Ethereum is not just the second-largest cryptocurrency by market cap. It’s also the backbone of decentralized finance (DeFi). Unlike Bitcoin, which is mainly held as a store of value, Ethereum can generate active income through yield strategies. This difference is a big reason why institutional treasuries, hedge funds, and long-term crypto investors are increasingly allocating capital to ETH.

With the right approach, your ETH can earn while you hold it. From simple staking to advanced restaking strategies, the opportunities to put Ethereum to work have never been more diverse. The DeFi sector is maturing, and yields on ETH are now part of serious financial planning for both retail and professional investors.

Ethereum – The Future of Finance

Ethereum’s evolution over the past few years has been remarkable. Initially launched in 2015 as a programmable blockchain, it’s now the largest smart contract platform in the world. It powers thousands of decentralized applications, from trading protocols to lending markets and NFT platforms.

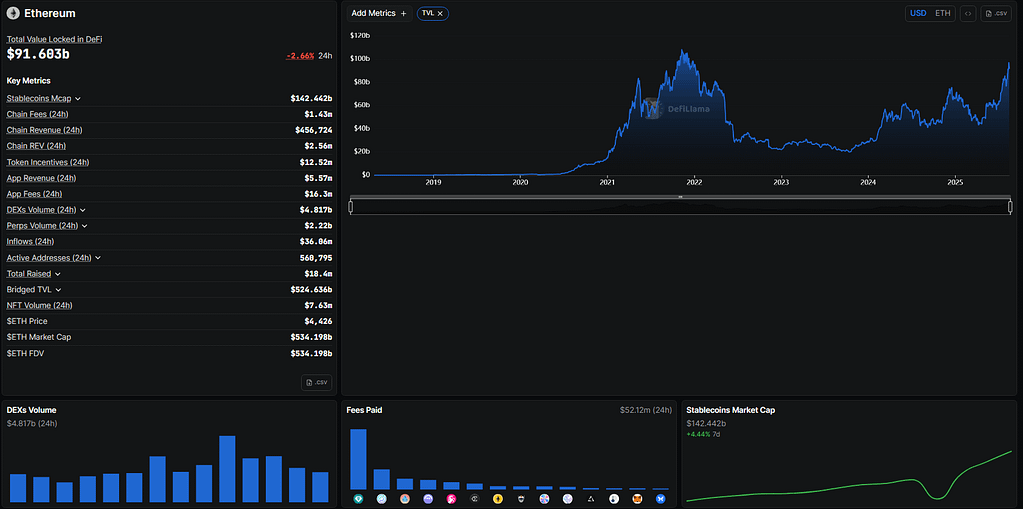

According to DeFiLlama, Ethereum’s total value locked (TVL) reached over $91 billion in mid-2025. This figure represents more than 60% of all value in DeFi. The network’s resilience, security, and developer ecosystem have kept it ahead of other blockchains.

Growth in liquid staking, restaking protocols, and DeFi lending has fueled this momentum. The rise of tokenized real-world assets like U.S. Treasuries on Ethereum is also pulling in institutional capital. These developments are making Ethereum an essential part of the digital asset allocation playbook.

Related: Beginner guide to Yield Farming.

Key Takeaways

- More than 36 million ETH is staked in 2025, locking up over 30% of supply.

- Liquid staking removes the 32 ETH barrier, letting anyone participate.

- Restaking platforms can add layers of yield on top of base staking returns.

- Yield strategy choice depends on risk tolerance, liquidity needs, and control.

How Much ETH Yield Have You Already Missed This Year?

In yield farming, time is money. Every week your ETH sits idle, you miss compounding opportunities.

For example, if you had staked 10 ETH at 4% APY at the start of 2025, you’d have earned around 0.4 ETH by mid-year, plus any extra from DeFi integrations. Restaking strategies could push that to 0.6–0.8 ETH in the same period. Multiply this by years, and the missed gains can be significant.

With over 30% of Ethereum’s supply already staked, the early movers are steadily increasing their ETH holdings. The difference between earning a modest 3% and capturing 16%+ often comes down to knowing how to layer strategies effectively.

If I were Tom Lee, I would put my billions to work!

Basics of Earning Yield on ETH

At its core, earning yield on Ethereum means lending it, staking it, or providing it as liquidity so it can be used productively. In return, you earn rewards.

You can do this via:

- Decentralized finance (DeFi) – Using smart contracts on the blockchain.

- Centralized finance (CeFi) – Using exchanges or custodial platforms.

Returns are usually quoted as APR or APY. APR calculates interest on your initial deposit, while APY includes compounding — reinvesting your earned rewards to generate more returns.

DeFi makes this possible without banks or intermediaries. Smart contracts execute automatically when conditions are met, reducing reliance on traditional financial infrastructure.

Ethereum Staking in 2025: Maximizing Rewards

Staking is the foundation of Ethereum yields. By staking, you help secure the network and process transactions. In return, you earn rewards in ETH.

Three Main Staking Methods

- Solo Staking

- Requires 32 ETH and running a validator.

- Full control over your stake and rewards.

- Requires technical knowledge and reliable uptime.

- Pooled Staking

- Combine ETH with other users to reach 32 ETH collectively.

- Rewards are shared proportionally.

- Ideal for those with less capital.

- Liquid Staking

- Stake via a protocol and receive a liquid staking token (LST) like stETH or rETH.

- Continue earning rewards while using the token in DeFi.

- Flexible liquidity compared to traditional staking.

Related: The new Buzzword is Stablecoins.

Understanding Staking Yields

Base staking yields are around 3–4% APY in mid-2025. This rate changes with network conditions — the more ETH staked, the lower the base reward.

Restaking and DeFi integrations can push returns higher, but they come with extra risk. Liquidity is another factor: solo stakers face withdrawal queues, while LSTs can be traded instantly, though they may briefly trade below ETH’s value during market stress.

Best ETH Liquid Staking Platforms

Best for Liquidity

Lido (stETH)

- APY ~2.43% after fees

- Deepest DeFi integration

- Centralization concerns due to large market share

Frax (frxETH / sfrxETH)

- APY ~2.84%

- Flexible liquidity vs. yield choice

- Validators are whitelisted

Best for Decentralization

Rocket Pool (rETH)

- APY ~2.5%

- Permissionless node operators

- Slightly lower yield than Lido

StakeWise V3 (oseETH)

- APY ~1.3%

- Choose your validator

- Lower total value locked

Institutional Options

Stader (ETHx) – ~2.4% APY, strong multi-chain brand

Liquid Collective (LSETH) – ~3% APY, enterprise-grade, KYC required

Centralized Staking Platforms (CeFi)

For investors who prefer simplicity, centralized exchanges offer plug-and-play staking.

- Coinbase ETH Staking – Around 3% APY, no technical setup.

- XT Earn – Promotional rates up to 6% with flexible lock periods.

These are convenient but require trusting the platform’s custody.

Advanced Ethereum Yield Strategies

Once you’re comfortable with staking, you can explore more complex strategies to push yields higher.

EigenLayer (Restaking)

EtherFi (Hybrid Staking + Restaking)

Ethena (Synthetic Yield)

Top 5 Ethereum Yield Farms

- Aave – Lending protocol with variable interest rates.

- Uniswap – AMM exchange with liquidity pool rewards.

- SushiSwap – AMM plus token staking opportunities.

- Curve – Stablecoin swaps with low slippage and high yield.

- Yearn Finance – Automated yield aggregator for passive investors.

Layer 2 Opportunities

Ethereum’s base layer is secure and decentralized, but it can get congested and expensive during high activity. This is where Layer 2 (L2) solutions come in. They process transactions off-chain or in optimized environments, then settle back to Ethereum, drastically lowering fees and improving speed.

Over the past two years, the adoption of L2 networks has exploded. Rollups like Optimism, Arbitrum, Base, and zkSync have already attracted billions in total value locked (TVL). Now, a new generation of Ethereum-aligned L2s is emerging — and Linea is one of the most interesting players.

Linea and Beyond

Linea is positioning itself as the most Ethereum-centric Layer 2 yet. It doesn’t just replicate Ethereum’s functionality; it’s designed to amplify it. One of its standout features is native ETH yield for bridged ETH. Unlike most L2s where your bridged ETH just sits idle, Linea automatically puts it to work by staking it at the protocol level. That means you earn yield simply by having ETH on the network, before even interacting with DeFi apps.

Liquidity providers (LPs) can then layer this base yield with DeFi rewards from lending, trading, or liquidity pools on Linea’s growing dApp ecosystem. This creates stacked yield opportunities — returns from staking rewards plus protocol incentives plus DeFi income. For yield-focused investors, this structure offers some of the best risk-adjusted returns in the L2 space.

Linea also has a strong token incentive model. The upcoming Linea Token Generation Event (TGE) is set for Q4 2025, with a remarkable 85% of the token supply allocated to early users, builders, public goods, and R&D. The remaining 15% will be locked in the ConsenSys treasury for five years. This allocation suggests a heavy emphasis on rewarding genuine ecosystem participation rather than quick speculation.

Another innovation is Linea’s ETH burn mechanism. Twenty percent of all net ETH transaction fees on the network will be burned at the protocol level, reducing Ethereum’s overall supply and potentially benefiting long-term ETH holders. No other L2 has committed to this kind of direct ETH-aligned deflationary design.

Linea Airdrop is Coming

For those hunting for both yield and potential airdrops, Linea checks every box. By bridging ETH early, participating in DeFi activity, and building a transaction history, you can position yourself for both ongoing yield and the upcoming token distribution. The official eligibility criteria for the airdrop will only be revealed one week before the snapshot, making early action critical.

If you want to maximize your odds, you should read the full step-by-step Linea Airdrop Guide on AirdropAlert. It outlines how to bridge ETH, interact with the top dApps on Linea, and ensure your wallet activity is visible on-chain ahead of the snapshot. Given the token allocation size and Linea’s focus on rewarding early users, this is one of the most attractive Ethereum yield + airdrop plays of 2025.

Airdrops: Hidden Yield Boosters

Ethereum has hosted some of the largest airdrops in crypto history. In 2020, Uniswap gave 400 UNI tokens to early users. More recent restaking projects like EigenLayer, EtherFi, and Zircuit have rewarded active users with significant token drops.

Often, yield activities double as eligibility steps for these rewards. By using protocols, you not only earn yield but may also qualify for valuable airdrops — which can multiply your effective returns.

Make sure not to miss them by either following us on X, or using tools to check your airdrop eligibility.

Support Our Work

If you found this helpful, consider signing up on BloFin (Non-KYC) or Bybit using our referral links. Your support keeps this content free and flowing.

Final Words

Ethereum yields are no longer niche. With accessible staking options, advanced yield farms, and upcoming Layer 2 opportunities, ETH can work harder for both individual and institutional investors. Start with a method that fits your liquidity needs and risk profile, then expand into advanced strategies as you gain confidence.

Every idle ETH is a missed opportunity. The sooner you put it to work, the faster it compounds into long-term gains.

If you enjoyed this blog, you may want to check our content related to airdrop farming.

As always, don’t forget to claim your bonus below on Bybit. See you next time!