By James Van Straten (All times ET unless indicated otherwise)

Bitcoin (BTC) continues to climb the wall of worry, pushing above $97,000 despite hotter-than-expected U.S. consumer and producer price inflation reports in the past couple of days. That’s a surprise. With prices rising and the likelihood of a Fed rate cut receding, you’d expect risky investments like cryptocurrencies to pause, at the very least.

The buoyant behavior is possibly underpinned by signs that inflation is still seen as easing in coming months.

“Bitcoin could likely get some relief in the short-term judging by the high-frequency U.S. inflation indicator by truflation which suggests a significant decline in headline inflation over the coming months,” said Andre Dragosch, the head of European research at Bitwise. The Truflation U.S. Inflation Index currently shows 2.06%, indicating a potential decline.

Dragosch also noted the Federal Reserve’s cautious stance, suggesting the central bank is very aware of what happened in the 1970s, when three waves of inflation hit peaks of 6.2%, 12% and 15%.

“The Fed is afraid of the 1970s inflation scenario, which is why it rather takes a more cautious approach at the moment and is afraid of cutting rates too aggressively,” he said.

All that means the bitcoin bull market is far from over if historical trends hold out. Take a look at the 200-week moving average (a period of almost four years!). That’s currently around $44,200, below the previous market peak of $69,000 from November 2021. In the past, the average has risen toward the prior record, a move that implies further price growth is on the cards.

Also consider that short-term holders have accumulated 1.5 million bitcoin since September, showing continued demand from investors who tend to keep their BTC for less than 155 days.

On the public company front, Coinbase followed Robinhood with strong earnings and Gamestop is pondering a bitcoin investment, another potential catalyst for the market. Stay Alert!

What to Watch

- Crypto:

- Macro

- Feb. 14, 8:30 a.m.: The U.S. Census Bureau releases January’s Retail Sales data.

- Retail Sales MoM Est. -0.1% vs. Prev. 0.4%

- Retail Sales YoY Prev. 3.9%

- Feb. 18, 10:20 a.m.: San Francisco Fed President and CEO Mary C. Daly delivers a speech at the Conference for Community Bankers in Phoenix. Livestream link.

- Feb. 19, 2:00 p.m.: The Fed releases minutes of the Jan. 28-29 FOMC Meeting.

- Feb. 14, 8:30 a.m.: The U.S. Census Bureau releases January’s Retail Sales data.

- Earnings

Token Events

- Governance votes and calls

- Unlocks

- Feb. 14: Starknet (STRK) to unlock 2.48% of circulating supply worth $15.19 million.

- Feb. 15: Sei (SEI) to unlock 1.25% of circulating supply worth $13.46 million.

- Feb. 16: Arbitrum (ARB) to unlock 2.13% of circulating supply worth $46.2 million.

- Feb. 16: Avalanche (AVAX) to unlock 0.4% of circulating supply worth $43.55 million.

- Feb. 21: Fast Token (FTN) to unlock 4.66% of circulating supply worth $78.8 million.

- Feb. 28: Optimism (OP) to unlock 2.32% of circulating supply worth $36.67 million.

- Token Launches

- Feb. 14: Pudgy Penguins (PENGU) to be listed on Coinbase, according to a post shared by the Pudgy Penguins account.

Conferences:

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Token Talk

By Francisco Rodrigues

Binance founder and former CEO Changpeng Zhao’s dog has been the talk of the town. After revealing he had the pet and being bombarded with requests for information, he eventually gave in, knowing memecoins would be launched.

Zhao shared a picture of himself with the Belgian malinois named Broccoli in a lengthy post that inspired a slew memecoins. These tokens, trading under the ticker BROCCOLI, debuted both BNB Chain and Solana.

Some saw significant price rises right after their introduction to reach billion dollar-plus market caps as traders rushed in. As the hype faded, so did the prices. Fortunes were made and sold over Broccoli.

One trader, for example, spent less than $1,000 to create a token inspired by the dog and started selling the tokens just two minutes later. The trader managed to make $6.5 million on the launch, as CoinDesk’s Danny Nelson reported.

The volatility affected the price of BNB itself, which is now 6.6% lower in the last 24 hours while bitcoin and ether are both up slightly. PancakeSwap’s CAKE token, which was up more than 70% on the week, is down 18%in the same period.

Elsewhere, the Trump-backed DeFi protocol WLFI has kept accumulating tokens, purchasing around $5 million worth of wrapped bitcoin (WBTC) and $1.4 million of Movement (MOVE).

Derivatives Positioning

- XRP’s perpetual funding rates remain slightly negative, indicating a bias for shorts despite a 10% price surge. Should prices continue to rise, these shorts may throw in the towel, squaring off their bets and adding to an upward move in prices.

- LTC, XLM and DOGE have seen net buying pressure in perpetual futures, according to the open interest-adjusted cumulative volume delta tracked by Velo Data.

- BTC CME futures basis remains below ETH basis.

- Block flows on Deribit featured outright longs in out-of-the-money calls and a bull call spread. In ETH, a call option at the $3,300 strike was filed in the March expiry, according to Amberdata.

Market Movements:

- BTC is up 0.57% from 4 p.m. ET Thursday to $97,093.36 (24hrs: +0.96%)

- ETH is up 1.39% at $2706.09 (24hrs: +1.13%)

- CoinDesk 20 is up 3.70% to 3,324.03 (24hrs: +3.85%)

- Ether CESR Composite Staking Rate is up 1 bps to 3.06%

- BTC funding rate is at 0.0035% (3.8632% annualized) on Binance

- DXY is down 0.32% at 106.97

- Gold is up 1.17% at $2,960/oz

- Silver is up 4.32% to $34.06/oz

- Nikkei 225 closed -0.79% at 39,149.43

- Hang Seng closed +3.69% at 22,620.33

- FTSE is down 0.26% at 8,741.88

- Euro Stoxx 50 is unchanged at 5,501.78

- DJIA closed Thursday +0.77% at 44,711.43

- S&P 500 closed +1.04% at 6,115.07

- Nasdaq closed +1.5% at 19,945.64

- S&P/TSX Composite Index closed +0.53% at 25,698.5

- S&P 40 Latin America closed +0.69% at 2,438.53

- U.S. 10-year Treasury rate was down 7 bps at 4.53%

- E-mini S&P 500 futures are down 0.1% to 6,129.25

- E-mini Nasdaq-100 futures are unchanged at 22,107

- E-mini Dow Jones Industrial Average Index futures are down to 44,686

Bitcoin Stats:

- BTC Dominance: 60.58 (-0.63%)

- Ethereum to bitcoin ratio: 0.02783 (0.47%)

- Hashrate (seven-day moving average): 818 EH/s

- Hashprice (spot): $54.1

- Total Fees: 5.67 BTC / $546,770

- CME Futures Open Interest: 167,750

- BTC priced in gold: 33.0 oz

- BTC vs gold market cap: 9.37%

Technical Analysis

- XRP has bounced off the Ichimoku cloud support, keeping the broader bullish outlook intact.

- Prices seem to be headed toward the descending trendline resistance, which, if topped, will likely yield a move to record highs.

- A potential move below the cloud would signal a bearish trend change.

Crypto Equities

- MicroStrategy (MSTR): closed on Thursday at $324.92 (-0.58%), up 0.6% at $327.03 in pre-market.

- Coinbase Global (COIN): closed at $298.11 (8.44%), down 1% at $295.12.

- Galaxy Digital Holdings (GLXY): closed at C$28.37 (+5.58%)

- MARA Holdings (MARA): closed at $16.91 (+4.13%), up 0.65% at $17.02

- Riot Platforms (RIOT): closed at $12.23 (+9.59%), up 0.1% at $12.24.

- Core Scientific (CORZ): closed at $12.54 (+3.72%), down 0.32% at $12.50.

- CleanSpark (CLSK): closed at $10.67 (+1.43%), up 0.66% at $10.74.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $23.28 (+2.42%), down 1.12% at $23.02.

- Semler Scientific (SMLR): closed at $49.45 (+3.69%), up 1.86% at $50.37.

- Exodus Movement (EXOD): closed at $50.00 (+2.35%), down 3.34% at $48.33.

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$156.8 million

- Cumulative net flows: $40.05 billion

- Total BTC holdings ~ 1.171 million.

Spot ETH ETFs

- Daily net flow: $12.8 million

- Cumulative net flows: $3.14 billion

- Total ETH holdings ~ 3.777 million.

Source: Farside Investors

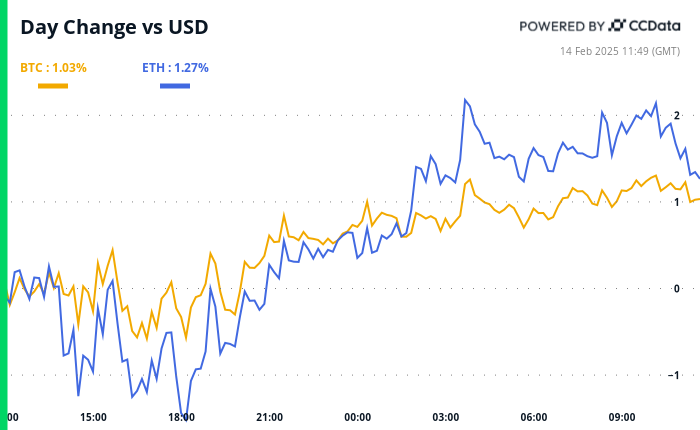

Overnight Flows

Chart of the Day

- The chart shows yields on the U.S. 10-year and two-year Treasury notes.

- The 10-year yield has declined by 27 basis points in four weeks while the two-year yield has dropped 10 basis points.

- The so-called bull flattening of the Treasury yield curve is a positive sign for risk assets, per some observers.

While You Were Sleeping

In the Ether