It has been a turbulent week across the globe. The United States officially joined the escalating conflict in the Middle East by launching direct strikes on Iran’s key nuclear facilities. This dramatic move sent shockwaves through both political spheres and financial markets.

Yet, despite the rising global tension, Bitcoin has managed to stay above the $100,000 mark.

Let’s break down what happened, what it means for crypto investors, and where the Bitcoin price may head next.

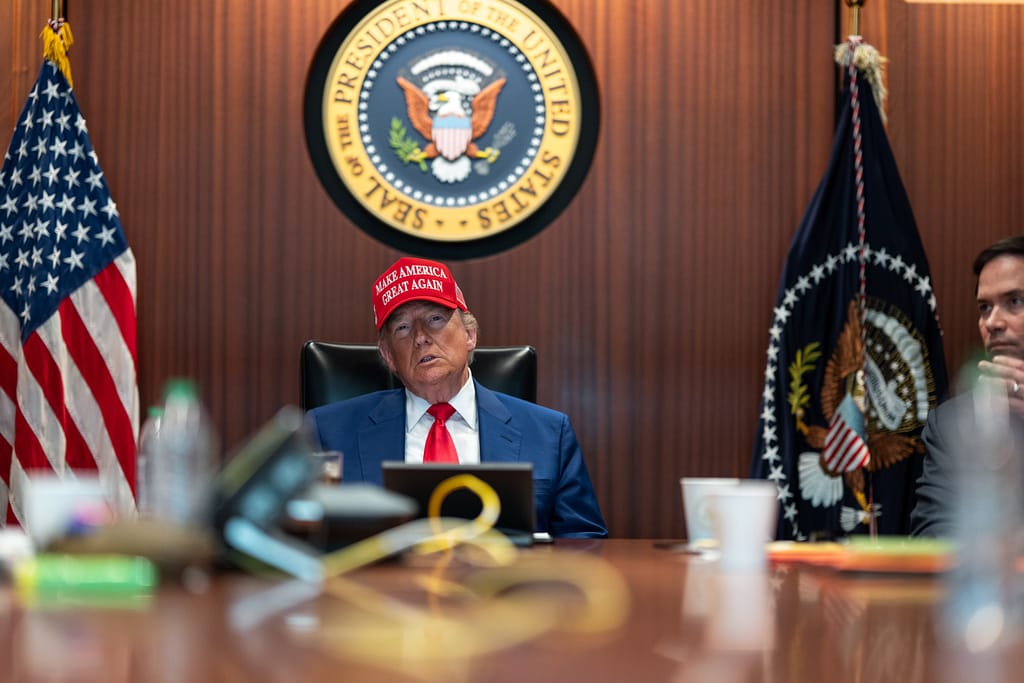

Trump’s Statement After US Joins the War

Late last night, President Trump confirmed that the US had successfully executed airstrikes on three major Iranian nuclear sites: Fordow, Natanz, and Isfahan. According to his post on Truth Social, the mission was completed with “great success,” and American planes were already returning home.

Trump emphasized the need for peace now more than ever. However, in a short Oval Office address that followed, he also warned that more military targets could be hit if Iran refuses to back down.

“Iran’s key nuclear enrichment facilities have been completely and totally obliterated,” he said.

Iran Responds With Outrage

Iranian officials reacted swiftly. Foreign Minister Abbas Araghchi accused the US of violating international law and the United Nations Charter. He emphasized that Iran’s nuclear program was peaceful and within legal bounds.

“The United States has committed a grave violation,” Araghchi stated. “These acts are lawless, and the world should be concerned about the consequences.”

Missiles fired in retaliation by Iran wounded at least 10 people in Israel, escalating fears that this war could spiral further.

Crypto Reacts to Chaos

In the hours after the first US strikes, the crypto market trembled. Bitcoin dropped sharply toward the $100,000 level, a psychological barrier watched closely by traders. Fortunately, the price quickly recovered, but the question remains—can it hold?

Events like this often cause extreme and unpredictable volatility. While it’s impossible to forecast future attacks, we can still study the Bitcoin charts and understand the bigger trend.

Let’s dive into the data and break down what’s happening on the technical side.

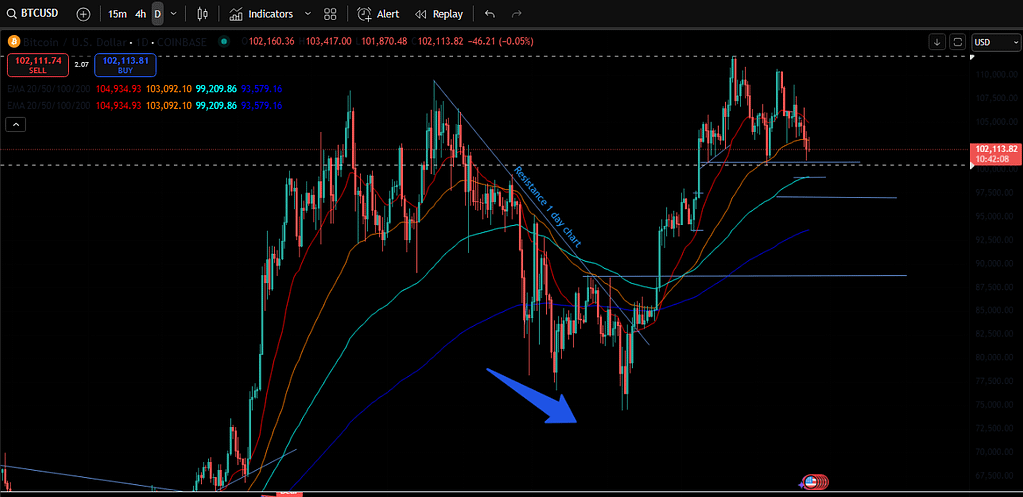

Analyzing the Bitcoin Trend

We begin with the daily chart. Here, each candle represents 24 hours, giving us a clear look at Bitcoin’s long-term movement. This also helps us pinpoint key price levels that traders are watching.

For a long time, Bitcoin (BTC) was stuck in a bearish trend, making lower highs and lower lows. That phase caused a serious drop in value over several months.

But things changed dramatically when Bitcoin broke above a previous high, marked clearly by a line on the chart around the 89k level. That breakout was the first sign of strength in a while.

Since then, the price has climbed steadily. This bullish momentum carried Bitcoin all the way to a new all-time high of nearly $112,000.

Trouble Near $100,000?

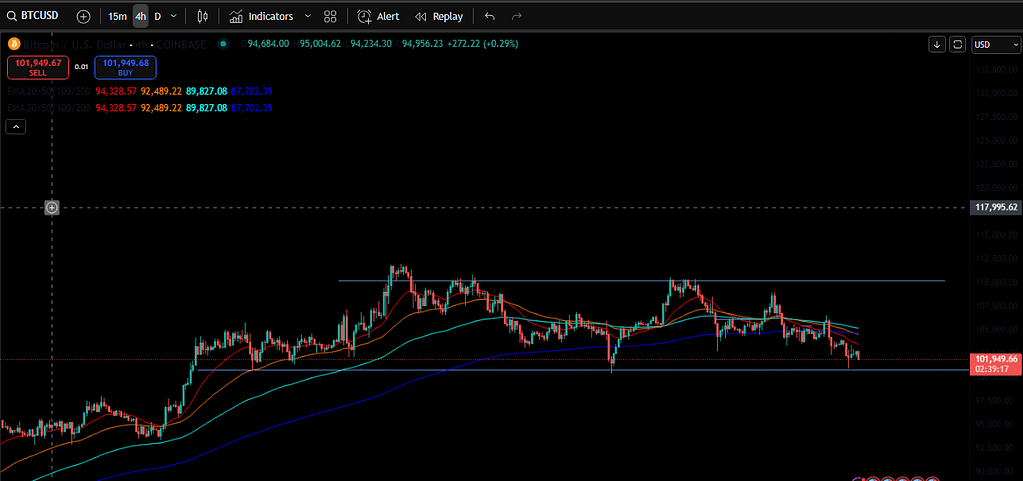

Lately, things haven’t been as smooth. Bitcoin has faced resistance and dipped closer to that key $100,000 level. To see the details, we zoom into the 4-hour chart.

On this timeframe, each candle shows four hours of action. And here, a blue line marks Bitcoin’s previous low. That line sits near $100,700 and has acted as strong support multiple times.

Every time the price has dropped near that level, buyers have stepped in. So far, Bitcoin has bounced back on each dip.

But there’s a catch—if the price falls below this blue line, things could get ugly.

That would signal a break in the current uptrend. In that case, it would be unrealistic to expect a new all-time high anytime soon. Instead, we’d likely see a long period of decline.

What to Watch Going Forward

The charts give us clues, but it’s important to combine them with real-world news. Bitcoin has become highly sensitive to major global events—especially war and regulation.

Now that the US is officially involved in the Iran conflict, market reactions could swing quickly in either direction. Investors should watch price levels closely, especially that $100,700 support zone.

At the same time, keep an eye on breaking news from the Middle East. If Iran strikes back again, or if the US responds with further military action, markets will react.

Also, traders are now watching for statements from central banks and large institutions. Any sign of monetary tightening or capital flight could impact Bitcoin’s path.

A Look at Other Markets

The fear of escalation didn’t just hit crypto. Oil prices spiked immediately after the US attack, with Brent crude jumping over 7% in a matter of hours.

Global stock indices also dropped. The S&P 500 opened lower, while defense and energy sectors surged. Gold prices climbed as investors sought safe havens.

Yet, Bitcoin is trying to find its own role in this new geopolitical environment. Some see it as a safe-haven asset like gold. Others believe its volatility makes it too risky in times of crisis.

Still, staying above $100K in the face of war is no small feat.

Could Bitcoin Stay Resilient?

Let’s return to the trend.

Bitcoin’s latest all-time high near $112,000 is fresh in traders’ minds. But if the blue support line at $100,700 holds, we could see another run-up.

That said, if global tensions continue rising, the situation might turn quickly. Markets hate uncertainty, and war creates exactly that.

On the flip side, if peace talks begin and both sides hold fire, Bitcoin may return to more stable price action. This could give bulls a new opportunity to regain momentum.

Support Our Work

If you enjoy insights like these, consider using our referral links when signing up for exchanges. It helps us continue offering free content.

Try BloFin for a fast, non-KYC exchange or Bybit, our go-to trading platform. Every referral makes a difference. Thanks for the support!

Always trade with proper risk management. Don’t bet it all and use a stop loss! This is a long game, not a get-rich-quick scheme.

Final Thoughts

The phrase “US joins war” has sent shockwaves through every corner of the world, including the crypto market. Yet, Bitcoin continues to show signs of strength.

That’s impressive, considering the chaos we’re seeing globally.

Whether you’re trading, holding, or just watching from the sidelines, now is the time to stay informed. Keep an eye on price levels and major headlines. In the midst of the chaos, we managed to get in a cheeky long on BTC around the lows. We shared it on X when it happened. Goes to show that, whatever happens, you can find opportunities if you are locked in.

If the past has taught us anything, it’s that crypto never sleeps—and neither does global news.

We’ll continue monitoring the situation. Check back for updates as this story unfolds. Stay safe, and stay sharp.

If you enjoyed this blog, you may want to check our other crypto news updates.

As always, don’t forget to claim your bonus below on Bybit. See you next time!