYC) or Bybit using our referral links. Your support keeps this content free and flowing.

Final Thoughts

The market has spoken. Jerome Powell’s dovish hints lifted Bitcoin, Ethereum, and risk assets across the board. Traders who held their nerve at the lows are smiling.

For me, today’s trade was a reminder of discipline. Take profits when planned, and don’t chase. There will always be another setup.

The next big question is September. Will Powell finally cut rates? If he does, the market could see a flood of fresh liquidity. Until then, expect more volatility, more noise, and more opportunities.

If you enjoyed this blog, you may want to check out our blog about $DOGE and a potential 51% attack.

As always, don’t forget to claim your bonus below on Bybit. See you next time!