Alisa Davidson

Published: June 05, 2025 at 11:09 am Updated: June 05, 2025 at 11:09 am

Edited and fact-checked:

June 05, 2025 at 11:09 am

In Brief

The article reviews fresh data from Grayscale, key trends like stablecoins and subnets, standout projects, 2025 token launches, and forecasts of potential 3x growth by 2026 as regulation and real revenue models take shape.

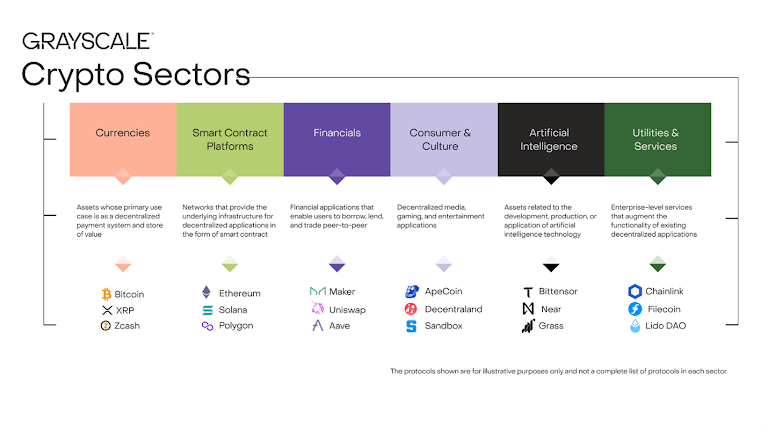

In just two years, the AI crypto sector has expanded from $4.5 billion in 2023 to nearly $20 billion in 2025. This represents a fourfold increase in value, driven by technical breakthroughs, institutional attention, and early but growing use cases. Despite its fast pace, this segment still holds a small share of the crypto landscape—only 0.67% of the total market.

By comparison, the Financials sector, which includes DeFi platforms and tokenized investment tools, has reached around $519 billion. That gap highlights both the early nature of AI crypto and its potential to scale.

A new report by Grayscale (a digital asset management firm focused on crypto investment products), led by Research Director Zach Pandl and Analyst Will Ogden Moore, breaks down the key forces behind the growth. From stablecoin integrations, and AI agent microtransactions, to distributed AI training and revenue-producing protocols, this sector is shifting from hype to foundation.

This article explores what’s happening across the AI crypto space, what’s coming next, and how its share of the Web3 economy may grow significantly in the next two years.

Growth and Token Performance

The AI crypto sector, which includes tokens built around artificial intelligence technologies, has expanded rapidly over the last two years. Its total market cap grew from $4.5 billion in 2023 to nearly $20 billion in 2025, marking a more than fourfold increase.

But the sector’s performance hasn’t been consistent across all tokens. ElizaOS dropped sharply — down by 80%. These wide differences show that while the sector is growing fast, it’s still early, volatile, and driven by experimentation.

Stablecoins Could Power AI Agent Payments

AI agents will need to make lots of fast, small payments. For that, stablecoins are ideal — they’re cheap to send, easy to program, and don’t change value.

Some big companies are already working on this. Coinbase, a crypto exchange and wallet platform, launched a new tool to help AI use stablecoins in payments. Meta, Stripe, and several large banks are exploring the same path.

In the U.S., lawmakers are discussing new bills like the GENIUS stablecoin bill and the crypto market structure bill. If these pass, more tools for AI and crypto could launch faster.

Decentralized AI Training: Prime Intellect Leads the Way

One major trend is distributed AI training. Instead of using one big data center, some projects use idle GPUs all over the world to train large models. Prime Intellect is doing just that.

It has already built models with over 30 billion parameters, which is a high number even for large companies. This method is cheaper and doesn’t rely on just a few tech giants. If more people adopt this model, training AI could become more open and cost-effective.

Real Revenue from AI Projects

Many crypto projects are still in early testing. But some in the AI sector are already making real revenue.

One example is Grass. It collects web data and sells it to AI companies. According to Grayscale, Grass earns tens of millions of dollars per year. It’s also working on a consumer product, which could bring in even more users and money.

Another project is Virtuals, which lets AI agents trade. Over the past year, it brought in about $30 million in trading fees. These numbers show that AI in crypto is not just theory — some projects are already working and earning.

New Tokens Are Coming in 2025

Grayscale also points to new tokens coming later this year. These include:

- Gensyn, a platform for machine learning power;

- Prime, building tools to run AI models and move data;

- Nous Research, a group focused on open-source models and community-driven networks.

These upcoming launches could bring more developers and money into the AI crypto space.

The Sector Is Still Small Compared to the Whole Market

Even with strong growth, the AI crypto sector is still small. Its $20 billion market cap is much less than other parts of crypto:

- Layer 1 chains: over $800 billion;

- Stablecoins: more than $130 billion;

- DeFi and Financials: around $519 billion.

But Grayscale believes this is a good thing. Like DeFi in 2020, the AI sector is young, full of ideas, and ready to evolve.

Big Companies Join as Rules Become Clearer

More big names are entering the space. Meta, Stripe, and Coinbase are all building tools that connect AI and crypto. Banks and payment systems are also joining. This is happening as rules and laws get clearer.

Grayscale says this shift shows AI in crypto is no longer just about hype. It’s about building real tools and services — things people can use.

AI Crypto Sector Is Becoming a Key Layer of Web3

The jump from $4.5B to $20B signals a fundamental change, not a temporary spike. With real businesses like Grass and Virtuals already making money, the space is gaining traction fast.

As Jensen Huang, CEO of Nvidia, said:

“AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate. Countries around the world are recognizing AI as essential infrastructure—just like electricity and the internet.”

This space isn’t just growing. It’s laying the foundation for how digital tools and finance will work together in the future. For investors, developers, and institutions, the AI crypto sector is quickly becoming one of the most active and forward-moving parts of the Web3 world.

Forecast: What’s Coming in 2025 and Beyond?

Grayscale believes the AI crypto sector could grow to $50–75 billion by the end of 2026. That would be around 2–3.5% of the total crypto market, up from today’s 0.67%.

What could drive this?

- More stablecoin-based payments by AI;

- A growing need for decentralized compute networks;

- Projects earning money through real-world use;

- Laws that make it easier for companies to join.

If decentralized AI training stays cheaper and more scalable, it could compete with today’s cloud giants.

These shifts suggest that AI in crypto is moving from experimental concepts to infrastructure-level innovation. The focus is no longer just on hype or speculation. Instead, builders are solving real technical bottlenecks — from compute access to payment logic — while investors are watching for models that can scale and monetize.

Whether AI crypto reaches $50 billion or more, the next wave won’t be defined by token launches alone. It will come down to utility, sustainability, and how well these networks integrate with the evolving internet and regulatory frameworks. The foundations are being laid now — and 2025 may be the year they begin to hold weight.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa Davidson

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.