Only a few days ago, we wrote about Bitcoin breaking $112k. Altcoins were popping, and things looked great. Well, we hope you paid attention, because it just got crazier over the weekend. Bitcoin 123k is already a fact, and it made a new ATH overnight.

Our exchange referrals have been blowing up. Some platforms are even showing record-breaking volume. Honestly, it is wild to watch. This motivates us to keep bringing you the best crypto trading updates. Let’s dive into Bitcoin’s historic rally.

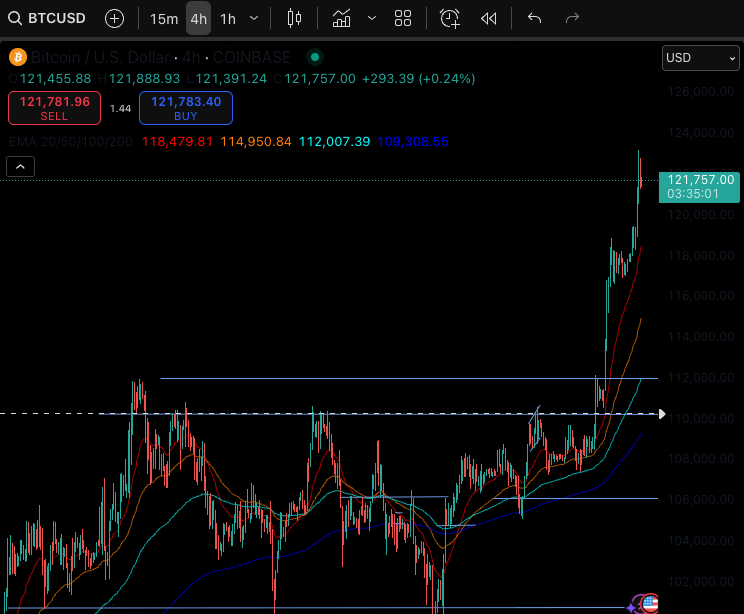

Bitcoin 123k Marks a New All-Time High

Bitcoin has once again shocked the world by reaching a fresh all-time high of $123,300. At the moment, it trades around $121,500, holding steady after the weekend pump.

In this article, we will look at possible upside targets. However, we will also point out the current risks.

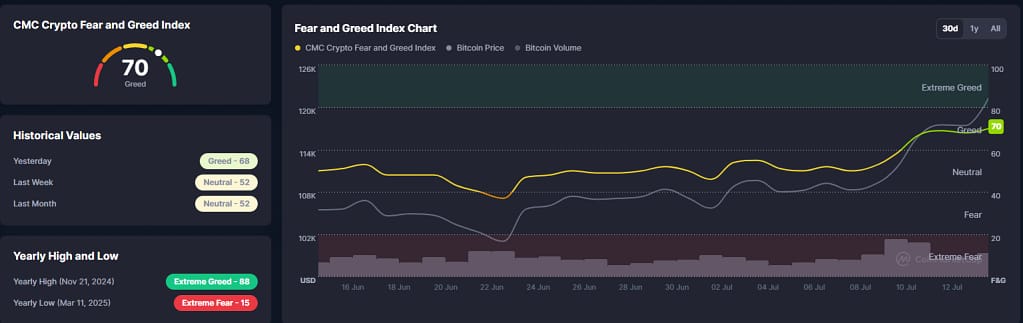

Greed Is Back in the Market

The Crypto Fear and Greed Index has moved back into greedy territory. Right now, it shows a reading of 70 out of 100. Just a few days ago, we saw “Extreme Greed.”

Investors are clearly chasing the pump. Bitcoin shows no signs of slowing down. On top of that, U.S. lawmakers are pushing more crypto-friendly regulations. The market sentiment has shifted, and bulls are in charge.

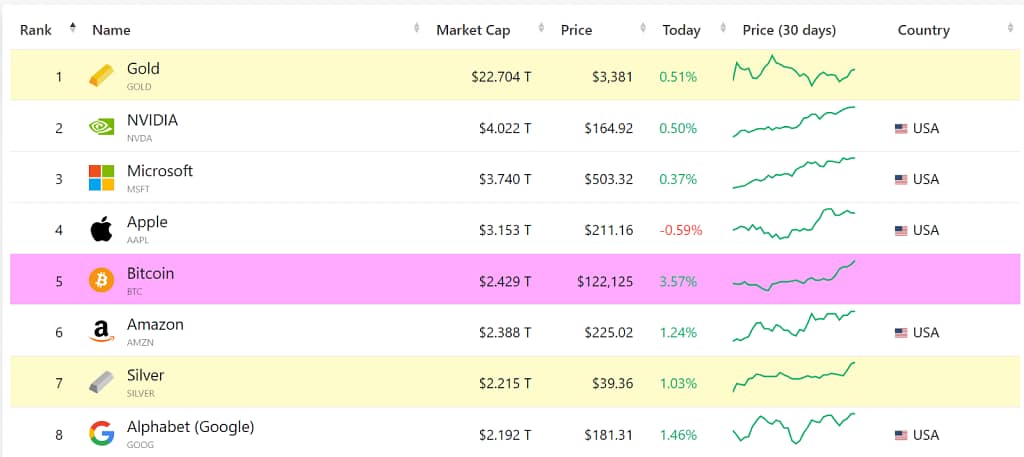

Bitcoin Flips Amazon’s Market Cap

Bitcoin is now the fifth-largest asset in the world. It recently passed Amazon’s $2.3 trillion market cap. With Bitcoin at $121,500, its total valuation sits above $2.4 trillion.

BTC also flipped Silver and Alphabet (Google), making this one of the most impressive weeks for Bitcoin holders in history.

Billions Flow into Bitcoin ETFs

Investors have been pouring cash into Bitcoin exchange-traded products (ETPs). Last week alone, Bitcoin ETPs saw $2.7 billion of inflows. This represents 73% of all crypto ETP inflows.

After last week’s brief slowdown, inflows exploded again. Daily ETF inflows jumped back above $1 billion after Bitcoin broke through $112k.

Crypto funds now hold more than $211 billion in assets, with Bitcoin leading the pack.

Claim a Bitcoin Bonus with Bitso.

Bitcoin Becomes 2025’s Top Asset

Bitcoin is officially the best-performing asset of 2025 so far. It has climbed over 30% this year, outpacing Gold’s 27% gain.

This is only the second time in history that Bitcoin and Gold have been the top two assets. Usually, this indicates rising market anxiety. Investors are fleeing to safe havens as macroeconomic risks build up.

U.S. Debt Crisis Pushes Bitcoin Higher

Much of Bitcoin’s rise is linked to worries about the U.S. economy. The U.S. recently passed the “Big Beautiful Bill,” raising the debt ceiling by $5 trillion.

At the same time, the dollar index has been falling. Inflation remains sticky. Geopolitical tensions are rising. All these factors drive more investors toward Bitcoin.

Some analysts call this a “crisis rally,” with Bitcoin acting as a hedge against economic instability.

Bitcoin Breaks Eight-Year Resistance Line

For the first time in eight years, Bitcoin smashed through a key resistance line at $117,000. This level had stopped every previous rally since 2017.

Breaking this line opened the doors for price discovery. Many analysts believe Bitcoin can now surge toward $130,000 or even higher.

Public Companies Quietly Buy More Bitcoin

A growing number of companies are adding Bitcoin to their treasuries. While big names like Tesla make headlines, smaller firms are also loading up.

Companies like Aker ASA, Cipher Mining, and MercadoLibre have added Bitcoin quietly. Over 250 companies now hold Bitcoin on their balance sheets, up from 224 just last month.

This shows growing corporate confidence in Bitcoin as a reserve asset.

Bitcoin Acts as a Hedge Against the Deficit

Bitcoin’s recent rally is not just hype. It is driven by fears of a U.S. debt crisis. Analysts describe Bitcoin as a macro asset, similar to Gold.

With the U.S. adding trillions in debt and planning rate cuts, Bitcoin is the clear winner. Investors are betting on its fixed supply and global liquidity.

Related: The XLM chart is exploding

More Crypto Legislation Is Coming

The U.S. government is preparing for a big “Crypto Week.” Lawmakers will debate multiple bills, including the CLARITY Act and the GENIUS Act for stablecoins.

Trump’s Digital Asset Task Force will also release key policy updates. With these developments, Bitcoin could get even more attention from Wall Street.

Analysts Expect More Upside

Crypto experts remain bullish. Some see Bitcoin hitting $130,000 in the coming weeks. Others point to targets around $150,000 before the end of the year.

A few models even predict Bitcoin reaching $200,000 by the end of 2025. This aligns with previous bull market cycles and increased ETF demand.

July Is Historically Bullish

Historically, July is a strong month for Bitcoin. This year is no exception, with Bitcoin gaining nearly 15% already.

Some experts predict a small pullback in late July. However, the overall trend remains up, especially with important policy decisions on the horizon.

What About Altcoins?

Altcoins have been lagging behind Bitcoin so far. However, some early signs of life are showing. Ethereum has regained $3,000, and several smaller coins are pumping.

If Bitcoin stabilizes above $120,000, altcoins could enjoy a mini-rally as traders rotate profits.

Final Thoughts: How High Can Bitcoin Go?

With Bitcoin at $123,000, many wonder how much further it can climb. Could we see $150,000? Maybe even $200,000?

Nobody can predict the top. However, the fundamentals remain strong. ETF demand, macro uncertainty, and legislative changes all support higher prices.

One thing is clear. Bitcoin is no longer just a speculative asset. It is now a major player in global finance.

Our Trading Plan

Right now, we are not shorting Bitcoin. In price discovery, shorting is risky. We prefer to long small dips or focus on altcoins when Bitcoin cools off. If you do plan a short, wait for bearish candlesticks to form. You can study a guide on trading candlesticks here.

Our advice is simple. Do not go all-in. Always use stop-loss orders and manage your risk carefully. Remember, the crypto market rewards patience and discipline.

Support Our Work

If you enjoy our market updates, consider signing up to your favorite exchanges using our referral links. It helps us keep producing free content for you.

Popular choices are BloFin (Non-KYC) and Binance. Thanks for supporting independent crypto reporting!

Stay safe, stay smart, and happy trading!

If you enjoyed this blog, go check out our speculation on whether Bitcoin can hit 500k.

As always, don’t forget to claim your bonus below on Blofin. See you next time!