Everything looked perfect just a few days ago. Bitcoin smashed through resistance and hit a record $124.5k. Solana broke $200 like it was nothing. Ethereum stayed strong, and the market mood felt like a bull run on steroids. Then, as quickly as it started, the rally turned into a red sea. Bitcoin pulled back, altcoins followed, and traders were left wondering — what just happened? Let’s break it down.

Bitcoin Hits Record High of $124.5k

On Wednesday, Bitcoin set a new all-time high of $124.5k. The move came right after the U.S. Consumer Price Index showed inflation holding steady at 2.7% year-over-year. That number was slightly better than expected and pushed hopes for a Federal Reserve rate cut in September.

Traders were already bullish thanks to strong inflows into Bitcoin and Ether spot ETFs. BlackRock’s iShares Bitcoin Trust added hundreds of millions in BTC in a single day, and Ethereum’s ETF saw its first $1 billion inflow. The perfect recipe for a new high was in place.

The Dump: From $124k to $117k

Just 48 hours later, Bitcoin was back at $117k. The reason? A hotter-than-expected U.S. Producer Price Index reading. The jump in wholesale prices made traders question whether the Fed would actually cut rates in September.

The sell-off was sharp. Over $1 billion in leveraged positions were liquidated within a day. Panic selling hit retail traders, while institutions quietly stepped in to buy the dip.

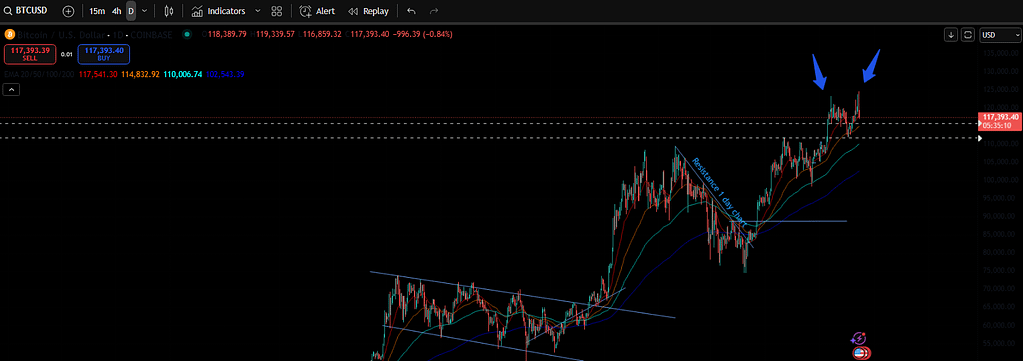

Technical Picture: Double-Top Risk

On the daily chart, Bitcoin’s recent high forms a possible double-top around $124k. The RSI has cooled off to neutral territory, while volume on the sell candles outpaced the buying volume.

Key levels to watch:

- Upside trigger: $120k break with strong volume could retest the highs.

- Downside risk: $117k break could send price to $113k–$115k.

For now, Bitcoin is stuck between dip buyers defending support and sellers looking to lock in profits.

Solana Price Action: From Breakout to Pullback

Solana was one of the strongest altcoins during the rally. It broke above $200 for the first time since early summer. The breakout was fueled by DeFi TVL growth and momentum from Bitcoin’s move.

But Bitcoin’s dump changed the game. SOL quickly fell back under $190, showing how sensitive altcoins remain to Bitcoin’s direction. If BTC can reclaim $120k, SOL might make another run at $200. If not, a dip to $175–$180 is possible.

Macro Forces at Play

The macro environment is driving these wild swings. Inflation data, interest rate expectations, and even geopolitical events are influencing crypto prices.

The upcoming Trump-Putin summit in Alaska could also be a volatility trigger. History shows Bitcoin reacts strongly to major geopolitical headlines. A positive outcome could fuel another rally, while uncertainty or tensions could spark a deeper correction.

Long-Term Holders Are Not Shaken

Despite the pullback, on-chain data shows long-term holders are keeping their coins. Bitcoin supply last active over a year remains near record highs. That means most of the selling pressure is coming from short-term traders and leveraged positions.

This kind of holding behavior often provides a strong base for the next move up.

Strategies for Navigating the Volatility

Here are some ideas to handle these swings:

- Buy the Dip: Accumulate in the $115k–$118k BTC range if the macro picture doesn’t worsen. (I currently took 1/3 long postion at 117.2k, will add more lower)

- Watch Solana’s Key Levels: $175 support and $200 resistance are the main zones.

- Diversify Holdings: Don’t keep all your capital in one coin, especially in volatile conditions.

- Stay Informed: Inflation data, Fed announcements, and ETF flows matter now more than ever.

If you want to sharpen your trading during these swings, check out these guides:

Support Our Work

If you found this helpful, consider signing up on BloFin (Non-KYC) or Bybit using our referral links. Your support keeps this content free and flowing.

Final Words

The “Bitcoin dumps after ATH” move was a reminder that the market can flip in a heartbeat. Solana’s breakout above $200 looked unstoppable — until Bitcoin’s pullback took the wind out of its sails.

The next few weeks will be all about whether BTC can reclaim $120k and hold it. If that happens, altcoins like Solana could see another surge. If not, we may be in for a deeper correction before the next leg up.

If you enjoyed this blog, you may want to check our recent update on Pepe.

As always, don’t forget to claim your bonus below on Bybit. See you next time!