July was fun. Altcoins were running, and many of us caught some great trades. Then August came along. A lot of chop, a lot of stops. I’ll be honest, my last few fartcoin longs got cooked. Time to let those rest a bit.

Now we’re in September, or as traders like to call it, Rektember. Historically, it’s been a tricky month. But that doesn’t mean every coin is doomed. The key is picking the right horses. Today, I’ll share the top altcoins I’m trading for Rektember. These are coins I track daily, some I’m already long, and a few I’m eyeing for entries.

Study our latest trading guide on moving averages

Rektember and Market Sentiment

People often say September is bad for crypto. Slow summers, early autumn corrections, and lower risk appetite all play a role. But history shows it’s not always the case. Some years, September sets the stage for a strong Q4.

The important lesson? Don’t generalize. Bitcoin dominance may shift, liquidity may dry up, but strong altcoins can still run. If you’re selective and patient, Rektember can hand you the best setups.

The Obvious Ones: Ethereum and Solana

Before diving deeper, let’s get the obvious out of the way. You cannot ignore Solana and Ethereum. Both charts look constructive, and momentum is building again. I covered these in detail recently, so if you want deeper analysis, check here:

Now let’s move to the coins I’m actively watching this month.

Trading Volatility and Bybit WSOT

Volatility is why we trade crypto. Big swings mean big opportunities. Personally, I enjoy it. Over the years, I’ve learned that volatility is both friend and foe. Manage it right, and it’s a goldmine.

Speaking of volatility, Bybit’s WSOT trading competition is live with a $10M prize pool. Events like this always bring energy to the market. I usually join because it keeps me sharp. Trading is fun when you’re up against the best.

If you want to check it out, here are the links:

Top Altcoins for Rektember

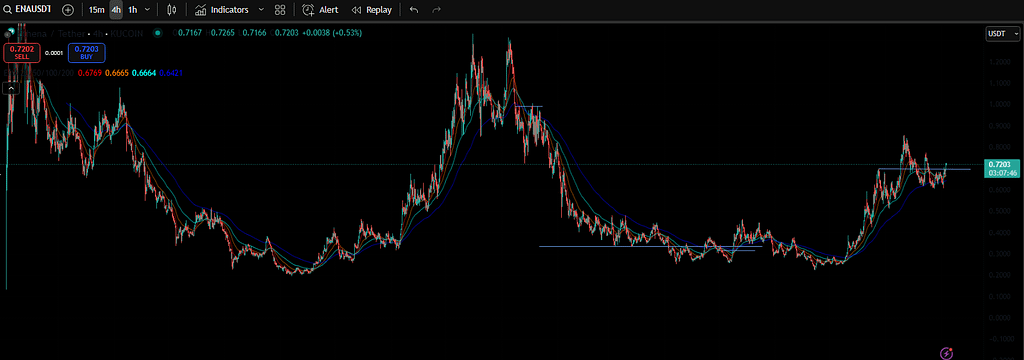

Ethena (ENA)

Ethena has been showing strong signs of recovery. Recently, it has been grinding higher with consistent green candles.

- A major unlock of 171M ENA is coming this week, which is about 2.7% of circulating supply. That could pressure the market.

- At the same time, open interest is rising, which shows traders are confident.

- On the 4H chart, ENA is pressing against $0.6911 resistance. If it breaks, we could see $0.75 soon.

The indicators are supportive too. RSI is trending higher at 62, and MACD momentum is positive. As long as ENA holds above $0.61, I expect continuation.

Note: I am long.

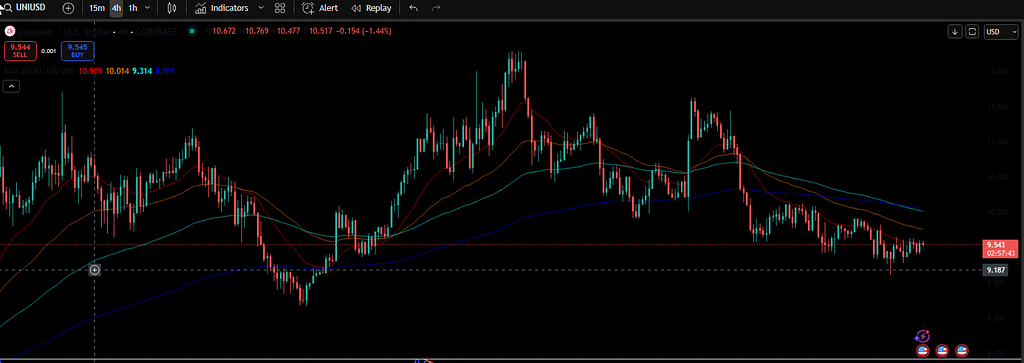

Uniswap (UNI)

Uniswap has been under pressure lately. Price is stuck around $9.41 and struggling to hold above $9.50.

- On the daily chart, sellers keep rejecting UNI near resistance at $9.64.

- Bollinger Bands show rising volatility, which means more movement is coming.

- RSI sits near 42, leaning bearish.

The 4H chart confirms the same. UNI is fighting for support around $9.20–$9.40. If this breaks, we may see $9 or lower. Still, volatility creates entry points. I’m watching this closely for a bounce.

Note: Looking for entry.

Chainlink (LINK)

Chainlink has been buzzing. It’s sitting near key support levels while whales and institutions load up.

- $28 is the level to watch. A breakout above $26.50 would set the stage for $30+.

- Whale activity shows accumulation, with millions withdrawn from exchanges.

- Institutions have added $3.6M in inflows, raising total AUM to $137M.

On the TA side, LINK is consolidating. RSI at 54 gives room for upside. The 20-day SMA supports around $24, making this an attractive dip-buy zone.

Note: I am long.

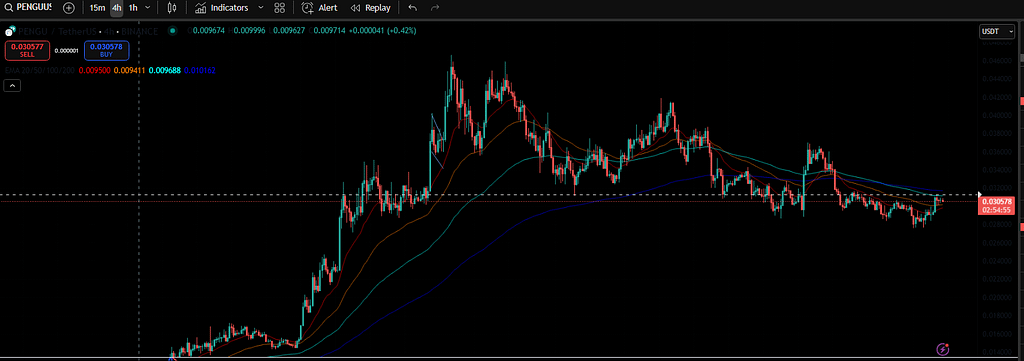

Pudgy Penguins (PENGU)

Yes, a meme coin. But don’t underestimate it. Pudgy Penguins (PENGU) has been trading with serious volume, over $350M in 24 hours.

- It broke above $0.026 resistance and now looks to stabilize higher.

- Key support sits at $0.020, aligned with Fibonacci retracement.

- The EMA 200 trend is still bullish long-term.

Short-term pullbacks may happen, but as long as volume stays green, PENGU has room to push higher. I like watching these plays because they often front-run narrative-driven pumps.

Note: I am Long

World Liberty Financial (WLFI)

WLFI has been a rollercoaster. Whales, Trump headlines, and token burns keep it in the spotlight.

- The Trump family holds 60% of supply and controls 75% of revenue. Centralized, yes, but also powerful.

- Whale transfers of billions in WLFI tokens have sparked extreme volatility.

- Just yesterday, the team burned 47M tokens worth over $10M and bought back another $2M.

- Support level forming above $0.20

It’s high risk, high reward. If you enjoy volatility, WLFI is a must-watch. I am long here, but I size smaller due to risks.

Note: I am long

Read all about the WLFI launch right here.

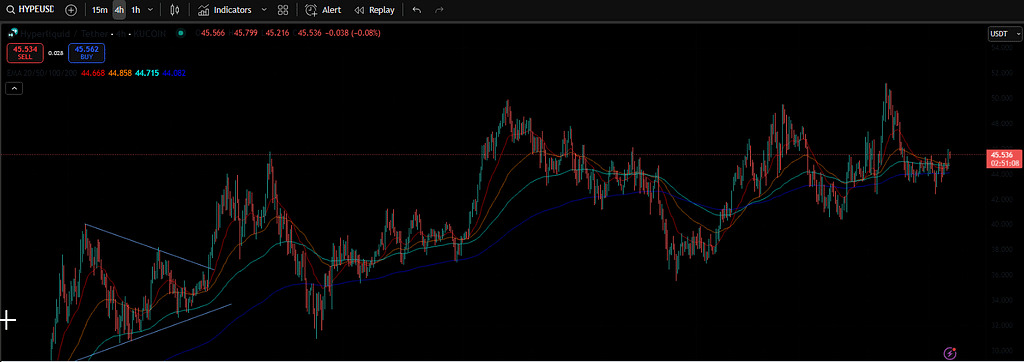

Hyperliquid (HYPE)

This is one of my strongest conviction plays right now. Hyperliquid keeps grinding higher along its uptrend.

- Support sits around $42–$43, and so far, it’s held perfectly.

- Next targets are $55–$60 if momentum continues.

- Revenue is insane: $106M in the last 30 days, more than Solana and Ethereum combined.

Despite this, Hyperliquid’s market cap is only $12B. That’s a fraction compared to Solana at $108B and Ethereum at $530B. For me, this shows it’s undervalued.

Note: I hold spot and stake HYPE. I didn’t hedge, as I see this as one of the top tokens of the bull cycle.

Read the story on how Hyperliquid whales made millions squeezing the XPL chart.

Support Our Work

If you found this helpful, consider signing up on BloFin (Non-KYC) or Bybit using our referral links. Your support keeps this content free and flowing.

Final Words

Rektember doesn’t have to live up to its name. If you manage risk, watch support levels, and pick the right coins, there are plenty of opportunities.

This month, I’m focused on Ethena, Uniswap, Chainlink, Pudgy Penguins, WLFI, and Hyperliquid. Some I already hold, others I’m stalking for entries.

Stay sharp, trade safe, and remember—volatility is your best friend when you respect it. Q4 could be huge, but Rektember still has plenty of action to offer.

If you enjoyed this blog, check out our recent blog about the Cardano price.

As always, don’t forget to claim your bonus below on Bybit. See you next time!