I’ve been getting texts from my high school friends again. They all want my thoughts on Ethereum. Most of them remember me shilling ETH back in 2015. None of them bought. They still tease me about it when we meet up. But now that the price is heating up, suddenly my phone is buzzing.

As a holder since the early days, I can’t blame them. Ethereum has been the backbone of my DeFi farming and NFT trading. Even when I hedge short to stay neutral, I always keep exposure. Today, let’s dive into the latest Ethereum update. We’ll look at the charts, speculate on the price, and see what might come next. Hopefully, my old buddies are reading this too.

Study our series of trading guides

A New Phase in the Market

Ethereum has been volatile lately. That’s nothing new, but the bigger story is capital rotation. For months, Bitcoin hogged the spotlight. Institutions piled into BTC, while retail only wanted Bitcoin exposure.

But tides change fast in crypto. Money is moving from BTC to ETH. This is a classic cycle shift. First, Bitcoin rallies. Then, Ethereum takes center stage. Eventually, liquidity spreads to smaller altcoins.

This moment feels like the second stage. Institutions are beginning to diversify. They see Ethereum not just as speculation, but as the backbone of DeFi, NFTs, and enterprise solutions.

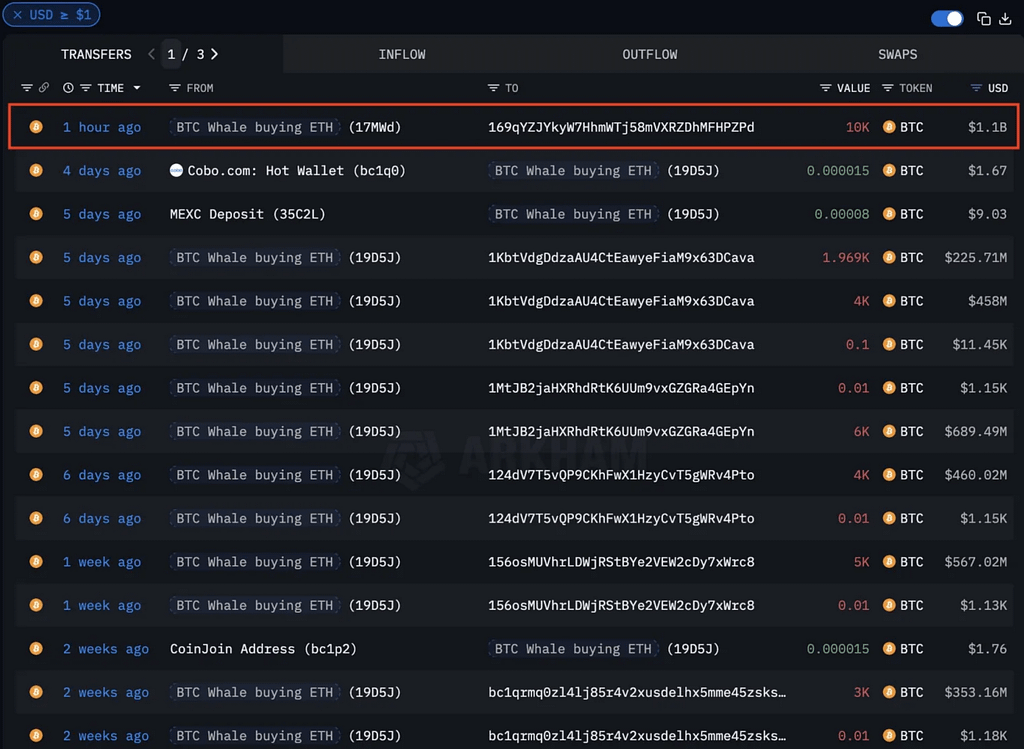

Whale Accumulation: A Bullish Signal

One Ethereum update that caught my eye came from Arkham data. A whale holding more than $5 billion in BTC started buying ETH. That’s not a random degen flipping coins. That’s a calculated move.

This whale rotated billions into ETH. First, they moved over $1.1 billion in BTC to a fresh wallet. Then, they purchased $2.5 billion in Ethereum through Hyperunit/HL. This kind of aggressive buying is hard to ignore.

Whales don’t spend that kind of money on a gamble. It shows conviction. To me, it signals confidence that ETH is undervalued compared to its long-term potential.

I’ve always believed whale activity can be a leading indicator. Back in 2020, I noticed whales stacking ETH just before DeFi summer. That gave me the push to farm like crazy. The results were life-changing. Today feels similar.

ETH/BTC Pair Shows Strength

The ETH/BTC pair is another important chart in this Ethereum update. Right now, it trades around 0.0402. That’s double the level from May, when it was near 0.021.

Ethereum has broken out of a year-long downtrend. It also climbed above the 50, 100, and 200-day moving averages. These levels now act as strong support.

There’s resistance just under 0.042. If ETH breaks through, the next zone sits around 0.045–0.046. That would put Ethereum at levels not seen since mid-2023.

For ETH holders like me, this ratio matters. When ETH gains on BTC, it shows real strength. It’s not just dollar price moving with the market. It’s Ethereum outperforming Bitcoin directly.

Trading Volatility and Bybit WSOT

Volatility is what makes crypto exciting. Personally, I love it. I’ve been around long enough to know that big swings create big opportunities.

Right now, Bybit’s WSOT trading competition is live. The prize pool is $10 million. Events like this always bring energy to the market. I usually join because competition sharpens my focus. Trading is more fun when you’re up against the best.

If you want to check it out, here’s the link: Bybit WSOT. You can also read more details on AirdropAlert.

Ethereum Transactions Hit All-Time High

Fundamentals are equally important in this Ethereum update. According to Pillows data, Ethereum monthly transactions hit a new all-time high. Almost 47 million transactions in one month.

That’s massive. It shows adoption is growing, even during volatility. DeFi protocols, NFT markets, and enterprise apps keep pushing demand. Ethereum isn’t just speculation. It’s infrastructure.

Some traders only look at price. I see fundamentals too. Back in 2018, when ETH crashed below $100, I didn’t panic. I looked at developer activity and transactions. Both stayed strong. That gave me the conviction to hold.

History is repeating. A recent 11% pullback looks like noise. Behind the scenes, whales are buying. Adoption is growing. The base is strong.

For anyone farming, I also recommend checking out this guide: Best Ethereum Yield Farms.

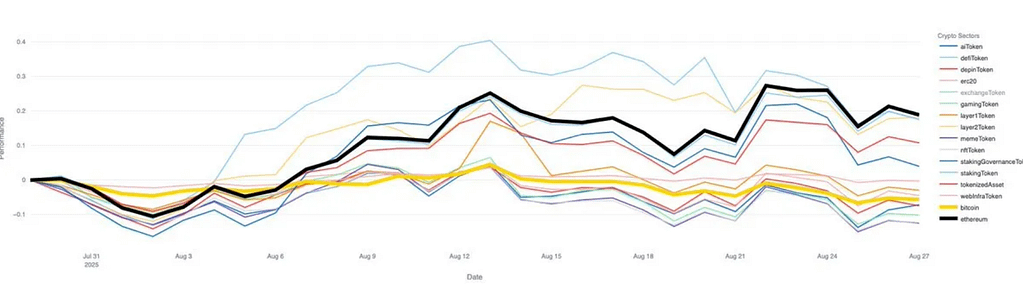

Ethereum Dominates While Altcoins Struggle

Another bullish sign is ETH’s dominance. Glassnode data shows no altcoin sector outperformed Ethereum last month. Not even DeFi or Layer 2s.

Most altcoins dropped while ETH held up. That’s a rare show of strength. Usually, ETH moves with the pack. This time, it’s leading.

Analysts call this “Ethereum season.” First, BTC pumps. Then ETH runs. Later, altcoins follow. Right now, ETH is setting the tone.

I’ve seen this cycle play out before. In 2017, ETH broke out after BTC peaked. In 2020, ETH led DeFi summer. My guess? 2025 might be another ETH-driven phase. I do believe when ETH goes up, it will pull some alts with it, and some liquidity may flow to Solana. You can read more about my thoughts on SOL right here.

Current Price Action and Chart Levels

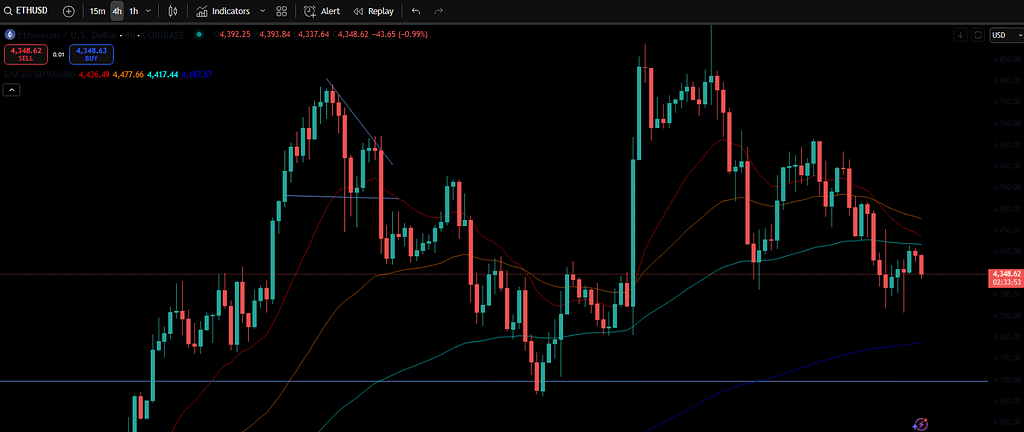

Ethereum is trading around $4,366. It recently pulled back 9% from highs near $4,800. That correction was sharp, but normal after a strong rally.

The weekly chart looks solid. ETH doubled in value since summer, rallying from below $2,000. Even with the pullback, ETH sits well above major moving averages.

The 50-week sits at $2,863. The 100-week at $2,819. The 200-week at $2,446. All are trending upward. These averages act as long-term support.

In the short term, ETH is testing the $4,200–$4,300 demand zone. If it holds, ETH may consolidate before breaking $4,800. If it fails, we could revisit $3,800.

A Simple Trade Setup

Here’s a straightforward idea from this Ethereum update. Buy ETH around $4,250 with a stop loss at $3,800. Target $5,000 for a clean round number.

Risk is manageable. The reward is attractive. Of course, nothing is guaranteed. But if whales are right, ETH above $5,000 could come sooner than people expect.

Memory Lane: The ICO I Missed

I can’t write an Ethereum update without sharing a story. Back in 2014, Ethereum had its ICO. Price was $0.30. I didn’t buy.

Why? I was a Bitcoin maxi. I believed smart contracts could run on BTC through layer 2s. I even invested in a layer 2 on BTC called “Counterparty”, which had smart contracts on Bitcoin. I didn’t see the need for Ethereum. I dabbled in DOGE and LTC, but my main goal was stacking sats.

One of my friends tried to convince me. I laughed it off. Big mistake. ETH went 23x before I finally caved in. I bought at $7 in 2015.

It still turned into one of my best investments. But I always remember that missed ICO. It taught me to stay open-minded. That’s why I farm, trade, and explore new projects today.

Support Our Work

If you found this helpful, consider signing up on BloFin (Non-KYC) or Bybit using our referral links. Your support keeps this content free and flowing.

Final Thoughts

This Ethereum update shows a mix of signals. Whales are buying. Transactions are at record highs. ETH/BTC is breaking out. Altcoins are underperforming.

Price may pull back again, but the bigger picture looks bullish. Ethereum feels like it’s entering another phase of leadership. My old high school friends might finally buy in this time.

Ethereum has always been more than just a coin to me. It’s been a journey—filled with mistakes, lessons, and wins. And if history repeats, the next chapter could be even bigger.

If you enjoyed this blog, check out our recent blog about the Cardano price.

As always, don’t forget to claim your bonus below on Bybit. See you next time!