After a few exciting weeks for altcoins — with BNB hitting fresh all-time highs — markets are shifting again. Ethereum treasury companies are popping up everywhere, giving ETH a fresh narrative. But what about Bitcoin? While BTC seemed steady around $120,000, the past few days have felt uncertain. Let’s break down the latest on Bitcoin’s price, explore why PayPal might be the biggest catalyst yet, and look at what’s next.

Bitcoin Hovering Around $118K – Calm Before the Storm?

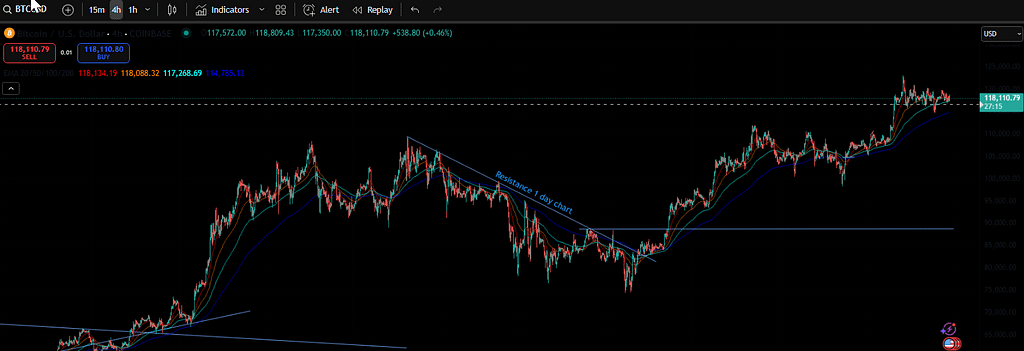

Bitcoin is currently trading near $118,000. That’s a solid number, but things aren’t moving much. Over the weekend, BTC pushed to $120K, then quickly slipped. The 4-hour chart shows the 100 EMA offering support at $117,000, holding price action for now.

Daily candles formed a classic Doji pattern, signaling indecision. RSI dropped from 60 to 55, showing a lack of strong momentum. Volume also declined, suggesting buyers are waiting for a clear signal before diving back in. Analysts say this could just be the pause before the next big move.

A Possible Dip to $112K Before the $130K Liftoff?

Several traders are eyeing $112,000 as a key level. It’s not because they’re bearish long term, but because the structure suggests a short-term correction. Galaxy Digital recently sold off 80,000 BTC, causing some panic. But with that sell pressure out of the way, buyers may return stronger than before.

We believe BTC dominance breaking its multi-year trend line signals the start of altseason. That’s great for traders rotating into altcoins, but it also adds pressure on Bitcoin to hold support.

Meanwhile, the U.S. Federal Reserve is preparing for another rate decision. Macro events like this tend to shake markets. If Bitcoin dips below $117K, we might see it fall further before rebounding.

Increase your edge with our series of trading guides

All Eyes on FOMC and the White House Bitcoin Report

Traders are watching two things this week — the FOMC meeting and a White House report on Bitcoin reserves. There’s even speculation that President Trump might propose a strategic Bitcoin reserve. That kind of headline could spark a major rally. But if nothing big comes from the reports, BTC might keep drifting inside this current range.

The 100 EMA on lower timeframes has been a reliable line of defense. If that breaks, downside targets between $114K and $112K come into focus. That would likely set up a cleaner base for a breakout toward $130K later.

PayPal Pushes Bitcoin Into the Mainstream

Here’s where things get interesting. PayPal just launched a feature allowing more than 400 million users to spend Bitcoin at checkout. Merchants can now accept crypto through wallets like MetaMask, Coinbase, and Kraken. Even better — they receive dollars or stablecoins instantly. No volatility headaches. No technical barriers. Just smooth conversion.

This isn’t just another crypto gimmick. PayPal is rolling this out under its “Pay with Crypto” banner, with plans to expand globally via a new product called “PayPal World.” It’s being designed as a global settlement layer for crypto. That’s a big step from holding BTC in a PayPal wallet — now, it’s about real-world usage at scale.

Why This Integration Could Be a Game-Changer

Many past attempts at crypto payments failed because of friction. Users had to copy wallet addresses, wait for confirmation times, and worry about price swings. With PayPal’s new system, the user experience gets a complete overhaul.

- Instant conversion to fiat or PYUSD

- Merchant receives stable value at checkout

- Up to 4% APY for balances in PYUSD

- Easy plug-ins for popular wallets

This eliminates two huge hurdles: volatility and complexity. Now, Bitcoin can actually be used as a currency, not just an investment. And that could shift how people — and markets — view BTC.

Bitcoin Price Still Range-Bound… But Not for Long

Even with the PayPal news, Bitcoin continues to move sideways between $116,000 and $120,000. Traders call this “compression” — when price gets squeezed into a tighter range before breaking out.

Technicals show a symmetrical triangle forming. The top sits around $121,000, with support near $117,400. If Bitcoin breaks above the top, targets near $125,000 become likely. A breakdown could mean another test of $114,500.

Either way, this coiling action suggests that a big move is coming. And with catalysts like PayPal, FOMC, and possible Bitcoin reserve news from the White House, the timing couldn’t be better.

Liquidity Trends Could Be the Final Push

Many analysts think liquidity is the missing piece. Rising global M2 money supply, falling interest rates, and easier credit conditions tend to fuel crypto rallies. If that liquidity surge aligns with utility upgrades — like PayPal’s system — Bitcoin could quickly move toward $200,000.

And let’s not forget the 2025 forecasts. Several crypto funds and macro economists now point to $250,000 BTC by late next year. The math is simple: more people using crypto + limited supply = bullish pressure.

Start Yield Farming with Crypto today.

So, Where Does Bitcoin Go From Here?

Here are two likely scenarios:

Bullish case:

PayPal adoption goes global, White House supports Bitcoin reserves, and macro conditions loosen. BTC breaks above $121,000 and rockets to $130,000. From there, it sets up for a parabolic run toward $200,000+ into 2025.

Bearish case:

FOMC announces another rate hike. White House report underwhelms. BTC breaks $117,000 support and falls to $112,000. But that dip becomes a strong buy zone before the next leg higher.

Either way, this isn’t the time to sleep on Bitcoin.

Support Our Work

If you found this helpful, consider signing up on BloFin (Non-KYC) or Bybit using our referral links. Your support keeps this content free and flowing.

Final Thoughts: Bitcoin PayPal Narrative Just Getting Started

Bitcoin might be stuck in a tight range right now, but don’t let the slow price fool you. Under the surface, big changes are happening. PayPal’s move is more than a payment option — it’s a shift in how crypto works in daily life.

With macro events on the horizon, retail adoption expanding, and institutional sentiment warming up again, the stage is being set. Whether BTC dips to $112,000 first or explodes past $130,000, the long-term trajectory is intact.

And if PayPal becomes the default bridge for millions of people into crypto, we could look back at $118,000 as a massive opportunity.

The keyword isn’t just Bitcoin anymore.

It’s Bitcoin PayPal — and that combo might just unlock the next phase of this bull run.

If you enjoyed this blog, you may want to check our recent update on one of the top alt coins of this moment: “SUI”

As always, don’t forget to claim your bonus below on Bybit. See you next time!